Image © Adobe Images

A U.S. court overturned the 'Liberation Day' tariffs, boosting the Canadian Dollar.

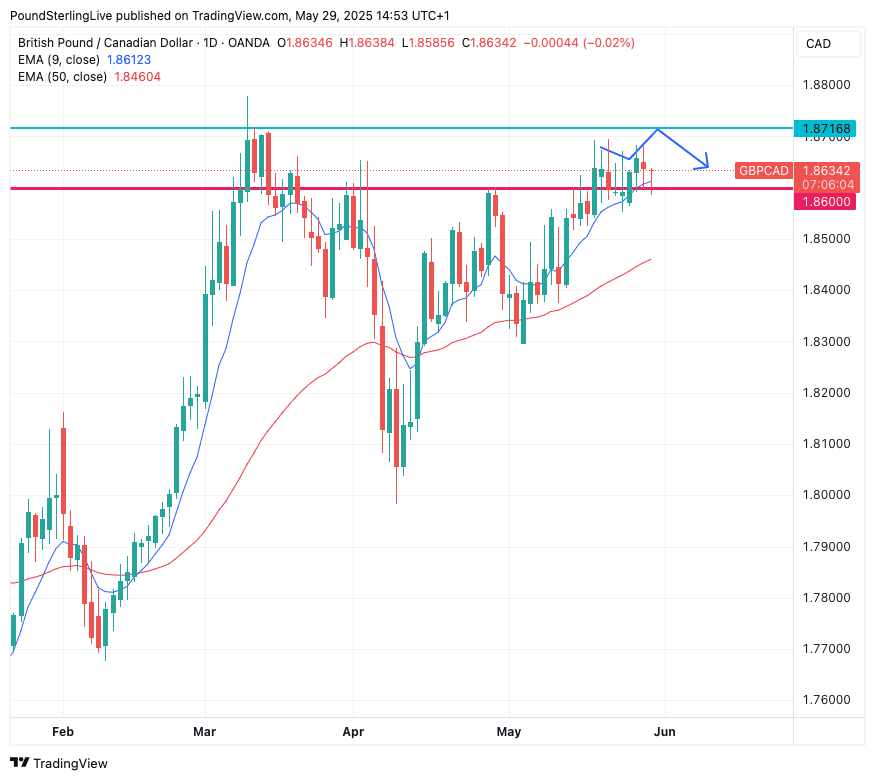

This renewed Canadian Dollar strength sucks the impetus out of the Pound to Canadian Dollar rate's advance, risking a near-term setback below 1.86, although the bigger picture remains one where GBP/CAD extends higher.

North American currencies rose against European peers after the three judges on the Federal Court of International Trade (CIT) unanimously agreed that the U.S. President does not have sufficient authority under the International Emergency Economic Powers Act of 1977 (IEEPA) to enact broad-based reciprocal tariffs.

The court said the U.S. trade deficit does not constitute the definition of an "unusual and extraordinary threat" to warrant the use of IEEPA powers.

"The CAD has picked up - marginally - on the back of the latest twist in the tariff saga but the gains are minimal relative to yesterday’s close," says Shaun Osborne, Chief FX Strategist at Scotiabank.

The court's decision invalidates the administration’s 10% 'baseline' tariff on all trading partners, as well as 'reciprocal' tariffs that are set at specifically higher levels for numerous countries.

The fentanyl-related penalties imposed on China, Canada, and Mexico earlier in the year are also invalidated.

The White House now has ten days to suspend its tariff collection activities and is also required to begin refunding monies collected thus far.

Investors now see less likelihood that the economy falls into recession, bidding the Dollar and U.S. stocks higher. The Canadian Dollar, which often tracks its North American peer, particularly against European currencies, is also benefiting.

The result for the Pound-to-Canadian Dollar is a failure of a recent recovery to result in a retest the 2025 highs at the 1.8716 level, which we thought might have been where resistance was layered:

Instead, the pullback that was forecast in the above chart (the arrow was drawn last Monday, in our regular Week Ahead Forecast), has occurred earlier.

Nevertheless, the general sense that GBP/CAD will struggle to advance from these levels has proven correct and a pullback and consolidative action is expected to extend.

That being said, the broader, longer-term trend in GBP/CAD remains higher as we note uncertainty regarding tariffs and the U.S. economy could actually increase following Trump's latest setback.

"Relief for Canada from the court ruling may be limited. It’s unclear how promptly the administration will respond to the ruling, the appeal process will play out, probably not that quickly," says Osborne.

A move to 1.8716 and above is, therefore, still on the cards for the coming weeks as it becomes clear we are no closer to seeing Trump fulfil his ambitions on the world stage.