Image © Adobe Images

The Aussie starts the new week on a strong footing, amidst political intrigue and global debt concerns.

France's government has collapsed again while Japan's ruling LDP has selected a new leader who is very much of the belief that the country should print more debt to boost its economy.

Both political issues tie in with the wider concern about a world awash with debt and authorities seemingly unable, or unwilling to, control it.

France's debt is projected to continue rising to 126% of GDP by 2030, according to Capital Economics, highlighting an urgent need for some consolidation in the finances. This is unlikely given the composition of the country's parliament.

Japan holds the highest debt-to-GDP ratio amongst the major developed economies, but the government had put in measures to try and reach an annual primary budget surplus this year.

This ambition changes with the election of Sanae Takaichi, an advocate of Abenomics, a central pillar of which is the use of the central bank to buy government debt.

All this speaks of the potential of currency debasement and in a world where this is a concern, obvious winners will be currencies belonging to fiscally sound countries, such as Australia.

Australia's government gross debt was approximately 50% of GDP in 2024 and is projected to hold steady over the next few years, dipping to 49.02% by 2030.

Australia's dollar trades higher at the start of the new week, confirming traders see it offering a hedge against currencies worried about politics and debt.

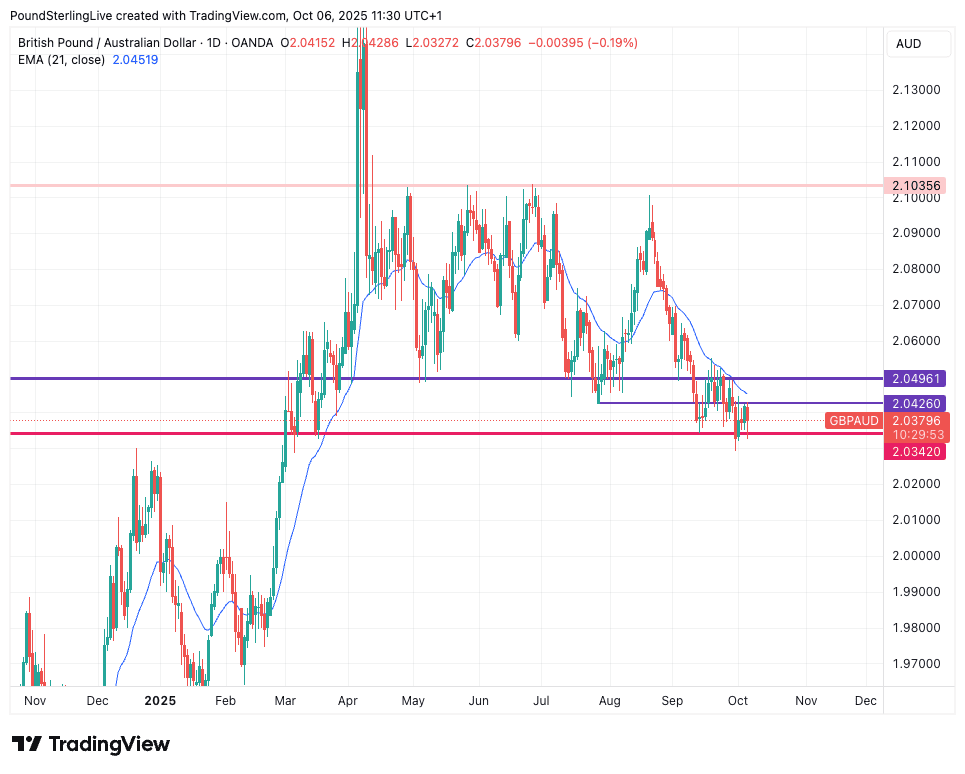

The pound to Australian dollar exchange rate (GBP/AUD) naturally reflects these dynamics, trading at 2.0372, down a quarter of a per cent on the day.

The chart shows that the pair is now squeezed in the lower-bound of the September-October trading range. It also shows it is below the 21-day moving average, which signals intact downside momentum for the coming week and from here, a sustained break below 2.0342 becomes visible.

Should this happen, then we could turn our sights on support at 2.0 for the remainder of the quarter as a longer-term uptrend rolls over and the Aussie retakes the initiative.