Image © Adobe Images

Pound Sterling has erased its July gains against a resurgent Euro, and there is only one question to be asked in the coming week: where will the selling end?

Our previous Week Ahead Forecasts correctly called selloffs that characterised the past two weeks, and the theme for the coming week is based on the view that a landing zone is coming into sight.

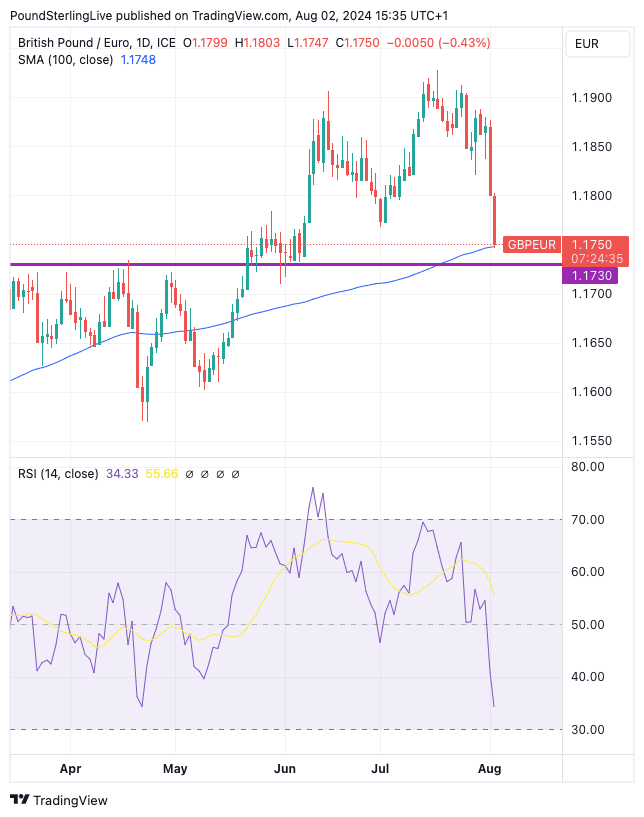

Our overarching expectation is that the Pound to Euro exchange rate will dip further before levelling out above the 1.17-1.1730 area.

Regular followers of our Week Ahead Forecast will recall that 1.1730 formed the top end of a frustratingly dull multi-month range that dominated proceedings in the first half of the year.

1.1730 then morphed into a support zone for the period of trade in late May to mid-June:

Above: The kiss of support? GBP/EUR at daily intervals with the RSI in the lower panel and 100 DMA (blue line, main chart). Track GBP/EUR with your custom alerts; find out more here

We now have some welcome volatility, which offers an opportunity for market participants to transact, but it also makes calling technical levels a little harder.

To be sure, the selloff can extend a little further as GBP/EUR is not yet oversold as per the Relative Strength Index, which is at 35 and pointed lower, advocating for further weakness.

GBP/EUR sliced through the 50-day moving average (DMA) last week, which is a dovish signal, before picking up some support at the 100 DMA (1.1748) on Friday. The 100 DMA's vicinity to the aforementioned 1.17-1.1730 builds the framework of a support structure for the coming week.

There are no major data or calendar events to concern the Euro or Pound Sterling this week, but the fundamental picture is fluid: a global equity market selloff centred around fears for the U.S. economy is playing a significant role in Pound Sterling price action.

The Dollar sold off last week amidst a succession of poor U.S. economic data prints that were topped off by Friday's non-farm payroll undershoot. The weakness in the employment data (the unemployment rate notched up to 4.3%, which is well ahead of Federal Reserve estimates) prompted markets to bet the Fed would potentially cut rates before the September meeting.

Such a move would smack of panic. Another equally unsavoury option for Fed credibility would be an outsized 50 basis point hike in September. Either way, the sense in the market is the Fed let it too late to cut rates.

This Matters for the Pound

The result is a ramping up in rate cut expectations. But, this matters for the Pound, too: we have seen time and time again that when Fed rate cut bets rise, so too do Bank of England rate cut odds.

The market thinks the Bank will cut at a faster pace if the Fed is doing so, diminishing the Pound's 'carry' appeal.

This is particularly important for the Pound-Euro exchange rate, according to David S. Adams, FX strategist at Morgan Stanley:

"I've spent most of the last four months on the road seeing clients. What have I learned? Quite a lot. Short EUR/GBP as a carry trade was surprisingly popular."

He elaborates:

"GBP was a more surprising beneficiary of carry seeking behavior. Investors weren't buying GBP necessarily because they liked the fundamental story; rather the carry relative to volatility was so high it was too difficult to pass up. This is why short EUR/GBP has been such a consistent position in our tracker."

So, if the carry trade is dying under the weight of U.S. rate-cut bets, it could also mean the end of the Pound's rate attractiveness against the Euro.

If this is the case, the highs for 2024 might have already passed.

That said, as a counterpoint, there are numerous institutional strategists who think the supportive fundamental backdrop that has benefited the Pound in 2024 remains in place following last week's 'hawkish' cut at the Bank of England.

The feeling is that the Bank will proceed carefully with rate cuts, ensuring the Pound remains attractive from an interest rate perspective and potentially rebooting the uptrend.

So, the coming week is one of flux for the Pound to Euro rate, where global fears will butt heads with positive fundamentals and solid support around 1.17-1.1730.