Despite being undervalued, the Australian Dollar should fall "materially further" in 2025. But near-term, the exchange rate could find some support.

Pound to Australian Dollar Rate Surges

- Category: AUD

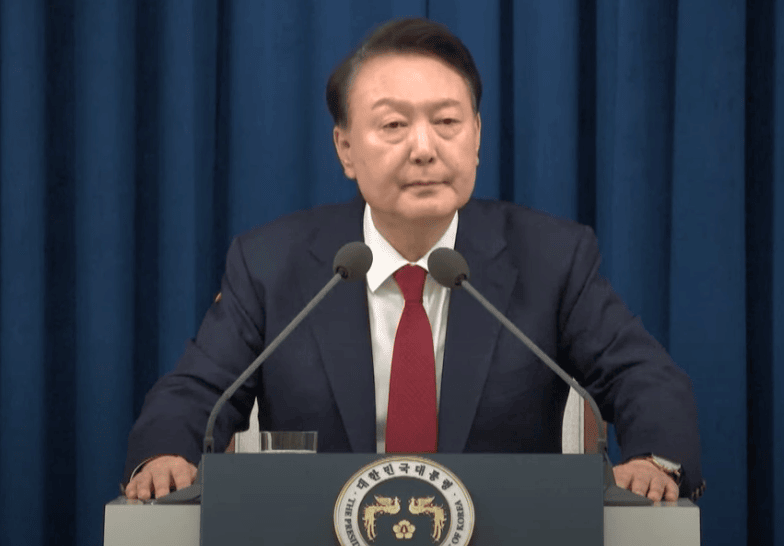

The Australian Dollar is under pressure amidst political chaos in South Korea and a surprisingly weak domestic GDP print.

The Australian Dollar will have RBA caution in its corner in 2025.

GBP/AUD recovery is building momentum, and further advances are possible this week.