Image © Adobe Images

Expect a big decline in the Pound to Australian Dollar exchange rate (GBP/AUD) if Kamala Harris wins the U.S. Presidential election.

From a technical perspective, the GBP/AUD setup is constructive: it trades above the nine-day moving average, while momentum is positive according to the Relative Strength Index, which is at 60 and pointing higher.

GBP/AUD even managed to record a weekly gain last week, despite Pound Sterling coming under broad-based pressure in the wake of a poorly received UK budget that triggered concerns about the new government's high tax, high spending and high borrowing agenda.

If this was a normal week, we would suggest we have a 65% confidence that GBP/AUD is going to end the week higher than where it starts.

However, this is by no means a normal week given the event risk that lies ahead in the form of the U.S. presidential vote.

The resilience in GBP/AUD, in the face of UK-specific pressures, speaks of the Australian Dollar's particular vulnerability to a Donald Trump win this week.

Should the betting odds prove correct, and Trump wins, then we could see GBP/AUD move back above 1.98 and retest the 2024 highs just below 1.99.

"The Antipodean currencies are highly exposed to the US election," says a note from Crédit Agricole. "The AUD and NZD have high exposures to UST yields, but unlike the JPY, are negatively exposed to any risk-off trading and weaker equities in the event of a Trump election victory."

The Australian Dollar is also highly sensitive to all things China. With Chinese imports in Trump's cross-hairs, a Trump win would raise concerns about China's growth trajectory, which would impact negatively on the Aussie Dollar.

China is expected to announce a new fiscal stimulus package, potentially as soon as this week, but analysts say authorities are waiting for the election results, judging more will need to be done to counter the negatives from a Trump win.

"Adding to the Antipodean currencies' angst is their relative high exposures to trade with China as well as their high correlations with the CNH during Trump’s first term. The AUD was an especially popular proxy for short CNH trades," says Crédit Agricole.

Should Kamala Harris win, the Australian Dollar could be one of the biggest beneficiaries.

AUD started the new week on a firmer footing against the U.S. Dollar and other G10 currencies after new polls released over the weekend were more favourable to Kamal Harris, with one even suggesting she would register a shock win in Iowa.

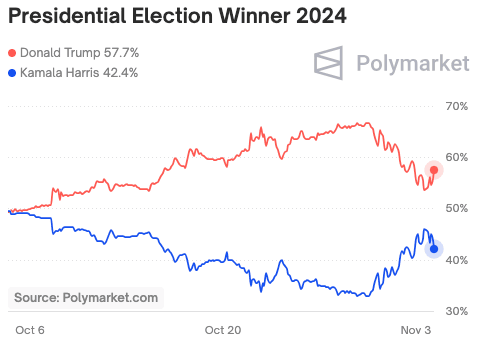

This triggered a retreat in betting market odds in favour of Trump, which would better reflect the uncertainty in the polls.

Ultimately, the polling is tight and well within the margin of error, suggesting a 50/50 toss-up for the outcome.

"Recent polls suggest that Kamal Harris has been gaining favorability in the swing states at the same time as the odds of a Trump win on betting markets continue to fall. Investors at Polymarket and Kalshi still see the former president in the lead. However, Predictit now has Harris narrowly winning the contest," says Boris Kovacevic, Global Macro Strategist at Convera.

This week will also see the Reserve Bank of Australia deliver its latest policy decision, where no change in interest rates is expected.

"We continue to expect rates to remain unchanged this year, and that the rate-cutting phase will begin with a 25 basis point cut at the February 2025 meeting," says Luci Ellis, Chief Economist at Westpac Group.

The RBA will, therefore, be amongst the last of the major central banks to cut interest rates, which is favourable to AUD valuations.

Money tends to chase higher interest rates, and AUD is becoming increasingly attractive in this regard.

The Bank of England is also in focus this week, with another 25 basis point interest rate cut likely to be announced Thursday.

The Bank will release its latest economic projections, which should show an upgrade to inflation and growth forecasts for 2025 in the wake of the government's budget announcement.

The decision to spend big and borrow big are inflationary and should see the UK enjoy a sugar rush of activity in the coming months.

This will require caution from the Bank, which is only likely to cut at quarterly intervals.

"The market selloff in the wake of the autumn budget could force the BoE to prioritise restoring financial stability while also revise up its inflation outlook at its November policy meeting. A 'hawkish' cut could help the GBP stabilise," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

"The outlook for higher yields to remain in place for longer now could encourage a stronger pound when the Gilt market eventually settles down," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

Markets show expectations for a quarterly pace of interest rate cuts in the UK, which should ensure interest rates remain amongst the most attractive in the developed world, which will bestow support on the Pound.

The big risk to Sterling would be the Bank adopting a 'dovish' tone, whereby it tries to encourage expectations for a second consecutive rate cut in December.