Horizon Currency Beats Wise and Revolut on Money Transfer Costs

A recent survey of the money transfer pricing landscape conducted by The Money Cloud has shown payments firm Horizon Currency to outcompete major rivals on pricing.

The Money Cloud - an independent international payments intelligence consultancy - found Horizon Currency offered better returns on international payments than Wise, Revolut, Western Union and HSBC.

HSBC was sampled as offering a representative view on the costing and pricing structures offered by the banks.

Revolut and Wise were sampled as representing a new wave of mass-adoption do-it-yourself currency providers.

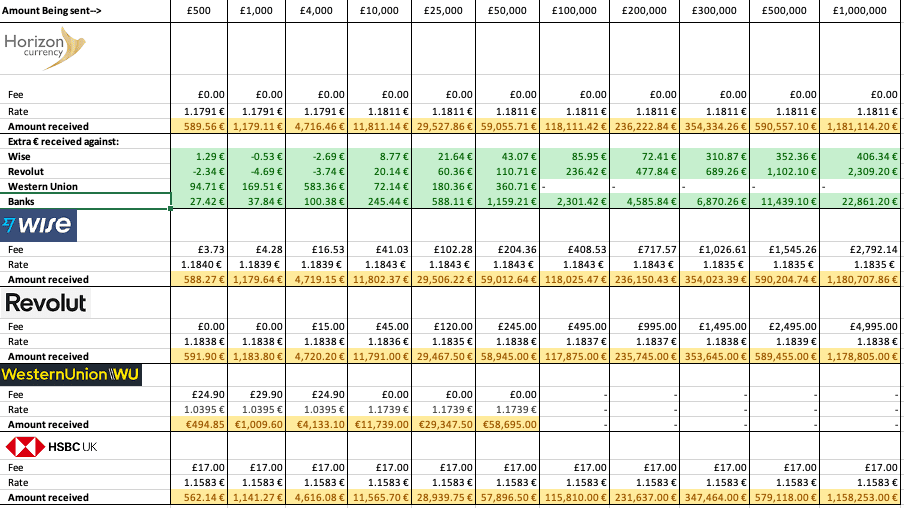

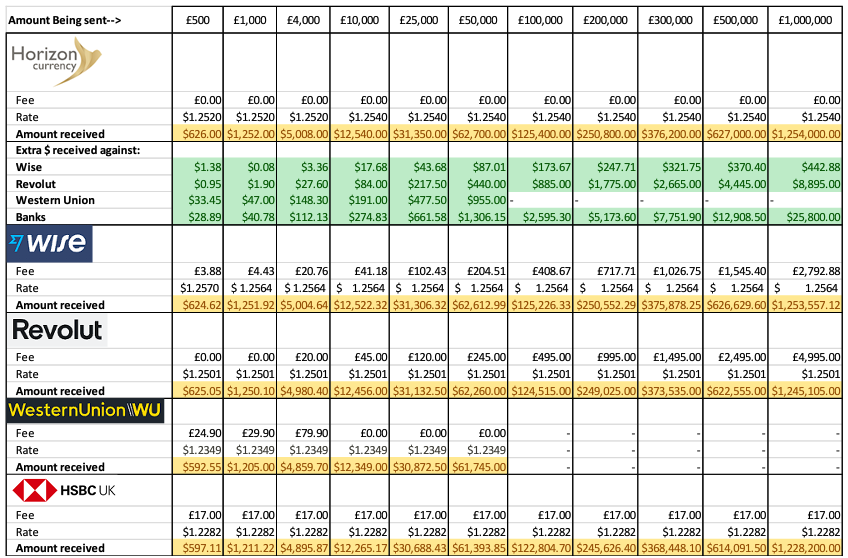

Horizon Currency was particularly more competitive on rates and fees for international payments above £100K.

When looking at the Pound-Dollar payments channel using Horizon Currency resulted in the receipt of an additional $173.67 when compared to Wise. Against Revolut the result was $885.00 and against HSBC the amount was $2595.00.

On the $500K transfer bracket Horizon Currency delivered $370.00 more than Wise, $4450.00 more than Revolut and $12908.50 more than HSBC. On a $1M transfer this stacked up to $442.88 against Wise, $8895.00 against Revolut and $25800 against HSBC.

Given the same margins are applicable on the Pound-Euro channel identical savings were likely for Euro purchases. In fact very similar margins would apply to all G10 currency channels, including EUR/USD, GBP/AUD, GBP/NZD and GBP/CAD.

"The results clearly demonstrate the cost-savings that can be made, particularly in comparison to using your high street bank. It also shows that when you are sending larger amounts of money that the savings made increase further against all payment companies compared with. Even comparing against Wise, the closest competitor on exchange rates offered, Horizon Currency comes out on top," says Emmanuel Addy, CEO of The Money Cloud.

The research finds Horizon Currency is able to save individuals or businesses between 3-6.0% per transaction.

"As a currency specialist buying in bulk and working with live rates, Horizon Currency can get much closer to the interbank rates than banks, thereby saving clients thousands. Understanding how it works is essential in realising just how much you can save on your international payments," says Addy.

Charts

GBP/EUR:

Above as of 3pm GMT 27/07/2022.

GBP/USD:

Above as of 3pm GMT 27/04/2022.