Image © Adobe Images

Pound sterling is forecast to maintain a short-term uptrend against the euro this week.

The pound to euro exchange rate (GBP/EUR) opened weaker on Monday but soon bounced off support to register a daily gain, putting behind it four successive daily closes in the red.

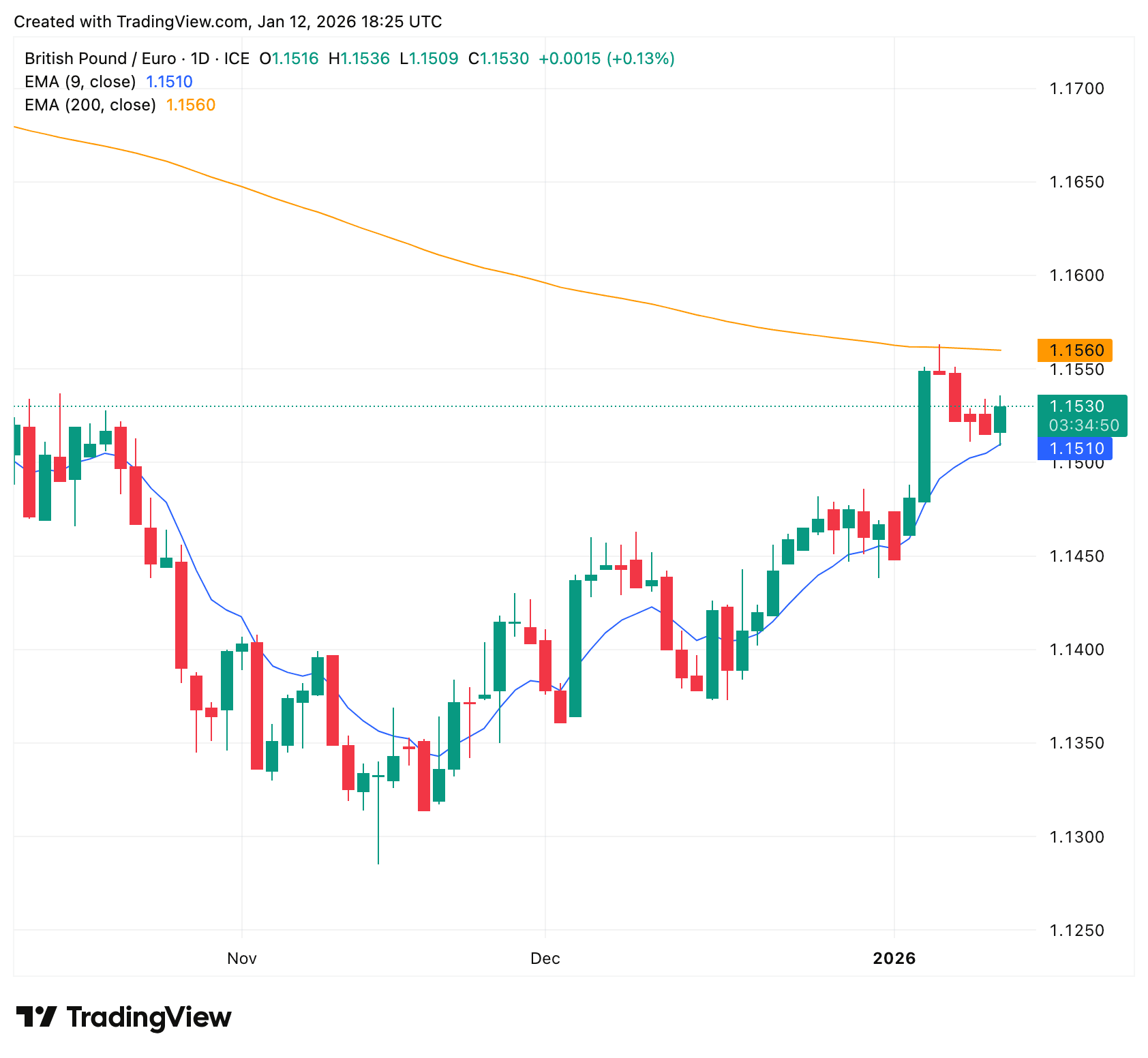

Support was found at the nine-day exponential moving average (EMA) at 1.1510 and while above here, we are inclined to maintain a constructive tone on the pair.

The nine-day EMA is a dynamic trend filter; if the price holds above it, it suggests buyers are defending pullbacks and dips are being bought rather than sold.

Given this we'd expect a retest of 1.1560 before long.

Why 1.1560? This is another important technical level - in the form of the 200-day EMA - that should attract the exchange rate.

Last week, GBP/EUR rose to the 200-day EMA, which was located at 1.1563 on Tuesday, and where we had expected the rally to be challenged, as is often the case when significant MAs are encountered.

This duly happened, and there was enough selling interest around this technical indicator to trigger a pullback.

So we have a conflicting setup: short-term positive trends rising up towards that major obstacle in the form of the 200-day EMA.

There’s a decent chance the pair is caught between these opposing forces and is constrained near current levels for a few days until a new directional trigger is pulled.

Technicals can only take a market so far, and the pound will need some solid fundamental improvements to back the case for further advances in GBP/EUR.

With this in mind, we'll be watching Thursday's monthly GDP release that should show the economy returned to growth in November, having shrunk in October. If the data beats expectations, sterling can find a decent enough bid that opens the door to that high at 1.1563.

But it won't be until next week's release of labour market and inflation data that we receive some true 'front line' data. For the recent rally to morph into a genuine uptrend, the UK economy must start surprising to the upside.

For now, there's enough technical support in the charts to keep GBP/EUR relatively elevated, but be aware that the year's data calendar is nearly upon us.

The nature of those data will determine whether we end January higher or lower than current levels.