Above: File image of Bank of England Governor Andrew Bailey. Image courtesy of the Bank of England, reproduced under CC licensing conditions.

The British Pound is under pressure after the Bank of England Monetary Policy Committee (MPC) voted by a narrow margin to reduce Bank Rate to 5.0% from 5.25%.

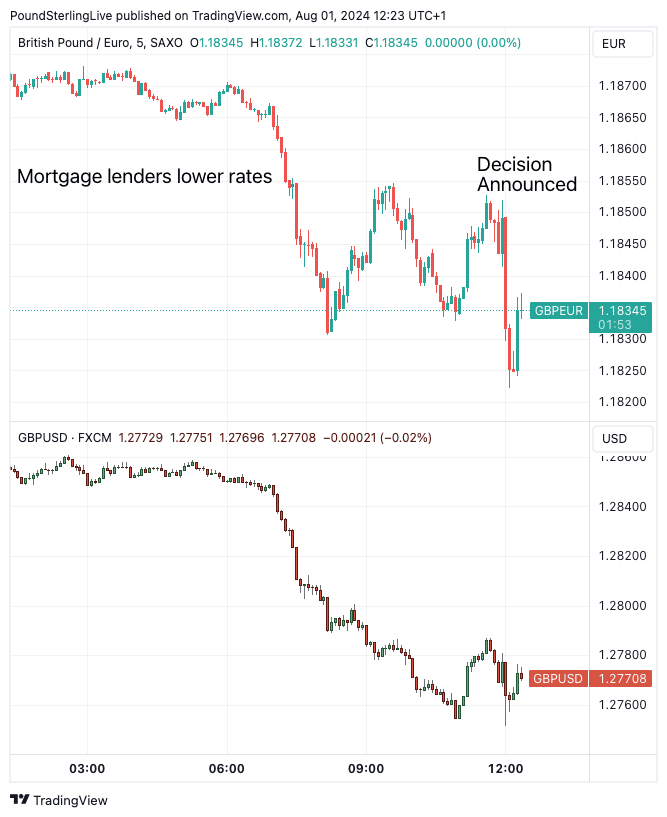

The Pound appears to have expected the move, as the initial reaction to the decision seems to have been fairly contained, with sizeable losses recorded in the London morning session.

Indeed, there was some suspicion this decision was coming as a number of mortgage lenders slashed rates in the hours ahead of the decision's release. This will potentially explain why the Pound was under significant pressure in the run-up to the midday announcement.

The Pound to Euro exchange rate hit a daily low at 1.1824 but has pared the weakness to 1.1855 by the time of article update, the Pound to Dollar exchange rate was as low as 1.2750 but has recovered to 1.2790.

"The British pound is the biggest mover on the major-currency board, down roughly half a percentage point after the Bank of England kicked off its long-awaited easing cycle," says Karl Schamotta, Chief Market Strategist at Corpay.

The Bank said the cut was justified because "inflationary pressures have eased enough that we’ve been able to cut rates today."

For Pound exchange rates, the key question is how soon the Bank will follow up with another rate hike and how committed it is to delivering rates in the coming months. Following the move, money markets indicate 35 more basis points of cuts are expected by year-end.

This equates to one more quarter of a percentage point reduction in Bank Rate to 4.75%. Speaking to the media, Bailey said, "we need to put the period of high inflation firmly behind us… need to be careful not to cut rates too much or too quickly."

For FX markets, it is the quantum of cuts that matters, a cautious approach to cuts can ensure UK rates remain elevated relative to elsewhere, potentially supporting the Pound. However, a desire to bring rates down rapidly can result in notable GBP weakness.

Above: GBP/EUR and GBP/USD price action has been curious. Track GBP with your custom alerts; find out more here

The Bank said it will "need to make sure inflation stays low and be careful not to cut interest rates too quickly or too much."

The guidance on the outlook for interest rate policies will be a key determinant of GBP price action in the coming weeks. Importantly, it looks as though the Bank's new forecasts don't advocate a rapid pace of interest rate cuts.

The Bank forecasts inflation will rise over the coming months, reaching 2.75% by year-end, but it is then expected to drop below 2.0% again by 2026.

A rising path of inflation explains why some members of the MPC thought it too soon to cut interest rates. It also signals that the Bank might not be in a hurry to cut rates too far, too soon.

The Bank also raised GDP growth estimates to 1.25% for the full year 2024 from 0.5% previously. This suggests the economy is not in dire need of further cuts. Such an expectation could ultimately offer the Pound support going forward.

But, the Pound headed into Thursday's decision with a significant 'long' position, which meant it was at risk of a washout of these positions in the event of a cut.

The extent of this washout will determine how far the Pound will fall in the coming days and when support can rebuild.

"The cut feels tentative, given the MPC's split vote of 5-4, indicating that hawks within the committee remain concerned about wage growth and service sector inflation. Huw Pill's decision not to vote for a rate cut feels slightly odd, as it stands at odds with the bank's own inflation forecasts," says Joe Tuckey, Head of FX Analysis at Argentex Group PLC.

Bailey, Breeden, and Lombardelli joining Ramsden and Dhingra in voting for a cut, but Pill, Greene, Haskel, and Mann continued to support a hold

"We continue to expect the MPC to cut Bank Rate again in November. We then expect the Committee to reduce the policy rate at a quarterly pace thereafter until Bank Rate hits 3% in 2026-Q3," says James Moberly, an economist at Goldman Sachs.