Picture by Simon Dawson / No 10 Downing Street.

Pound sterling looks to remain under pressure against the euro.

It's a strong start to the new week for the pound to euro exchange rate (GBP/EUR), rising a third of a per cent on the day to hit 1.1357, however our forecast suggests rallies will be sold into and Sterling will remain under pressure as a result.

With momentum indicators and directional signals pointed lower, this edition of the Week Ahead Forecast suggests a strong likelihood of a move below 1.13, although much will depend on the midweek release of inflation data and Friday's PMI release.

These data points come amidst a grey background of dour investor sentiment towards the UK, amidst uncertainty surrounding next week's budget announcement. GBP/EUR dropped below 1.13 last week after the government indicated it would abandon attempts to raise income tax, triggering concerns that the public finances would remain in a precarious position.

Days of leaks, counter-leaks and about-turns regarding the budget raise questions over the competency of the current leadership and are taking a toll on the pound; market sensitivities will remain high.

This wariness will reflect in a risk premium on sterling exchange rates that should keep it on offer in the coming days.

Citi describes the British pound's recent price action as "ugly" and the bank's strategist Jim McCormick warns that markets remain highly sensitive to fiscal noise: "Another budget of a million small tweaks is not credible, and this is a negative."

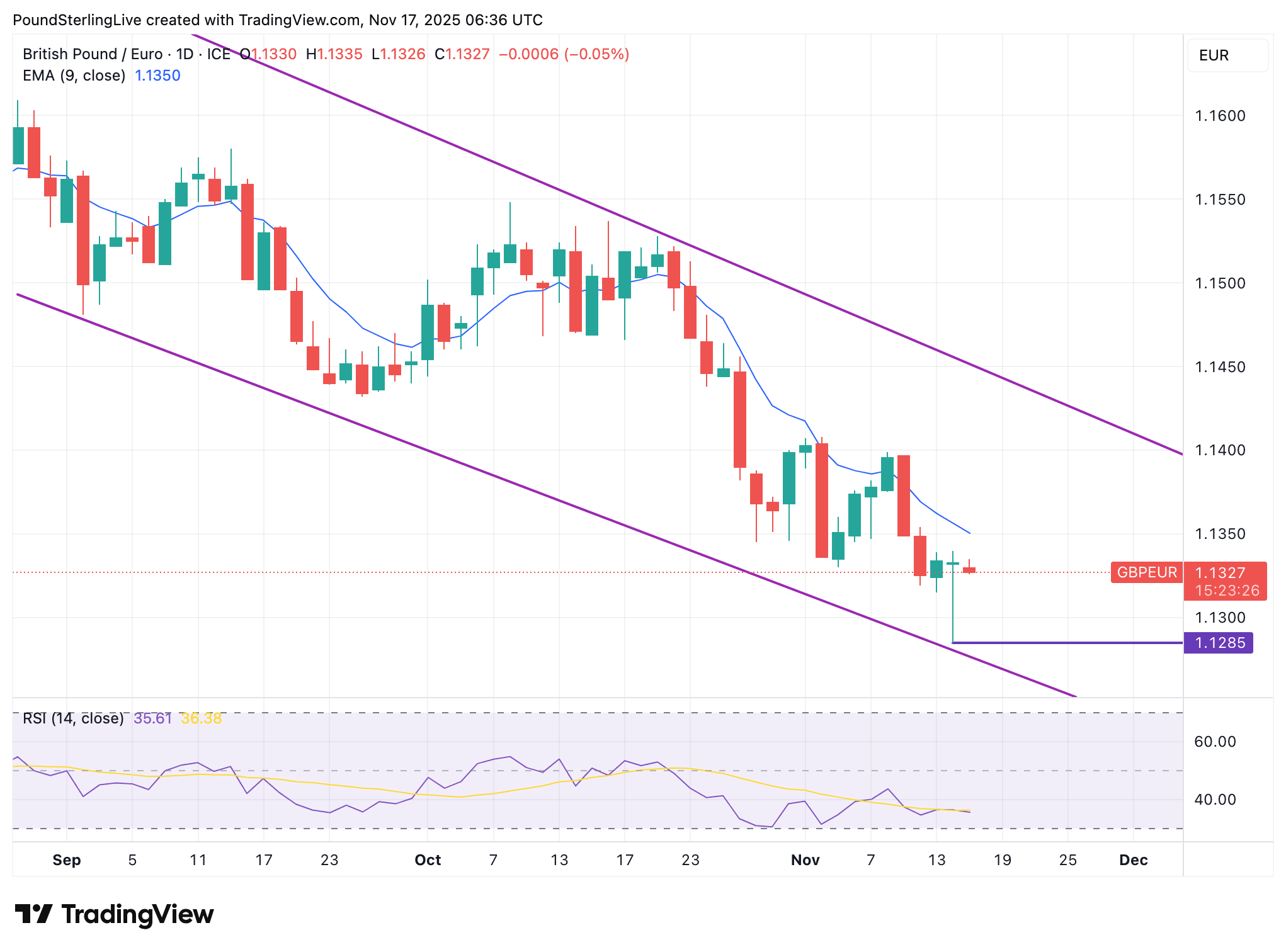

The net result ia a GBP/EUR exchange rate that is under pressure, trading at 1.1325 at the time of writing Monday, placing it below the nine-day exponential moving average on the daily chart.

While below here, further losses are anticipated near-term, with the immediate target being last week's low of 1.1285. Momentum indicators, such as the RSI, verify the heavy tone to proceedings and there is nothing to stand in the way of the bearish stance.

Some midweek excitement will come in the form of inflation data, which should confirm domestic inflation has peaked and is turning lower.

Should the figure fall below the 3.6% year-on-year consensus expectation, then the pound will come under pressure as this would cement bets for another interest rate cut at the Bank of England next month, and then potentially again in February.

Odds of further cuts have steadily grown over recent weeks, amidst soft economic data and the expectation that tax increases in the budget will stall the economy and help lower inflation next year.

Friday sees retail sales data released, which can also have an impact on sterling. Interestingly, recent retail sales releases have beaten expectations and offered sterling exchange rates some welcome, albeit limited, relief.

The bigger event comes later in the day with the release of PMI survey data for November, which will give an initial insight into how the economy has fared this month.

Recent editions of the PMI have come ahead of expectations, indicating an economy that remains somewhat robust.

If repeated, the odds for future rate cuts can recede, offering the pound-euro exchange rate some near-term support into the weekend.

Nevertheless, strength will likely prove limited and we don't see anything in the calendar having the ability to finally snap and reverse GBP/EUR's steady trend of decline.