File image of Andrew Bailey, credit: Bank of England.

The Bank of England will strike a 'hawkish' note on Thursday but don't expect this to boost the Pound.

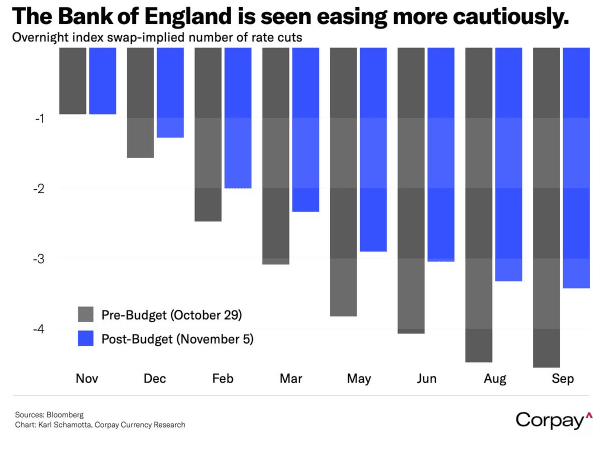

This is because the market is already expecting the Bank to concede it will be unable to cut interest rates as far and fast as previously assumed, owing to last week's budget.

In the budget, UK Chancellor Rachel Reeves unleashed an inflationary set of spending and borrowing increases while confirming that the minimum wage would increase by an inflation-busting 6.7% next year. Meanwhile, National Insurance tax hikes on businesses will be passed on to consumers through higher prices.

"Reeves confiscates doves' ammunition," says Andrew Wishart, Senior UK Economist at Berenberg Bank. "It is customary for the BoE to brush off changes in fiscal policy, but it would have to be tone deaf to do that this time around."

The Bank might have wanted to cut interest rates in November and then again in December, at least based on Andrew Bailey's assessment at the beginning of October that it could be more "activist" in its approach to cutting rates.

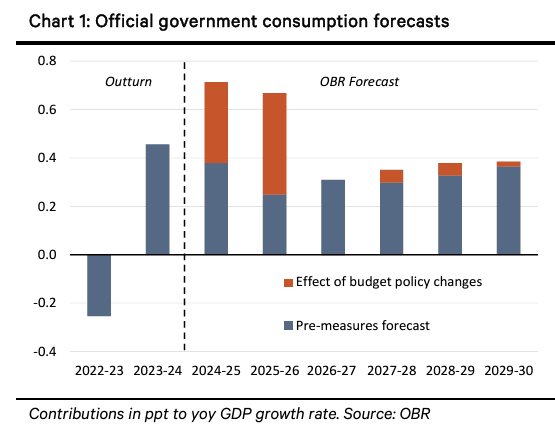

But, new forecasts from the Office for Budget Responsibility show why Bailey might have to cool his ambitions.

The OBR says we should now expect the Bank of England to cut interest by less than was the case before the budget, as it now sees 25 basis points fewer rate cuts by 2025 as a direct result of Reeves' budget.

Will the Bank of England change its own assumptions about how it will proceed based on this?

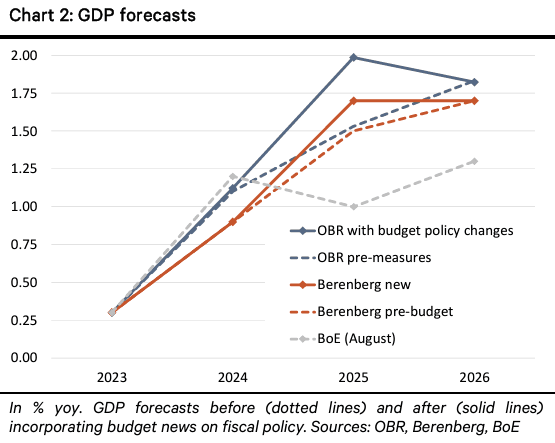

Berenberg thinks the Bank cannot ignore these developments, which means the Bank will have to raise forecasts on Thursday.

This would amount to a 'hawkish' development that would support UK interest rate expectations and the Pound.

However, the Pound's relationship with interest rate expectations has broken down somewhat since last week, making it difficult to anticipate market moves ahead of this week's event.

The task is made no less easy by the U.S. election which is currently underway, with results due at some point on Wednesday.

"A BoE cut is well priced in and is unlikely to be a big driver of the GBP. We are cautious of any rally in GBPUSD with the risk of US elections and with positioning in the pound still relatively long and optimistic," says Jayati Bharadwaj, Global FX Strategist at TD Securities.

"Of all weeks, that of a knife-edge U.S. election isn't the easiest to formulate UK rates market views ahead of a BoE meeting," says Nick Kennedy, FX Strategist at Lloyds Bank. "UK rates markets are arguably already braced for a hawkish MPC."

The Bank will need to raise its inflation forecasts in light of Reeves' budget, and Lloyds thinks the all-important forecast for the two-year horizon will rise from August's projection of 1.6% to around 2.0%.

This effectively means that inflation will fall to the 2.0% target, based on expectations of a limited interest rate-cutting cycle.

"If the MPC retains the ‘upside risks’ judgement, the projection incorporating this looks set to be above the 2% target. All this implies a hawkish MPC message," says Kennedy.

Berenberg's Wishart is "sympathetic" to the OBR's outlook, in which stronger demand causes a renewed tightening in the labour market, sustaining high pay growth and a return to above-target inflation.

"In this environment, higher labour costs stemming from the further increase in the minimum wage will put further upward pressure on prices, particularly in recreational and personal services. We raise our 2025 inflation forecast by 0.1ppt to 2.6%," he says.

The Pound has come under pressure over the course of the past week as markets adjust to shifts in the bond markets as investors digest the Labour government's new budget.

However, analysts at Bank of America say the fundamental outlook remains supportive of the Pound, which can return to its winning ways.

"When the dust settles on the U.S. elections, widening UK rate differentials should be a driver for renewed GBP strength," says Kamal Sharma, FX analyst at Bank of America in London. "We are cognizant that sentiment has been dented against the slew of negative news headlines but fail to see how a stronger growth/inflation outlook over the next two years meaningfully weighs on GBP."