File image of Michel Barnier © European Union. Source: EC - Audiovisual Service / Photo: Mauro Bottaro.

The Euro could come under fresh pressure against Pound Sterling as an unstable French government prepares to pass what will be a very unpopular budget.

France's new Prime Minister has warned that his government would seek to cut two-thirds of the country's burgeoning budget deficit by "reducing spending" as he seeks to put the country's finances back on track.

Michel Barnier told parliament that the target for bringing the country’s surging deficit to 3% would be pushed back to 2029 and the cuts would be achieved through tax rises and spending cuts.

"Reaching the 3% target that France has promised its European partners in 2027 would require savings of €110bn between now and 2027, an effort that has never been made in France (and is virtually impossible)," says Charlotte de Montpellier, Senior Economist for France and Switzerland. She describes the issue as an "explosive situation."

The cost of financing France's debt has risen sharply in recent weeks amidst rising investor concerns, with French bond yields even rising above those of Spain for the first time since 2008.

Currency market analysts warn these fears could soon be reflected in foreign exchange markets via a premium on the euro.

"We could see some fresh political risk premium being built into the euro as new French Prime Minister Michel Barnier is facing an even worse than expected deficit situation," says Francesco Pesole, FX Strategist at ING Bank.

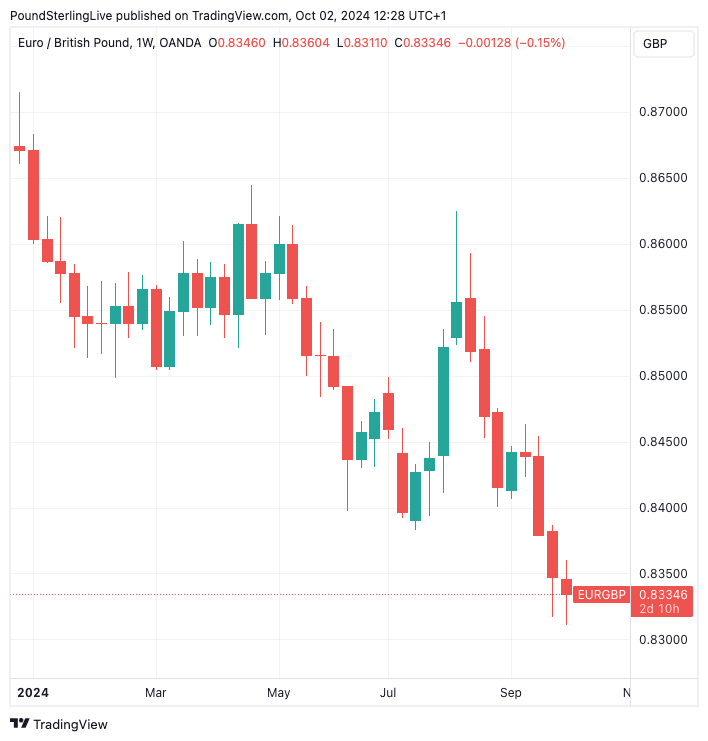

Above: EUR/GBP in 2024.

The Euro to Pound Sterling exchange rate (EUR/GBP) is down 3.88% in 2024 and has fallen below the key 0.84 threshold of late (Pound to Euro rate above 1.19). A deeper dive in EUR/GBP could be in prospect if Barnier is unable to deliver the changes required of him.

Barnier said France's public deficit is set to hit 6% of economic output instead of the 4.4% forecast at the start of the year.

To address the deficit, he warned the "richest part of the population" and large companies would be asked to contribute to turn around the public finances. However, two-thirds of the effort will be achieved by cutting spending.

The details of the cuts are yet to be made, and will almost certainly be met with that famous French resistance and penchant for protest.

"The fact that there are currently no specific plans to reduce public spending circulating in the media seems to indicate that this is easier said than done... it is certain that the decisions taken will not be popular," says de Montpellier.

The economist says France is not yet facing a 'Lizz Truss' moment as the government seems dedicated to addressing the fiscal deficits, which mitigates the chance of a disorderly sell-off.

Nevertheless, the ability of an unstable government to deliver far-reaching changes still poses significant uncertainty for markets.

"Long-term plans will have to be credible, which will be difficult to convince investors of given the fragile position of the current government. Rating agencies will also be critical and further downgrades seem likely in the eyes of the market," says de Montpellier.

"Add in the probability of a successful no-confidence vote, forcing President Macron to nominate a new prime minister (who has to form a new government), and we see many paths that could lead to even higher spreads from here," she adds.

The spread referred to is the difference between the bond yields of France and Germany. When the spread rises it indicates markets demand a premium on holding French debt.

A 'blow out' in the spread would be the first sign that market confidence has taken a hit, which will potentially have negative implications for euro exchange rates.