Above: File image of Michelle Bullock. Image © RBA

Thursday's speech by Reserve Bank of Australia Governor Bullock is the main event out of Australia this week. However, it will be a U.S. jobs report that will determine where Friday's close is recorded.

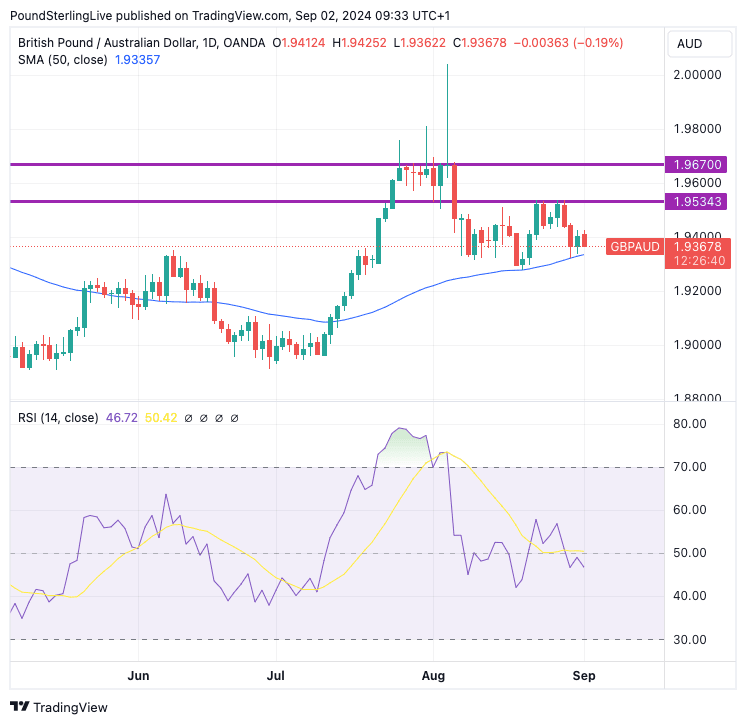

The Pound to Australian Dollar exchange rate (GBP/AUD) continues to find buying interest at the 50-day moving average support, which is acting as the key level of support in the short-term. As such, we think weakness will be limited to 1.9335 ahead of this week's calendar risks, which fall on Thursday and Friday.

Interim resistance is found at last week's highs at 1.9534, meaning we think strength will fade here. In short, we are looking at some tight ranges in GBP/AUD in the coming days, but we hope for a more decisive breakout from Thursday onwards.

A potential trigger to GBP/AUD strength or weakness would be a speech by RBA Governor Michelle Bullock, due Thursday.

She will address the Anika Foundation, a charity engagement that RBA Governor Philip Lowe made a regular event. In his final address to the Foundation last year, Lowe discussed the economy, inflation, and monetary policy, suggesting that his successor has ample precedent to engage these market-moving issues.

We would anticipate Bullock's trademark platitudes regarding the pain Australians are enduring under high interest rates and that the RBA stands ready to cut interest rates if the data allows.

Above: GBP/AUD at daily intervals showing support and resistance. Momentum is flat, however, as per the RSI in lower panel.

She will likely talk about encouragement in recent declines in inflation but caution that it is too soon to give the 'all clear' and cut rates.

We have strong assumptions about Bullock's speech, meaning it will require a conscious divergence in narrative to move the markets. Does Bullock paint a more positive picture of last week's monthly inflation release and other recent data prints? Or does she reinforce expectations that the RBA will be the last central bank in the G10 to cut rates.

If the former, then GBP/AUD can rally, if the latter, then a potential breakdown below the 50 DMA becomes possible.

We think Bullock will stick to the script, meaning her speech won't be a game-changer, allowing traders to fade any knee-jerk reactions.

The main event in the coming week for both the Pound and Australian Dollar will be Friday's U.S. jobs report as this should have a significant impact on global investor sentiment.

As a reminder, the Aussie Dollar is highly sensitive to global sentiment, tending to rise when markets are rising and fall when sentiment takes a hit.

Market sentiment was buoyant in August as markets saw increasing odds that the Federal Reserve would cut interest rates by an outsized 50 basis points later in September owing to a run of weaker-than-expected data.

We think that the odds of a 50bp cut can recede further on a stronger-than-expected U.S. non-farm payroll report on Friday, which can further bolster the Dollar and weigh on the Aussie Dollar.

This would press the GBP/AUD cross exchange rate higher.

"The incoming data this week has generally supported our view that the US is on track for a soft landing, and if we are right in thinking that payrolls growth will rebound a bit from the surprise weakness in July, the odds of a 50bp cut from the FOMC at its next policy meeting will probably recede further," says Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics.

The market expects a payroll print of 163K for August, up from 114K in July.

Capital Economics forecasts a healthier 170K gain, alongside a small fall in the unemployment rate to 4.2%. Wage growth should remain at 3.6%.

"Together, that would be consistent with a 25bp rate cut by the Fed next month," says Thomas Ryan, North America Economist at Capital Economics.

Lars Mouland, an analyst at Nordea Bank, says Hurrican Beryl, which swept through Texas on July 8th, might have been the main reason the July employment numbers looked so bad.

"We expect a rebound in next week's data will remove some of the recession fears," says Mouland.

He explains that economic activity was also impacted by Beryl as the entire 140K national drop in July housing starts can be traced back to the Southern states, with no discernible changes elsewhere.