Image © Adobe Images

The Australian dollar faces a four-way fork in the road says ING, as it maps out the currency's direction amidst renewed U.S.-China trade tensions.

"We admit we didn’t expect AUD/USD to be trading below 0.6550 a month ago,” says ING FX strategist Francesco Pesole, who attributes the weakness to "the rapid re-escalation in U.S.-China trade tensions” and a surprisingly resilient U.S. dollar.

Until investors are reassured that another wave of tariffs isn't imminent, he says, the Aussie "will struggle to benefit from its otherwise constructive fundamentals."

The Aussie fell sharply last Friday when the U.S. responded to Chinese rare earth export controls, threatening a 100% import tariff on November 01.

In the event of a full-blown trade war, ING warns that the Reserve Bank of Australia would be forced to cut rates again, growth would falter, and commodity prices would likely slump.

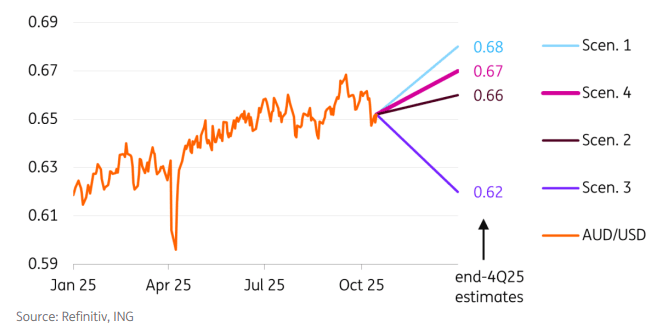

Against that backdrop, the bank sketches four possible scenarios for where AUD/USD could end the year.

Scenario 1: De-escalation (AUD/USD 0.68)

In the most optimistic case, a Trump–Xi meeting in South Korea later this month could yield “conciliatory tones” and extend the tariff pause.

That would lift risk sentiment and give the Aussie a reprieve. ING says a combination of calmer trade rhetoric, a cautious RBA, and a softer U.S. dollar could easily push AUD/USD to 0.68 by year-end.

Scenario 2: Volatile Status Quo (AUD/USD 0.66)

Here, tensions persist but don’t spiral. Some tit-for-tat measures drag into 2026, keeping uncertainty elevated but manageable. In such a backdrop, “antipodeans will hardly shine,” says ING. The Aussie would rely mostly on U.S. dollar weakness and seasonality to grind toward 0.66 by Christmas.

Scenario 3: Escalation (AUD/USD 0.62)

If Washington raises tariffs across the board and Beijing retaliates in kind, global trade would be hit hard. “It’s a very negative scenario for AUD/USD,” ING warns.

The RBA would come under pressure to ease further, while the Fed might slow its own cuts due to tariff-driven inflation risks—offering the U.S. dollar fresh support. In this world, the Aussie bears the brunt, dropping toward 0.62.

Scenario 4: April 2.0 (AUD/USD 0.67)

The wild card, according to ING, is a replay of April’s 'sell America' dynamic. If the U.S. were to impose 100%-plus tariffs and China countered aggressively, both economies would suffer—but this time, the U.S. could take the bigger hit.

"The 'sell America' trade returns in full swing,” the report says, as the dollar weakens and the Fed keeps cutting. The Aussie might initially plunge, but would later rebound sharply to finish the year around 0.67.

For now, the Australian dollar sits at a crossroads defined by geopolitics rather than domestic data.

As Pesole concludes, it’s "a sliding-door moment for AUD" - one where trade headlines, not the RBA, will decide which street it takes next.