Image © Adobe Images

The Pound to Euro exchange rate has recovered further from early August lows and could now be likely to spend the week ahead eroding technical resistance from the nearby 100-day moving average at 1.1747.

Sterling recovered further from the depths of its early August lows around 1.16 against the Euro last week, regaining its 200-day moving average at 1.1692 before moving on to test the 100-day average at 1.1747.

Its recovery has been helped by economic data highlighting a resilient labour market, more moderate than expected inflation pressures for July and a continued robust expansion of the economy for last quarter.

Financial market pricing has continued to imply as a result that the Bank of England is likely to be cautious and slow-moving in relation to interest rate cuts in the months ahead, with current pricing implying that the UK is likely to have the second highest interest rate in the G10 group of economies come year-end.

“The still higher yields on offer in the UK and stronger cyclical momentum for the UK economy remain supportive for the GBP,” MUFG analysts said in a Friday note.

Above: Pound to Euro rate shown at daily intervals with 100-day moving average (orange) indicating possible areas of technical resistance, while Fibonacci retracements of November recovery and 200-day average (blue) denote prospective areas of support. Click image for closer inspection.

There is little meaningful data in the economic calendar to guide Sterling or the Euro one way or the other ahead of Thursday’s S&P Global PMI surveys of the manufacturing and services sectors in the UK and Europe.

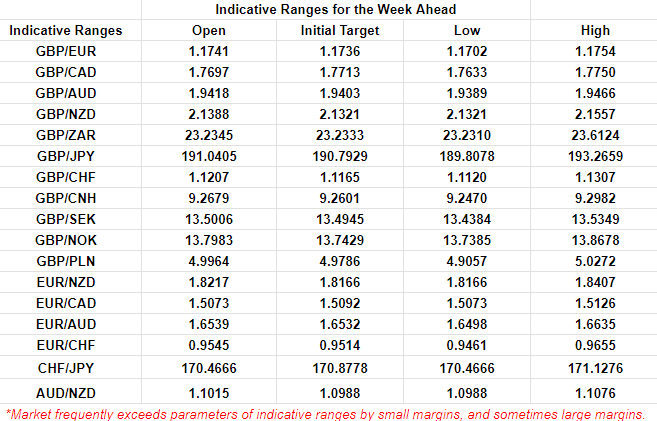

The author’s model suggests a narrow trading range spanning the gap between 1.1702 and 1.1754 is likely in the days ahead, which implies that the nearby 100-day moving average at 1.1747 may be likely to offer some resistance to the recovery in GBP/EUR in the absence of a catalyst for a break higher.

This catalyst may or may not come with the S&P PMI surveys out on Thursday, or the speech from Bank of England Governor Andrew Bailey at the Federal Reserve’s Jackson Hole Symposium at 20:00 on Friday. The consensus currently looks for both UK and European PMI indices to ebb modestly for August.

“Despite the recent sell-off, GBP remains the best performing currency in G10 year-to-date,” BofA Global Research strategists said in a note to clients last Thursday.

“The fundamental/secular positives remain the same and we are reassured that recent weakness has not been a reflection on the UK macro-outlook,” they added.

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.