Image © ArchivesACT, Reproduced under CC Licensing, Editorial, Non-Commercial

AUD would rise if RBA surprises and opts to keep interest rates level.

The Australian dollar may find support in the coming weeks if the Reserve Bank of Australia (RBA) defies market expectations for a rate cut at its July 08 policy meeting.

A new analysis from Bank of America (BofA) warns that the central bank could be minded to maintain interest rates at 3.85%, which would defy a market that is priced for a 25 basis point cut.

"The market is excessively rich in pricing a terminal cash rate below 3%," says BofA. "We see a strong case for the RBA to adopt a wait-and-see approach, rather than validate market pricing through back-to-back cuts."

Persistent inflationary pressures and a still-tight labour market are two reasons why the RBA might opt to leave interest rates unchanged and await further data.

Such a cautious stance would acknowledge a domestic economy still grappling with above-target inflation, rising unit labour costs and limited slack in the labour market.

Market implied odds for a July rate cut grew last week after Aussie inflation dropped from 2.4% year-on-year to 2.1% in May, undershooting the consensus forecast of a fall of 2.3%.

However, trimmed mean inflation, which the RBA watches, remains well above the midpoint of the RBA's 2–3% target band and is not expected to return to target until mid-2027.

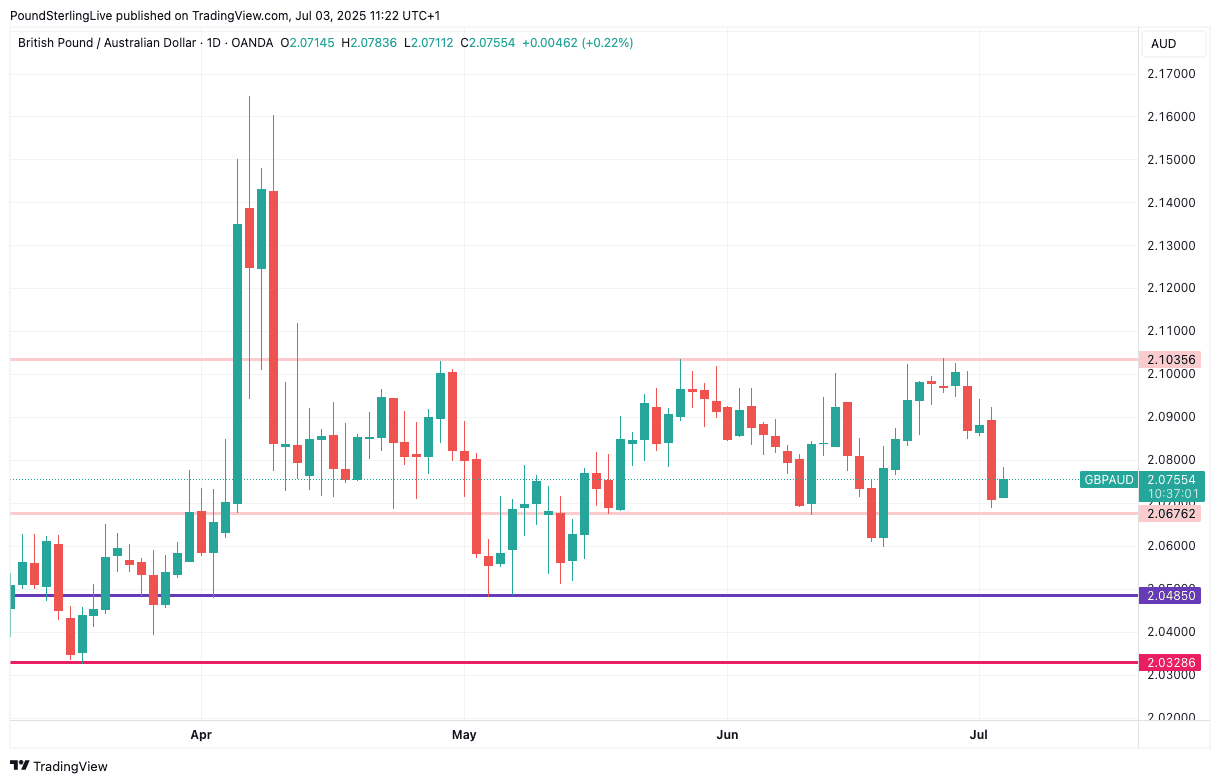

Above: GBP/AUD could test the lower bounds of its range if the RBA maintains rates at existing levels.

Markets may have overreacted to signs of softer growth in the first quarter, but BofA argues the underlying momentum in private consumption and investment remains firm, bolstered by improving global conditions and a rebound in public demand.

Strategists think a surprise hold by the RBA could trigger sharp repricing in front-end interest rate swaps and lift the Aussie dollar, especially as rate differentials shift in its favour.

They also point to a weaker U.S. dollar, accelerating Chinese growth, and a stable yuan as additional tailwinds for the currency.

"We remain bullish on AUD/USD," BofA said, adding that near-term upside could emerge if the RBA maintains its cautious stance while global growth stabilises.