Image © Adobe Images

Pound sterling is steadily adding to its advance against the euro.

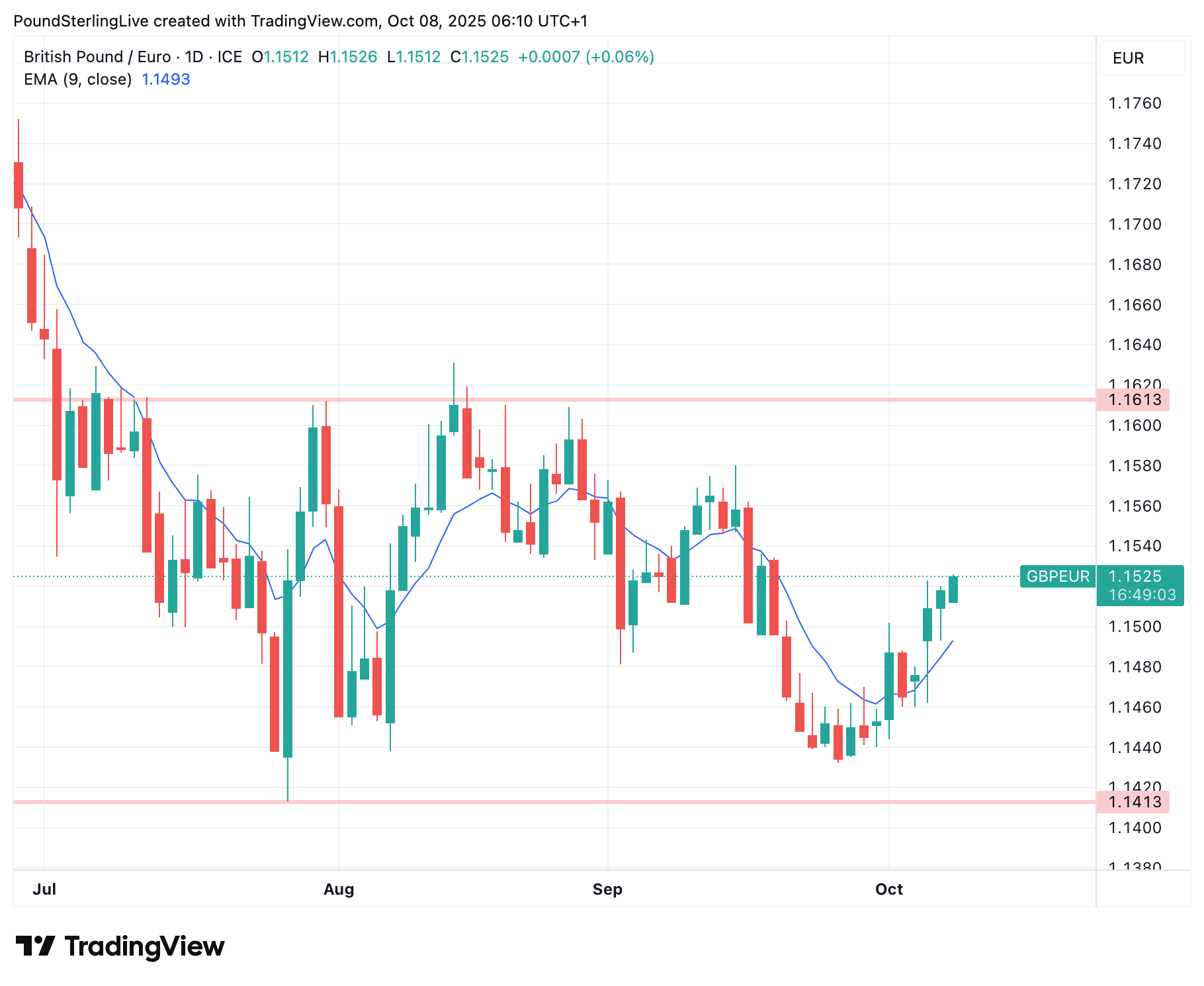

The pound to euro exchange rate (GBP/EUR) rises to 1.1522 in midweek trade and near-term technical indicators are consistent with an extension of the rally.

The pair broke above the 21-day exponential moving average on October 01, but more importantly, it managed to hold above that line when it inevitably pulled back from the highs.

GBP/EUR is consistently closing each day above the 21-day, and this signals we are in a mini uptrend that could extend to the layers of resistance that start building from 1.16.

Impetus for the recovery is provided by political dramas in France that leave markets concerned the country will be without a functioning government for an extended period.

As of Wednesday, President Emmanuel Macron's options to tackle the crisis appear limited, with his own allies beginning to distance themselves and opposition figures renewing calls for early elections.

With no government to provide a new fiscal framework, debt consolidation becomes impossible in Europe's second-largest economy and sovereign bond market risks grow.

Above: GBP/EUR trades above the 21-day moving average, signifying positive momentum.

The European Central Bank (ECB) won't let France default, but it could still be prompted to take measures to provide support, which will prove unsettling for the eurosystem, potentially creating frictions between France, the ECB and other countries that will ask why they simply can't spend as much as France is doing.

This uncertainty can ensure the euro trades with a soft tone.

Yet, the euro is not collapsing and stresses are restricted to France for now. This signals markets are relatively sanguine about broader Eurozone risks.

Given this, bond markets could still settle and the euro regain composure.

Also, France's fiscal difficulties are not a mile away from those of the UK and analysts are wary of a troubling few weeks in UK political and economic circles as the government leaks potential budget plans.

This should keep a hard cap in place above the pound-euro exchange rate's head and ensure buyers of euros see limited pickings going forward.

We also note increasing numbers of institutional analysts who are targeting a fall to 1.11 in the exchange rate over the coming months, as a sign of unease at the big investment banks.

Given these circumstances, those with sizeable international payment requirements should pay greater attention to limiting risks associated with holding Sterling over multi-week timeframes.