Image © Adobe Images

GBP/EUR: 1.1958

GBP/USD: 1.3112

A new report on the UK jobs market looks set to keep Pound Sterling under pressure.

The Pound to Euro exchange rate was at 1.1958 after the REC / KPMG Report on Jobs showed the UK labour market continued to weaken, lowering the bar for another Bank of England interest rate cut in November.

According to the REC/KPMG report, salary inflation fell for the third month in a row, with September's reading being the lowest since February 2021. According to survey respondents, a greater number of candidates and reduced demand helped to limit pay growth.

Reports of increased redundancies and lower demand for workers were submitted to the survey, and the overall availability of staff to fill positions increased again in September.

The Report on Jobs is considered a leading indicator and is more timely than the official ONS jobs and wages report. It can give the Bank of England confidence that the economy is slowing enough to pick up the pace at which it cuts interest rates, which would weigh on the Pound.

The Pound to Dollar exchange rate is down 0.13% on the day at 1.3107, having slid nearly 2.0% last week amidst increased bets for an accelerated pace of interest rate cuts at the Bank of England, while expectations for U.S. rate cuts moved in the opposite direction.

The REC/KPMG report matters as it signals to the Bank of England that the labour market is losing its ability to bolster wages and thus pressure inflation higher.

Although finding suitable candidates remained challenging, a general expansion of staff availability and reduced demand weighed on permanent salary growth during September. The latest data showed the weakest rise in salaries for over three-and-a-half years.

"The Bank of England will likely be encouraged by this easing in pay pressures, which could strengthen the case for a further cut in interest rates in the upcoming November meeting," says Jon Holt, Group Chief Executive and UK Senior Partner KPMG. "The slowing of hiring activity seen in September is to be expected as businesses apply the brakes on recruitment ahead of the Budget and wait for clarity on future taxation."

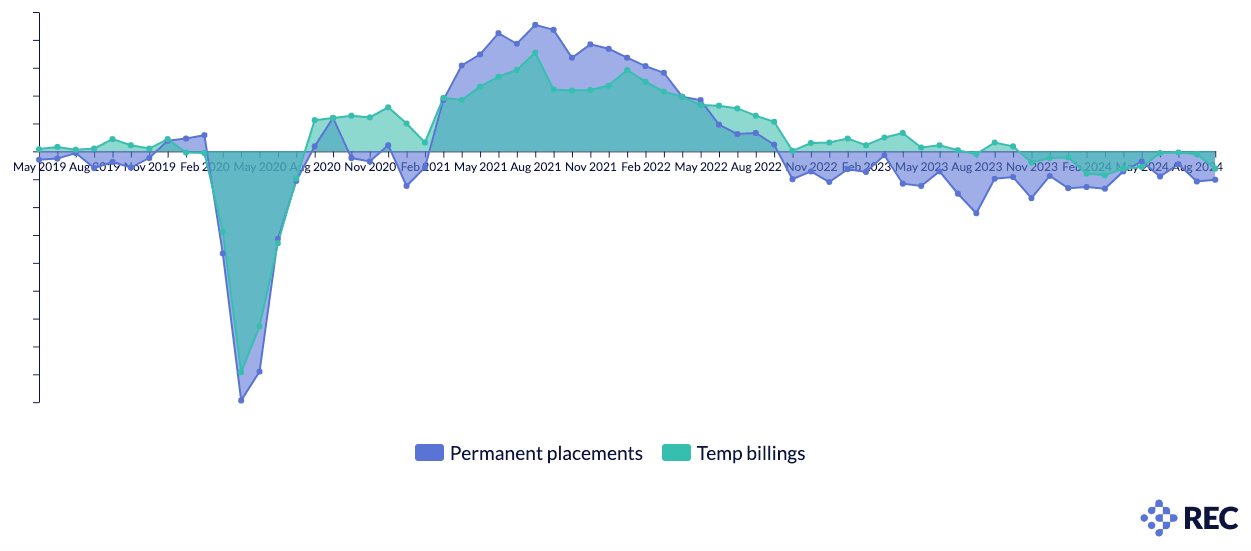

The report indicated a further reduction in permanent placements during September, extending the current run of contraction to two years. According to recruitment consultants, clients were cautious in their assessment of the outlook and reluctant to hire staff.

"Pay continues to moderate and is now below its long-term trend. This should add to the willingness of the Bank to become more activist on interest rate cuts, as the Governor hinted last week. This would be a big boost to business," says Neil Carberry, REC Chief Executive.

Uncertainty in the outlook, including around government policy ahead of late October’s Budget, meant companies were cautious in their hiring activity. Temporary billings also declined in September, and at the steepest rate since April.

Job vacancy numbers declined for an eleventh successive month during September, with falls recorded for both permanent and temp workers.

Pound Sterling fell by over a per cent last Thursday after markets sensed the Bank of England could cut interest rates two more times before year-end (as opposed to just once) following an interview by Bank of England Governor Andrew Bailey.

He said it could be time to accelerate the pace of interest rate cuts, marking a sudden departure from a previously cautious approach to easing monetary policy.

Speaking with the Guardian newspaper, Bailey said the Bank can be a "bit more aggressive" in cutting interest rates if the news on inflation continues to be good, and later that it could be "a bit more activist" in that situation.

These Jobs Survey data would bolster Bailey's hand, however, other members of the Bank's Monetary Policy Committee aren't of the same view.

The Pound recovered some losses on Friday after the Bank of England's Chief Economist, Huw Pill, said in a speech that he remains committed to a cautious approach to cutting interest rates.

The air of caution was boosted later in the day by the U.S. job report that showed the Fed would have to consider a slower pace of cuts. Economists say this would put the brakes on the ambitions of peer central banks - including the Bank of England - as they won't want to outdo the Fed.