Image © Bank of Canada

The Canadian Dollar has fallen across the board after the Bank of Canada cut interest rates for the second time in as many months.

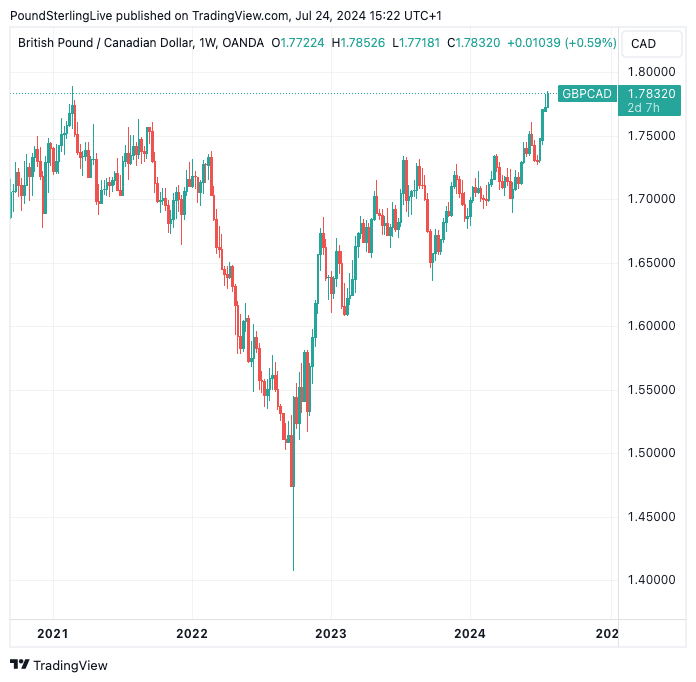

The Pound to Canadian Dollar exchange rate hit a new three-and-a-half-year high at 1.7850 after the Bank said it would likely cut rates again in the coming months if inflation continued to ease.

"Our forecast for inflation this quarter is the same as the Bank’s, leaving us to judge that another interest rate cut in September is the most likely outcome," says Stephen Brown, Deputy Chief North America Economist at Capital Economics.

The Canadian Dollar has come under notable pressure ever since it became clear the Bank of Canada would be amongst the leaders in the evolving interest rate cutting cycle.

"Two in a row with more to go was the message from the Bank of Canada today," says Avery Shenfeld, an analyst at CIBC. "Economic slack, or excess supply, has the economy no longer in need of punitive interest rates to contain inflation."

Canadian Dollar weakness is widespread following the decision, with USD/CAD up 0.12% d/d at 1.3810 and EUR/CAD up 0.22% at 1.4992.

The Bank of Canada's statement says a pickup in economic growth is expected, but lower interest rates are cited as a driver of that growth, "so there is clearly an intention to continue to trim rates this year and in 2025," says Shenfeld.

Above: GBP/CAD at weekly intervals. Track GBP/CAD with your custom alerts; find out more here

Notable developments include the Bank acknowledging the breadth of inflation has diminished, particularly as mortgage rate costs accompany base rates lower.

The Bank says it is increasingly wary of downside risks to the economy, suggesting it is inclined to give more weight to protecting the economy than fretting over remaining pockets of inflation.

"Governor Macklem struck a dovish tone in his press conference opening statement. Looking ahead, Governing Council sees “broad price pressures continuing to ease” and expects “inflation to move closer to 2%” as “ongoing excess supply is lowering inflationary pressures," says Randall Bartlett, Senior Director of Canadian Economics at Desjardins Bank.

The prospect of further cuts can keep CAD under pressure, particularly against currencies belonging to central banks that will be more cautious in approaching rate cuts.

"Our expectation remains that there will be two additional rate cuts this year, one at each meeting after today’s meeting that will lower the overnight rate to a still restrictive 4% by the end of 2024," says Claire Fan, Economist at Royal Bank of Canada.