- GBP/AUD uptrend intact

- Good news on tariffs offers AUD minimal returns

- Aussie Capex figures disappoint

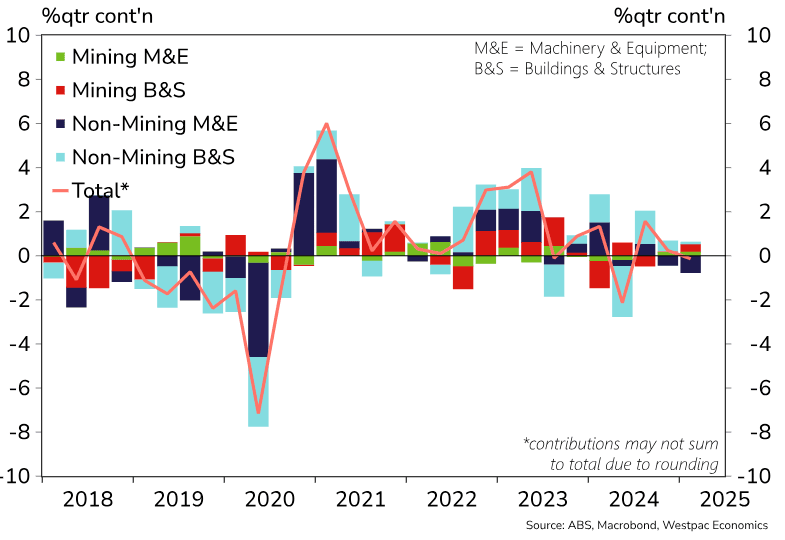

Above: Softer capital expenditure in mining contributed to disappointing domestic data. Image © Adobe Images.

The Australian Dollar received a lift after U.S. President Donald Trump was ordered to abandon existing import tariff plans, but gains are lacklustre and reflect broader AUD struggles.

The U.S. Court of International Trade upheld a legal challenge to Trump's 'Liberation Day' tariffs, agreeing that the U.S. President does not have sufficient authority under the International Emergency Economic Powers Act of 1977 (IEEPA) to enact such broad-based tariffs.

The news boosted the Dollar and other risk-on assets, such as stocks. The Australian Dollar also benefited, however, we note the currency's rally has been relatively lacklustre and does not mirror previous responses to good tariff news.

"AUD and NZD have been relatively less influenced by US trade policy compared to EUR, GBP and JPY," says Samara Hammoud, an analyst at Commonwealth Bank of Australia.

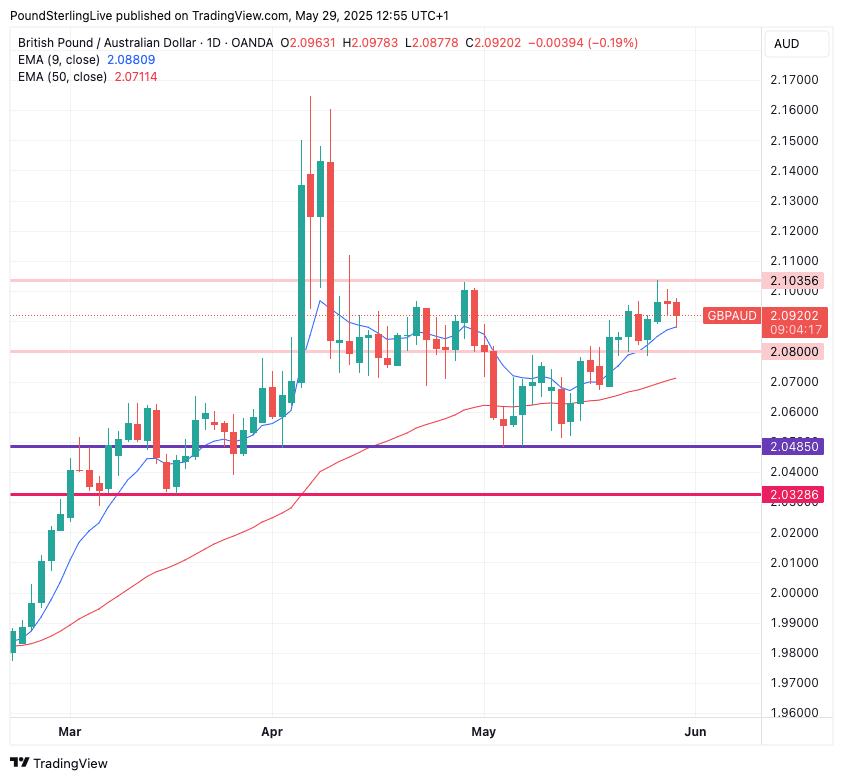

With no major kick higher in AUD following good news on tariffs, we note the Pound-to-Australian Dollar exchange rate still holds onto its May uptrend, and we maintain a preference for further gains to follow in the coming days, eyeing a move to 2.1035 ahead of an eventual move to 2.12.

Above: GBP/AUD at daily intervals.

Gains for risk-on currencies following news that tariffs have been struck down will also be limited by the belief that Trump will pursue other angles to deliver on his agenda, keeping headline risks alive.

The Administration has already challenged the decision, and legal experts note alternative options are open.

"We can expect the legal guardrails to the extent of Presidential power to continue to be tested. Such scenarios underline both ongoing policy uncertainty and or reticence by international investors to hold US assets," says Jeremy Stretch, Chief International Strategist at CIBC Capital Markets.

AUD has a high sensitivity to U.S. economic sentiment via the global sentiment channel, and ongoing uncertainty on this front will keep it pressured.

Image courtesy of Westpac.

Also, domestic headwinds to the Aussie Dollar emerged on Thursday after it was reported Australia's private new capital expenditure (capex) unexpectedly contracted over the first quarter.

Capex fell -0.1% q/q (consensus: 0.5%) vs. 0.2% in 4Q (revised up from -0.2%) driven by a -1.3% q/q decline in equipment, plant and machinery.

"Business investment unexpectedly contracted in Q1," says Stretch. "The capex data is part of a confluence of data releases that combine within the Q1 GDP data, due for release on 4 June. The capex retreat amplifies downside risks to the 0.4% qoq median assumption."

Following these data, RBA cash rate futures priced in a total of 75 basis points of cuts to a low of 3.10% in the next 12 months.

This implies more cuts from Australia than in both the UK and the U.S., which means relative interest rate differentials point to ongoing AUD weakness against GBP. For AUD/USD, it appears that broader sentiment surrounding U.S. debt and tariffs will dominate over interest rate developments.