Above: Marine Le Pen addresses supporters on Sunday night.

The Euro rose sharply against the Dollar, Pound Sterling and other major currencies as the first round in France's legislative election showed the odds of any single party winning a majority had narrowed.

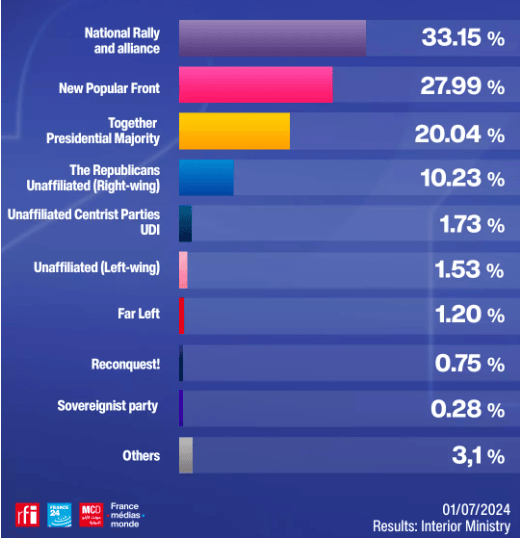

Marine Le Pen's National Rally is on course to win about 33% of the vote, underperforming the final poll of polls, which had them at 36.2%. Pollsters say National Rally can still win a majority in the National Assembly in Sunday's second round of votes, but a 'hung' legislature with no single party holding power looks a more likely outcome.

For currency markets, the base-case scenario is coming to pass, and this is reflected in a relief rally by the Euro. "The first round of the French elections perhaps delivered a slightly less convincing victory for the far-right than final polls suggested and with other parties now seemingly open to form alliances in the second round, this is likely to further reduce the far-right's chance of an overall majority in parliament," says Jim Reid, a strategist at Deutsche Bank.

The worst-case scenario was a stronger showing by the far-left New Popular Front, which we warned could propel the Pound-Euro towards 1.22.

The New Popular Front looks to be on about 29% and Ensemble, Macron’s coalition, on about 22%. The New Popular Front has indicated it will remove third-place candidates, a move it says would deny the National Rally the chance of winning seats in constituencies where a three-way showdown will take place.

Image courtesy of France24.

Over half the 577 parliamentary seats, a historically very high number, are expected to go to the second round with lots of tactical voting now likely.

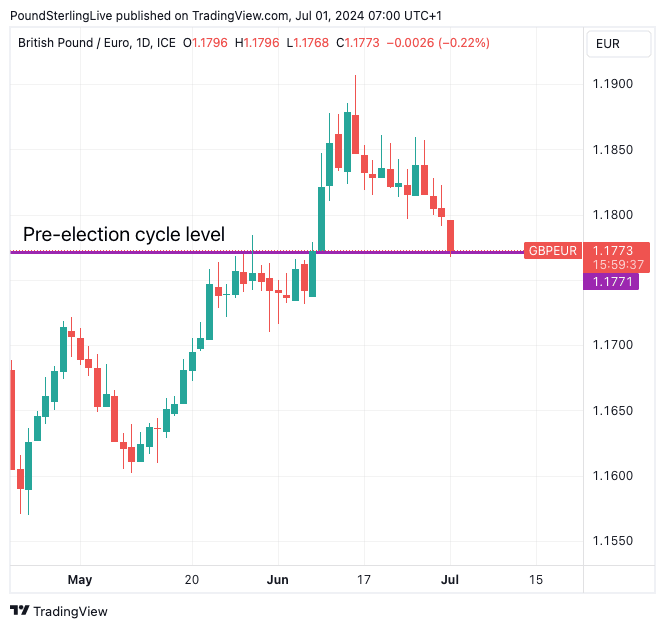

The Pound to Euro exchange rate 'gapped' lower when markets opened late on Sunday night, reversing the gap higher it experienced just weeks prior following the unexpected announcement by Macron that the country would be asked to vote for a new legislature.

Above: GBP/EUR at daily intervals. Track GBP/EUR with your own alerts, find out more here.

Pound-Euro has sliced through the 1.18 level and is now close to levels consistent with the market having removed the political risks premium associated with France. This means there is a growing likelihood the exchange rate will fall back into familiar 2024 territory, which saw trade centred around the 1.17 level.

The Pound-Euro rose following Macron's decision to call a vote as markets feared the uncertainty posed by a radical far-left or far-right party taking power.

The rally peaked at €1.19, the highest level for those buying euros in 22 months, meaning a long-running deadlock between the Pound and Euro was broken. (For most of 2024, the GBP/EUR conversion has been locked between 1.1764 and approximately 1.16.)

During the campaign period, Le Pen's party sought to calm investor fears, saying it would respect the institutions and would fund all its spending commitments, easing fears France's debt levels would ultimately become unsustainable.

Remember, too, that this week, the UK goes to the polls, and any unexpected results could offer some short-term volatility, although we don't anticipate that to last.

In short, it is central bank interest rate settings that matter, and whether the Bank of England will cut interest rates in August.