Image © Adobe Images

Pound Sterling endured its biggest one-day drop since April as investors ramped up bets that the Bank of England would cut interest rates next week.

Falling global equity markets are also weighing, but money market pricing shows a distinctive increase in expectations that the Bank of England will cut interest rates at the August 01 policy meeting.

The odds of such a move edged above 50%, in tandem with rising expectations for interest rate cuts in the U.S., confirming the linkage between U.S. and UK rate expectations.

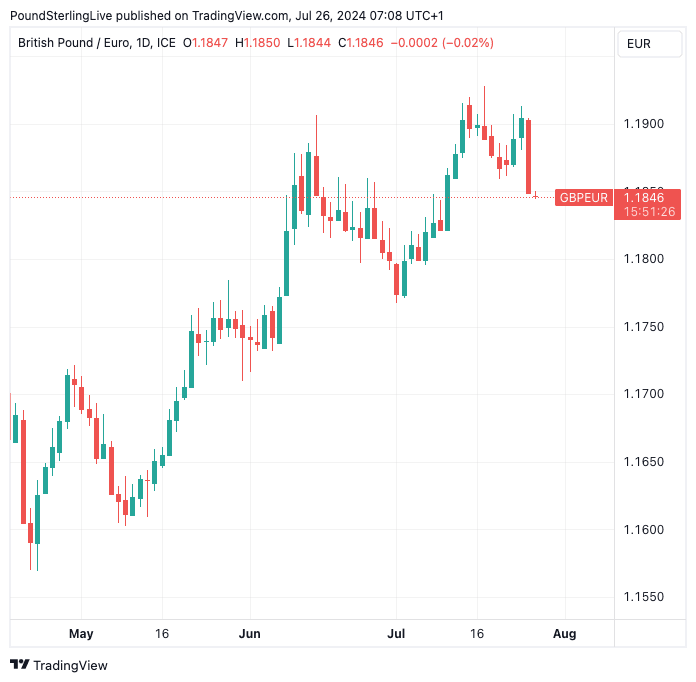

Above: GBP/EUR's rally has been dealt a setback. Track GBP/EUR with your custom alerts; find out more here

The odds of a September interest rate cut at the Federal Reserve are now fully priced following recent soft U.S. data and a significant stock market selloff, which means financial conditions in the U.S. have tightened.

"Markets think that the Bank of England will be encouraged to proceed with a 25 basis point cut if it thinks the Federal Reserve will also cut interest rates," says Harry Robertson, an analyst at Reuters.

The Pound to Euro exchange rate rose as high as 1.1930 last week but has since retraced by nearly 100 pips to about 1.1845. This brings it closer to the consensus median forecast of over 30 investment bank analysts.

Interest rate expectations play a significant role, if not the most important role, in global FX. The Bank of England holds one of the highest base rates in the developed world, which attracts inflows of foreign currency into UK assets.

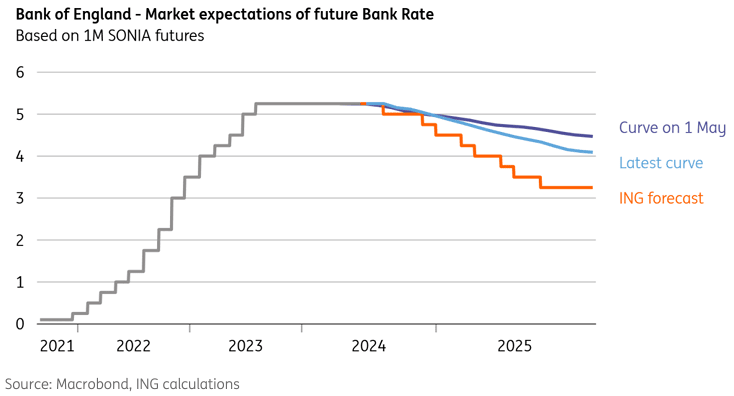

Above: The Bank might cut more than the market expects says ING. This can weigh on the Pound.

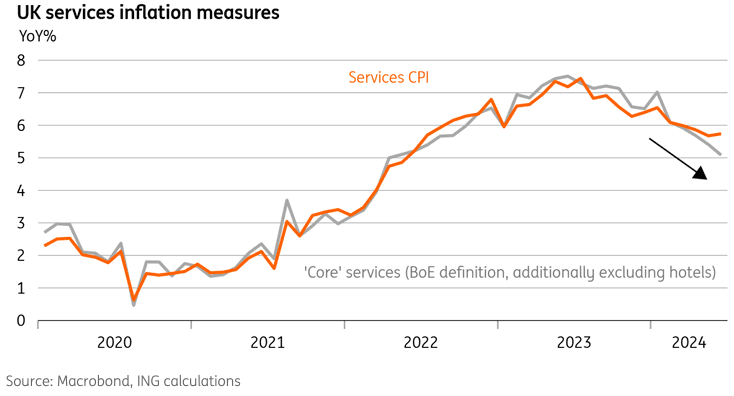

The odds of a rate cut in August retreated earlier in the month when the UK reported above-consensus services inflation, which signals inflation will likely start to climb again in the coming months. But with expectations for a cut growing again, the Pound is coming back under pressure.

"We stick with our forecast for a 25bp rate cut next week, but acknowledge that it is a finely balanced view. This can be seen in market pricing, which at the time of writing is for 13.1bp at the August meeting, i.e. just above a 50% chance of a cut," says George Buckley, an economist at Nomura.

The Bank of England decision comes amidst elevated sentiment towards the British Pound, with currency market participants holding a record 'long' on the currency heading into this week. This means it is stretched and liable to a setback.

"We have a tactical short GBP bias going into the meeting, based on market pricing, stretched long GBP positioning and the chance of declining risk sentiment," says Dominic Bunning, FX Strategist at Nomura.

Economists at ING think the Bank will look through the recent inflation data for signs that the disinflation trend remains intact.

"Pricing surveys point to less aggressive inflation," says James Smith, Developed Markets Economist at ING, who expects the MPC to vote 6-3 for a rate cut.

ING says a preferred measure of services inflation utilised by the Bank of England (chart above; it strips out rent) is more benign than other measures.

"More dovish interpretation of the recent CPI numbers is also supported by surveys that show firms are raising prices and wages much less rapidly. The Bank of England’s survey of Chief Financial Officers, its Decision Maker Panel, has consistently shown just that," adds Smith.

Still Too Soon To Cut

However, Andrew Goodwin, Chief UK Economist at Oxford Economics, says the Bank will maintain the base rate at 5.25% on August 01, although he acknowledges the decision will be a close call.

"The conditions are in place for the MPC to cut, but we think they will wait until September to avoid surprising markets," says Goodwin.

He thinks the 'hawkish reaction' of markets to June's inflation data will be the decisive factor.

If the Bank holds rates, the Pound could find itself better supported.

"The fact that those members who might switch to voting for a cut, particularly the Governor, have chosen not to speak since the June meeting suggests a lack of urgency on their part," says Goodwin.

Oxford Economics thinks the Bank will use the Monetary Policy Report and press conference to tee up a September rate cut.

"The more dovish members will reiterate that they are adopting a more forward-looking approach than they have over the past couple of years, supplementing that message with a forecast that shows inflation clearly below target at the two-year horizon," says Goodwin.