By George Vessey, Lead FX Strategist at Convera. Image © Bank of England

The pound is on track for its third weekly rise on the trot against both the USD and EUR and has recorded over 2-year highs against both peers this week.

Growth and yield differentials continue to favour sterling for now, whilst elevated risk appetite has arguably provided the fresh leg up of late.

The most striking bullish driver of GBP this year has been rate/yield differentials. This is because the Bank of England (BoE) has taken a more cautious approach to cutting interest rates than its peers.

Markets have listened and are pricing in less rate cuts over the next couple of years. Only 40 basis points (less than two standard rate cuts) of BoE easing is priced before year-end.

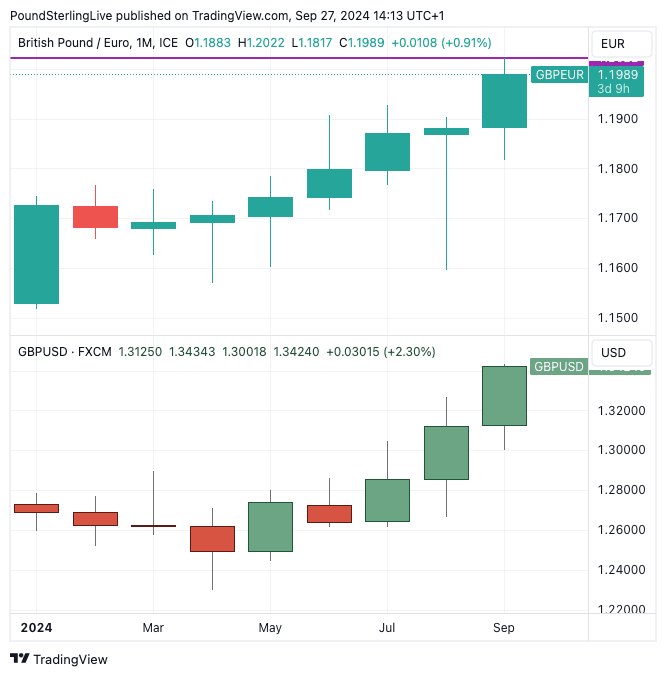

Above: GBP monthly performance in 2024 against EUR (top) and USD.

But we think the BoE is more likely to cut at both its November and December meetings, especially if services inflation falls back again.

This presents an obvious downside risk to the pound. However, growth divergence is also in play, especially when it comes to GBP/EUR.

Despite PMI surveys missing expectations in the UK and pointing to a moderation in growth, overall private sector activity has been in expansion for eleven months on the trot.

The UK economy seems much healthier than Europe right now. Moreover, European political woes add to the euro’s negative case and gives the pound an additional edge.

GBP/EUR needs to hold above the key €1.20 mark to establish a new, higher, trading range. But this looks more promising given it has convincingly broken above its 200-month moving average.

The pair looks primed to score its best Q3 performance since 2014, whilst GBP/USD is on track to record its best Q3 performance since 2013, and its fifth best on record, defying weak seasonal trends.

At the time of writing the Pound to Euro exchange rate is at 1.1990 and the Pound to Dollar exchange rate is at 1.3426.