Image © Adobe Images

The Pound to Australian Dollar exchange rate can recover to 1.91 this week.

Pound Sterling has some wind in its sails, rising even as the odds of an August interest rate cut increase, suggesting that some sentiment adjustment is underway following last week's election.

"The pound could be about to stage a bigger recovery as it has momentum on its side now that the UK’s political risk premium has been eradicated," says Kathleen Brooks, an analyst at XTB. "Interestingly, the pound is rising, alongside expectations of a rate cut from the Bank of England next month, there is currently a 66% chance of a rate cut priced in by the OIS market."

The convincing win by Labour in last week's election sets the UK up for a period of political stability, with Labour saying it is already moving to establish closer ties with Europe. Analysts have written that closer EU ties can support the Pound in the coming months as the long-standing Brexit premium the Pound still carries fades.

“We have raised our GBP forecasts in part on better political stability ahead and in part on the signs of a stronger rebound in economic growth than we previously expected," says Derek Halpenny, head of FX research at MUFG Bank Ltd.

The Aussie Dollar has had a good run of late, too, buoyed by the generally constructive global backdrop and expectations that the Reserve Bank of Australia will be the last of the major central banks to cut interest rates. In fact, it could raise rates again owing to a robust domestic economy and stubborn inflation.

This outperformance on both ends of the GBP/AUD equation has resulted in the exchange rate being in a consolidative mode.

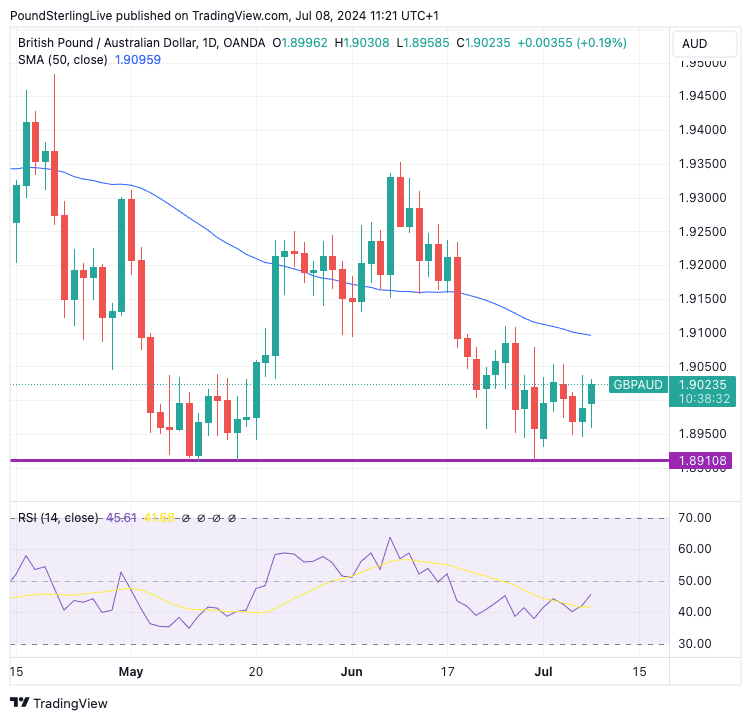

Support comes in at approximately 1.8910, and we are not inclined to expect a breakdown and a slide below here in the near term.

Above: GBP/AUD at daily intervals. Track GBP/AUD with your own alerts, find out more here.

The RSI has turned higher again, and our favoured stance is to see some gentle gains from here and target a move to the 50-day moving average at 1.9095.

That said, upside will be limited as this pair will have to do a great deal more work for the technical setup to turn outright bullish, with all the major moving averages seen to the topside.

Calendar-wise, there is nothing of interest in Australia or the UK to bother GBP or AUD this week. This means the steadily improving sentiment towards the Pound can continue to offer some direction, as will global market conditions.

With this in mind, the Aussie Dollar would be one of the bigger winners if Thursday's U.S. inflation numbers undershoot expectations and boost investor sentiment.

This is because a soft reading will raise the odds of an interest rate cut at the Federal Reserve in September. However, an above-consensus reading would risk a setback to AUD, allowing GBP/AUD to test multi-week highs.

Headline CPI is expected to decline to 3.1% year-on-year, down from 3.3% in May, a level last seen in January. The core inflation print is expected to be at 0.2% month-on-month.

Such readings would signal the disinflation process is underway again, having been disrupted by the price acceleration in H1. This will raise the odds that the Federal Reserve will cut interest rates in September and potentially weigh on the Dollar.

The inflation report will follow Friday's labour market report, which confirmed a trend of cooling is underway, and this will continue to bring wage pressures down. Falling wages will ultimately result in easing domestic inflation.

"This week will be a hot one for US macro, with the CPI report for June out on Thursday," says Francesco Pesole, FX Strategist at ING Bank. "There is a clear weakening trend emerging in the US jobs market and that will, in our view, push an FOMC that wants to avoid unnecessary economic pain to cut three times this year, starting in September."

A further repricing towards more rate cuts at the Fed will weigh on the Dollar.