Image © Adobe Images

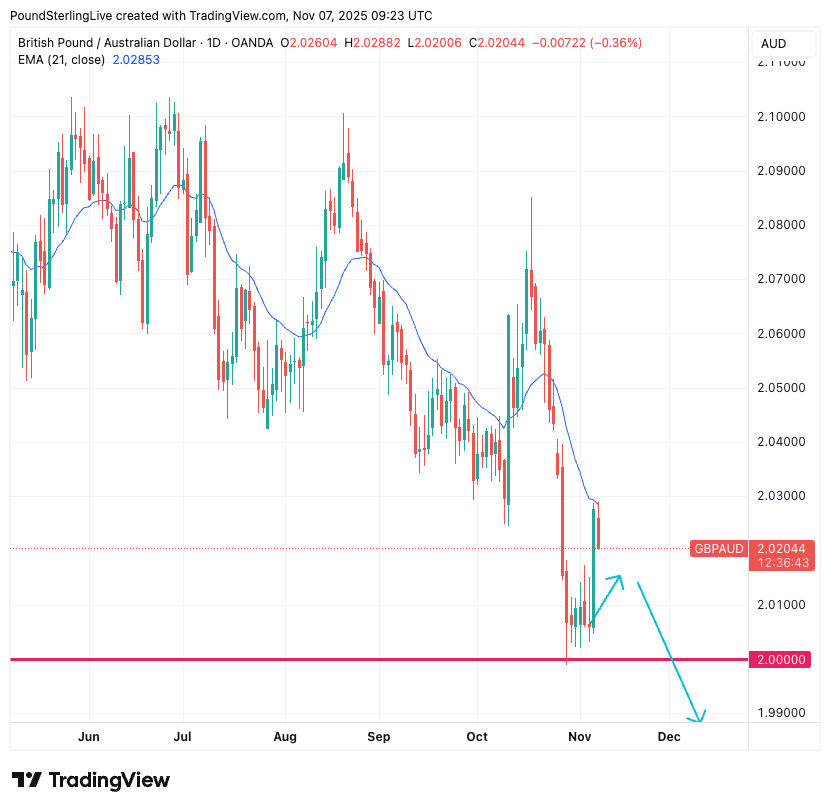

An impressive bounce by the pound to Australian dollar exchange rate (GBP/AUD) is already at its limits.

GBP/AUD was one of the bigger risers in response to Thursday's Bank of England decision, as a rally of 1.10% outstripped those seen in other GBP exchange rates.

The Australian dollar had recorded a run of notable gains against pound sterling since mid-October, with GBP/AUD falling 4.0% in this period, before consolidating just above the 2.0 mark in the lead up to the Bank of England's November interest rate decision.

Having been heavily sold across the board, GBP was always prone to a mean-reverting recovery, with the biggest GBP recovery potential lying against those currencies it fell hardest against.

GPB rose across the board after the Bank left interest rates unchanged but indicated it was ready to cut as soon as December. That message was on point with market thinking, meaning a brow-beaten pound rallied in relief.

Simply put, Sterling has taken a beating over recent weeks as markets built up expectations for another cut before year-end and the bar to keep the move going was set extremely high heading into Thursday's decision.

This mean reversion sees GBP/AUD rise back to its 21-day exponential moving average at 2.0285. For now, this EMA looks like a cap as we are seeing it pull back from this level on Friday.

For the GBP/AUD outlook to turn more constructive, we would like to see a move above here, which would introduce us to the 2.04-1.10 range.

But is GBP ready to deliver that kind of strength? We doubt it:

GBP/AUD looks to still be trending lower in sympathy with a broader GBP selloff related to concerns about the upcoming November 26 budget.

At the same time, AUD could be the one to beat going into year-end:

"Australia's mix of relatively tight monetary and loose fiscal policy appears optimal from the currency perspective and we see AUD as a relative outperformer in the G10 FX space," says a note from UBS, released Thursday.

AUD outperformance can continue if global equity markets extend the bull run, while a detente between China and the U.S. over trade is proving particularly helpful.

Hopes that the U.S. government shutdown will end soon and hopes for a December cut at the Federal Reserve would also help the Aussie.

Of course, any slipups on either of these issues would potentially weigh on markets and Australia's dollar, allowing GBP/AUD to recover.