Image © Adobe Images

The Pound to Euro exchange rate (GBP/EUR) is technically and fundamentally poised for further gains in the near term, and a move to 1.1850 is on the cards for this week.

Pound Sterling (GBP) can extend its rally in the coming days, aided by an increasingly supportive technical setup and firm fundamental foundations.

That said, we look for a near-term pullback in GBP/EUR in the early stages of the week as the exchange rate very rarely records four subsequent daily advances. We think the strong moves in the latter half of last week could leave the pair a little exhausted. Indeed, Friday's pullback from the 1.1833 peak hinted at this behaviour.

However, the key takeaway at this juncture is that weakness is likely to be limited to a couple of days, and the broader trend is higher, so we set an upside target of 1.1850.

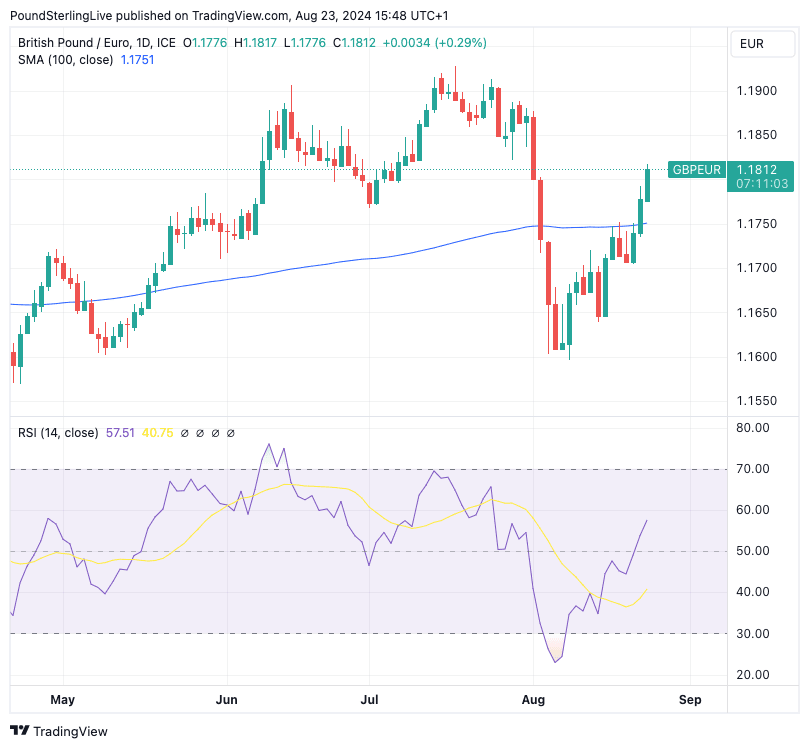

From a technical perspective, Pound-Euro has risen back above its 200-day and 100-day moving averages, signalling a medium-term uptrend is the pair's overarching backdrop. The RSI is pointed higher at 57 and advocates for further near-term gains.

GBP/EUR fell rapidly in the first two weeks of August as Sterling was weighed by the combination of a Bank of England rate cut and a fall in global stock markets.

The dip below the key moving averages warned that the trend might have turned to the downside, but the subsequent recovery suggests this was a pullback within the uptrend and warns of the dangers of following technical studies exclusively.

Indeed, the fundamentals for further advances over the coming weeks are compelling and always hinted that sellers had entered a bear trap:

1) Global stock markets are pointed higher thanks to Friday's speech by Jerome Powell that signalled the looming onset of interest rate cuts at the Federal Reserve. This has boosted investor sentiment, which is traditionally supportive of the British Pound against the Euro, Dollar, Franc and Yen.

2) The UK economic picture is supportive, with August PMIs showing the expansion continues. Importantly, forward-looking elements of the report are constructive, particularly when compared to the dour findings of the Eurozone's poor PMI report.

There will be no major data releases out of the UK in the next five days, and we think the thrust of action will depend heavily on how global markets behave.

On this count, it is hard to be anything other than bullish now that the Fed has greenlighted rate cuts with Powell's speech sounding so 'dovish' that it invited the prospect of a decisive 50 basis point cut in September.

We can look for some exhaustive pullbacks in markets - and, by extension, the Pound in the coming days - but ultimately, standing in the way of this train will be difficult and risky to justify.

The Eurozone is the locus of GBP/EUR-specific data for the coming days. Germany is performing poorly and is why Monday's IFO business sentiment survey and Tuesday's GDP release are important.

There are upside risks to GBP/EUR in the event that disappointing readings bolster the odds of a faster pace of rate cuts at the ECB in the coming months in response to the slowdown in Europe's largest and most important economy.

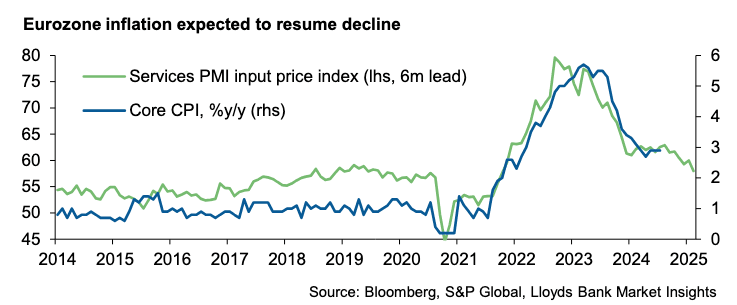

Thursday is another important day as we have German and Spanish inflation releases to look forward to. Any surprises here can shake the market ahead of Friday's all-Eurozone inflation release.

An undershoot of the consensus expectation for HICP to print at 2.3% year-on-year can weigh on the single currency.