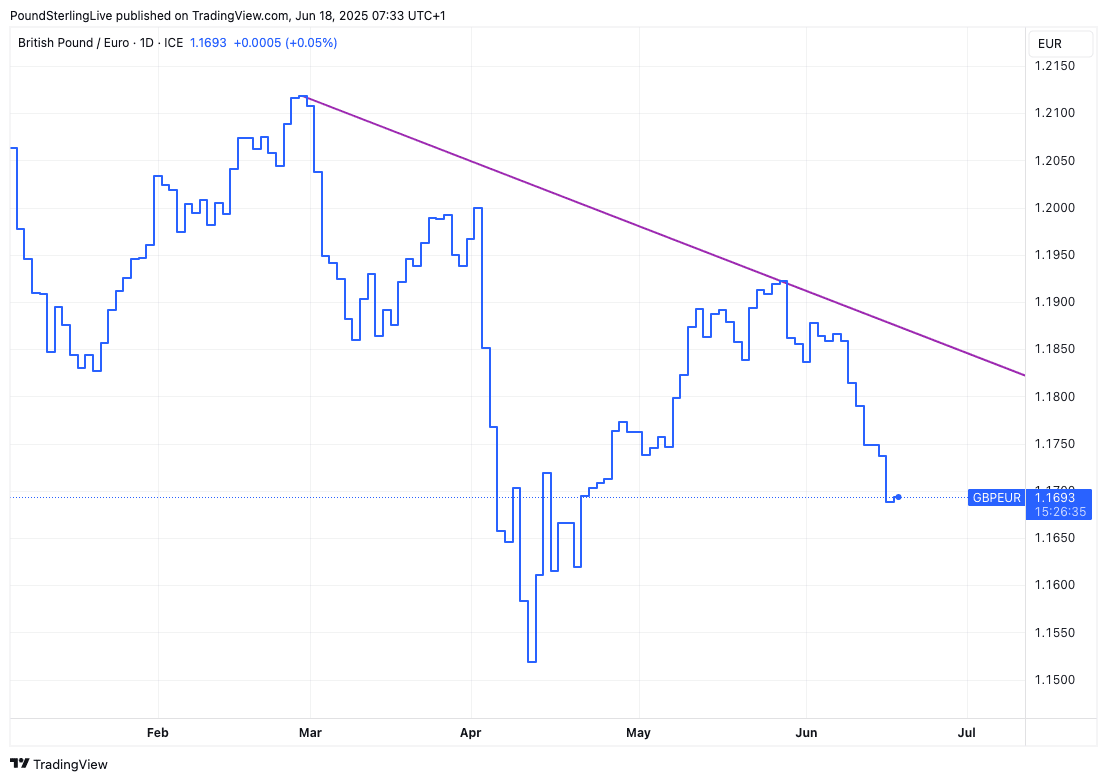

Above: Key measures of UK inflation.

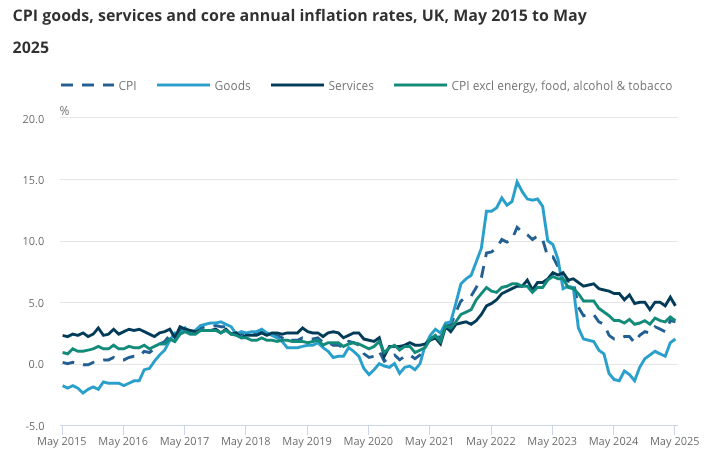

Pound Sterling remains under pressure against the Euro.

Nervous stock markets and a streak of soft UK economic data keep the Pound to Euro exchange rate pointed lower.

The pair fell below the 1.17 level overnight amidst ongoing tensions in the Middle East, ensuring a nervous market sentiment that traditionally weighs on GBP/EUR.

Hopes of a domestically generated recovery in the midweek session were dashed by a set of inflation numbers that met analyst expectations and raised the prospects of an interest rate cut at the Bank of England in August.

The ONS said UK headline inflation rose to 3.4% year-on-year, down from 3.5% in the previous month, but beating expectations of 3.3%. Core inflation met expectations by falling from 3.8% to 3.5%, and CPI services inflation - a key metric for the Bank of England - fell markedly to 4.7%, down from 5.4% in April.

These outcomes place the main inflation readings in line with the Bank of England's forecasts, buttressing the Bank's strategy of cutting interest rates at a quarterly pace. This means the next cut will be in August.

Recall that just two weeks ago, the market saw the prospect of just one further cut. However, bets for two further cuts this year rose sharply following last week's soft UK GDP and labour market figures.

These inflation numbers will help reinforce the view that the economy will cool further, allowing inflation to fall to the Bank's 2.0% target later next year.

Above: GBP/EUR is trending lower.

The Bank will leave interest rates unchanged tomorrow, as the bigger picture shows Britain is struggling with inflation figures that remain well above the 2.0% target. "The BoE is likely to leave interest rates unchanged despite the recent weaker figures from the real economy. This view is supported by the fact that core inflation remains far too high, despite likely declining in May, and has shown no signs of improving sustainably for many months," says Michael Pfister, FX Analyst at Commerzbank.

The softer Pound Sterling suggests markets are preparing for tomorrow's Bank of England guidance to put an August in the frame. We could even see three members of the Bank's Monetary Policy Committee vote for a vote as soon as this month, which would signal the Bank sees scope to keep cutting interest rates.

For Pound-Euro, we don't think the Bank of England decision will be a massive mover as the decision and possible permutations in the guidance are more or less expected.

Instead, the geopolitical setup will remain in charge. With the Israel-Iran conflict potentially escalating, the odds of further downside are elevated.

"GBP/EUR has been grinding lower since the start of the month, taking out its supportive key daily moving averages. Holding above €1.17 will be crucial or else an extended slide towards €1.16 or lower before month-end could be on the cards," says George Vessey, Lead FX & Macro Strategist at Convera.