Strategists target a higher Australian dollar with a conviction of 3/5.

"We enter a new long AUD/USD trade," say strategists at global investment bank Nomura, on Tuesday.

"We think AUD looks cheap relative to a range of cross-market indicators," they say.

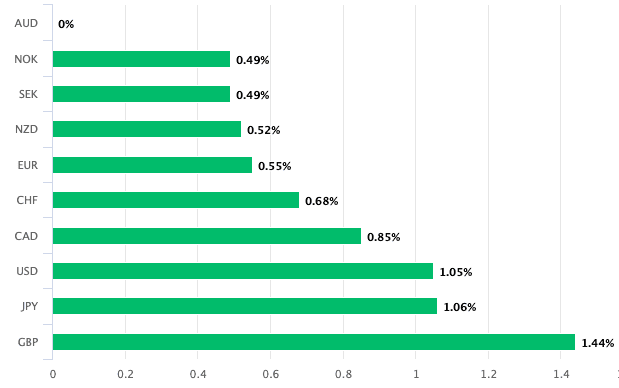

The call comes amidst renewed outperformance by the Aussie, which is now the best performing G10 currency for of the past week.

Nomura lists the following factors for the call:

- The recent calming of US-China trade tensions.

- Commodity prices – most notably copper – remain elevated "and this should provide support to AUD".

- With these tariff fears receding, there's scope for AUD to catch up with interest rate spreads, which favour a higher valuation

- Expect this week’s Australia Q3 CPI to be a positive catalyst for AUD

- There are also some signs of increasingly positive seasonal performance for AUD in December

Risks to the the Aussie dollar include a re-escalation in trade tensions and a sharp decline in risk sentiment and an increase in cross-asset volatility.

Nomura targets a move by AUD/USD to 0.6875 by end-December.