Above: P.M. Keir Starmer defends his budget in a speech delivered Monday. Picture by Simon Dawson / No 10 Downing Street.

Post-Budget relief for British pound, but a wary eye on the local elections in May.

The pound to euro exchange rate's (GBP/EUR) rally has scope to run further say analysts at Barclays, who judge "last week's budget generates scope for an, at least partial, unwind of the pound's fiscal risk premium."

In a weekly analysis, the investment bank's FX team say this upside potential derives from a larger headroom, residual net short positions, and a positive risk backdrop into December.

It adds that "a relatively warm reception" by the Labour party to the budget is important to consider, in that it allays near-term risks of political instability.

"The back-loading of fiscal tightening implies execution and credibility risks, but we think these are already adequately priced," says Barclays.

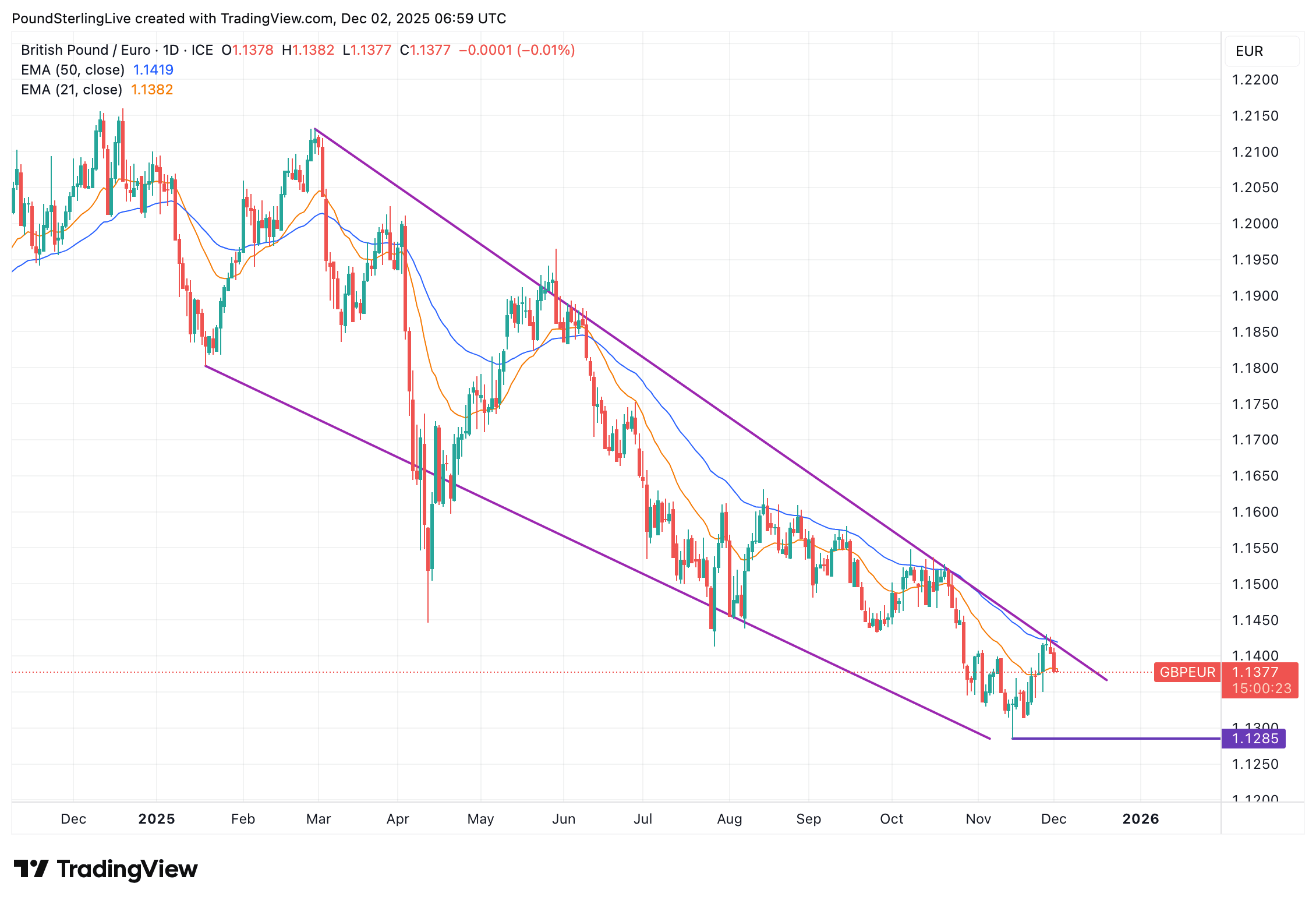

The pound has fallen steadily against the euro through the course of 2025, with losses accelerating in the summer as markets prepared for a tough budget.

Above: GBP/EUR remains in a downtrend, with the post-budget bounce faltering.

Fears were elevated that political pressures on Chancellor Rachel Reeves and Prime Minister Keir Starmer would result in a market-unfriendly budget.

In particular, there were concerns that the debt market would not take kindly to any budget that failed to address the country's growing deficit.

But some £26BN in tax rises over the coming years restores the Chancellor's headroom by £22BN, which is a relief to markets, if not the increasingly despondent UK taxpayer.

The Bank of England is another key consideration for financial markets and the pound.

"Terminal rate pricing of just under 3.5% for Bank Rate (including a 25bp cut in December) also remains appropriate, in our view, as the macro outlook over the Bank's policy horizon is largely unchanged," says Barclays.

A terminal rate of 3.5% implies two further cuts in the cycle.

Marrkets are fully priced for a cut in December, with another falling by April 2026.

"If anything, aggregate demand is supported on the margin and confidence could also rebound as Budget uncertainty clears, thereby reducing the dovish tail for the pound," adds Barclays.

In all, analysts expect EUR/GBP to edge closer to the rate differential-implied level (which is c.0.86) in the near term.

In GBP/EUR terms, that is 1.1630.

Further out, the next key milestone is the local elections in May 2026.

"With the market unlikely to be forgiving of further signs of fiscal slippage, such as in relation to the benefits cuts last summer, policy stability is a precondition for a more lasting rebound in sterling," says Barclays.

With Labour set for a wipeout in local elections, pressure to change leaders will grow, making the installment of a devout left wing leader and Chancellor a clear risk for sterling in the year ahead.