Official White House Photo by Daniel Torok.

The Euro is softer on fading trade war tensions.

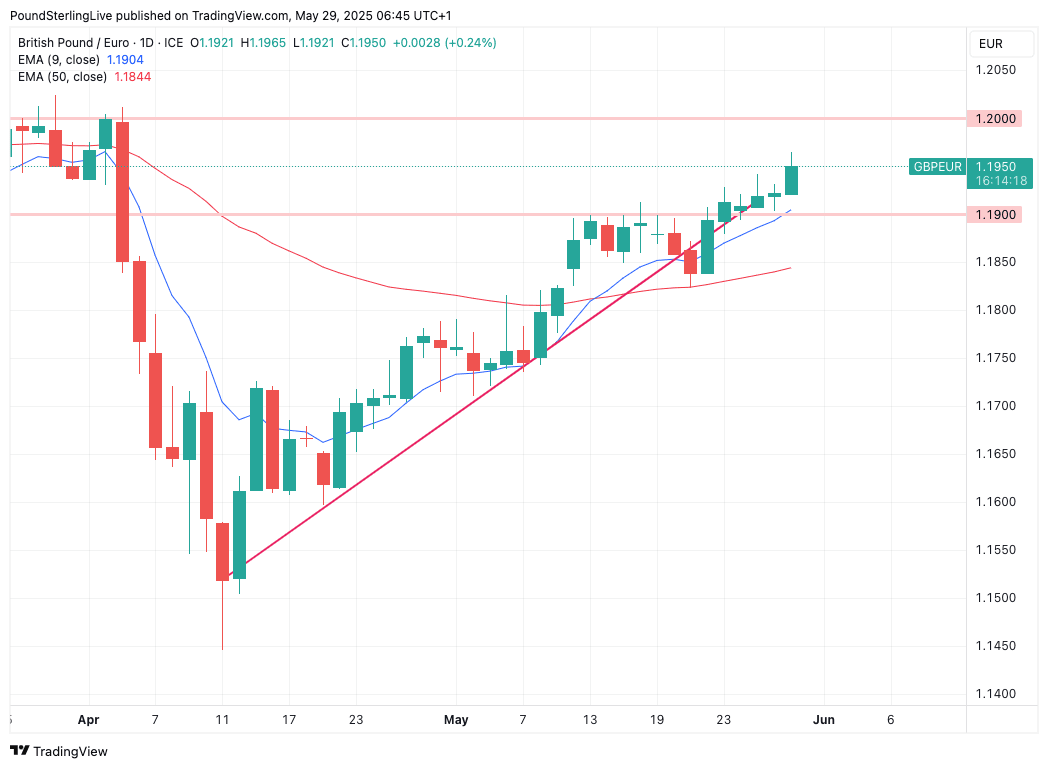

The Pound to Euro exchange rate (GBP/EUR) advances to 1.01965, its highest level since April 03, following a court ruling in the U.S. that eases global trade tensions.

This is after financial markets responded positively to a ruling that halts President Donald Trump's tariffs, with major stock futures rising sharply, reflecting investor optimism about reduced trade tensions and potential economic stability.

Pound Sterling benefits from the improved investor sentiment that follows a ruling by the U.S. Court of International Trade that Trump exceeded his authority by imposing sweeping tariffs under the International Emergency Economic Powers Act (IEEPA).

The court determined that the trade deficits and other issues cited by the administration did not constitute the "unusual and extraordinary threats" required to invoke emergency powers under IEEPA.

As a result, the court issued a permanent injunction against the enforcement of these tariffs.

The Euro is one of the biggest beneficiaries of fears that rising trade tensions will slow the U.S. economy, as investors seek out non-USD alternatives. Therefore, when trade tensions ease and optimism recedes, the Euro is amongst the biggest losers.

Above: GBP/EUR at daily intervals.

The ruling specifically targeted the "Liberation Day" tariffs announced on April 2, 2025, which included a 10% baseline tariff on most imports and higher tariffs on goods from countries with significant trade surpluses, such as China and the European Union.

These measures were challenged by small businesses and Democratic state attorneys general, who argued that the tariffs were economically damaging and legally unfounded.

While the court's decision invalidates these broad tariffs, it does not affect other tariffs imposed under different statutes, such as those on steel, aluminium, and autos, which were implemented under separate legal authorities.

The White House has indicated plans to appeal the ruling, asserting that addressing national emergencies should not be subject to judicial overreach.

Amidst hopes for easing tariff tensions, GBP/EUR trends higher, and we continue to anticipate a test of the 1.20 level within the coming days.

"Bottom line: the ruling is seen as a significant check on executive power in trade policy and is fueling a broad rally in risk assets," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman.