- "Employment the start of the show"

- Insulates AUD against downside

- GBP/AUD continues to struggle

Image © Adobe Images

The Australian Dollar is supported by confirmation that the Australian labour market remains in good health.

Australia added 89K jobs in April, up from 36.4K and breezing past expectations for 20K.

The headline figures signal that the Reserve Bank of Australia (RBA) can take its time when considering further interest rate cuts, which the textbook says is supportive of the domestic currency.

Central banks tend to cut interest rates when the labour market is seen to be deteriorating, and Australia's latest jobs print is "toning down some the apparent softness that looked to have emerged over the last couple of months," says Ryan Wells, Economist at Westpac.

"Employment was the star of the show, rising a whopping +89k (0.6%) in April, more than double the top-of-the-range estimate. Once smoothed on a three-month average basis, employment growth is sitting at an annual pace of 2.3%yr, broadly in line with the last few months of 2024," he adds.

Although strong labour market data, there was no surge in the AUD; instead, it looks comfortably supported near recent levels against the majors.

If anything, the strong jobs report will provide some insurance should any notable deterioration in the global picture emerge, while also confirming the AUD as a preferred pick amongst its peer currencies.

AUD and its fellow commodity currencies have been on the offensive since mid-April when the U.S. was seen to be rowing back on its extreme trade war stance.

The shifting stance culminated in the U.S.-China trade accord, announced Monday; however, markets are now looking for new good news to drive the relief rally.

This could suggest a 'peak optimism' moment might have been reached, and this seems to have taken the wind out of the AUD's sails through the midweek session.

Yet, despite the Australian Dollar taking a step back, it has not decisively turned lower.

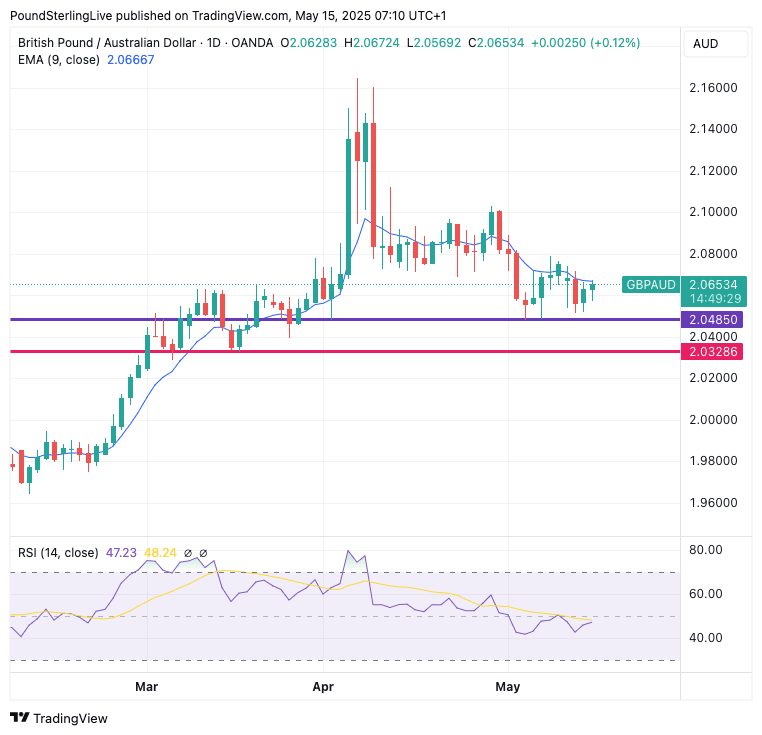

above: GBP/AUD at daily intervals.

A look at the GBP/AUD confirms this: GBP/AUD is higher (i.e. AUD is lower against GBP) over the past couple of days, but the rebound has not yet even cracked the 9-day moving average.

This would need to happen in order to send the signal that upside momentum (i.e. AUD weakness) was rebuilding more meaningfully.

We view this as a sign that the near-term trend for GBP/AUD remains lower, and as a result, our Week Ahead Forecast remains intact: that near-term downside should be expected.