Image © Adobe Images

Pound sterling is in a mild corrective upmove against the euro.

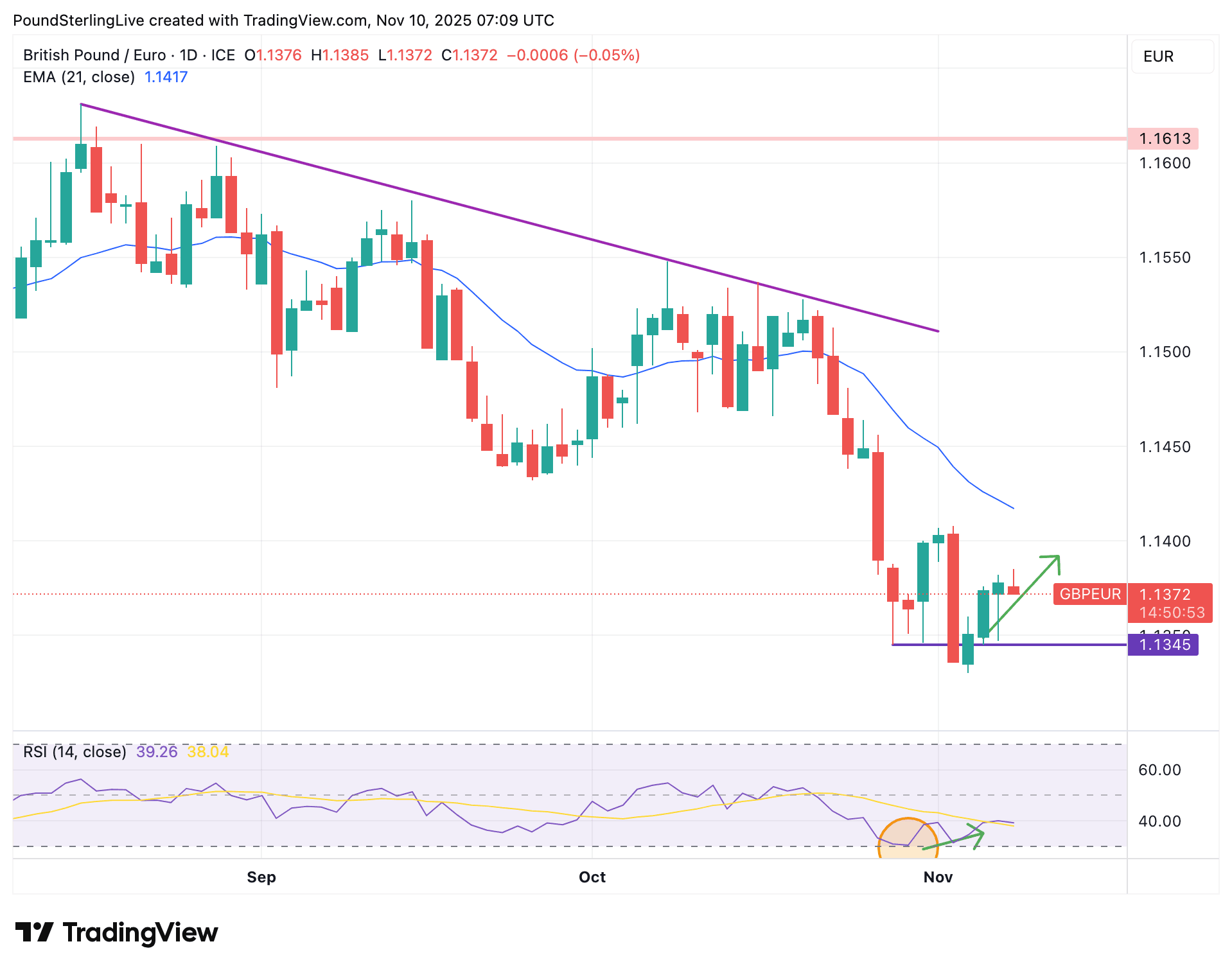

The pound to euro exchange rate (GBP/EUR) can fortify a recent recovery in the coming week, with gains potentially rising to the 21-day moving average at

GBP/EUR fell to two-year lows at 1.1330 last week but has since recovered to 1.1375 at the time of writing Monday.

The coming five day horizon could see further consolidation above support at 1.1345, a level that has witnessed buying interest in the past two weeks.

The rebound has extended to the nine-day exponential moving average (EMA) located at 1.1375, a level that is potentially capping upside.

However, we note that in the current cycle, recoveries have tended to move to the 21-day moving average, currently at 1.1417, which is the potential target for our Week Ahead Forecast.

Note that the pair is relatively contained and not prone to big upside moves, so it might not be until closer to the end of the week that the level is attained.

The recovery comes after the exchange rate recorded oversold conditions on the daily chart, with RSI sinking to 30, following the September dump.

The current rebound action is still considered technical in nature and not a signal of returning GBP strength.

The pair lacks meaningful impetus or intent and this of course owes itself to the generalised uncertainty that prevails ahead of the upcoming November 26 budget.

This suggests the pair is not yet ready to turn around and exit the 2025 selloff and it also means the market is still trending lower, meaning the current upturn will likely be limited and fresh 2025 lows beckon on the horizon.

The coming week's calendar highlight will be Tuesday's release of UK labour market data.

Here, the unemployment rate is expected to reach 4.9% in October from 4.8%, in response to rising unemployment.

A more severe deterioration in the headline employment numbers would trigger a selloff in the pound, that would undermine our technical expectation for a short-term recovery to extend.

Also, keep an eye on the wage figures, as this is closely associated with inflation. The figure to beat is 4.6%.

Thursday brings the quarterly GDP release, where the consensus looks for a 0.2% increase q/q. Believe it or not, the UK economy has actually been doing OK this quarter, so a beat on expectations can't be ruled out.

If it happens, then GBP/EUR can end the week above 1.14.