Image © Pound Sterling Live, Still Courtesy of RBNZ

The New Zealand Dollar has come under pressure after the Reserve Bank of New Zealand raised market expectations that it would cut interest rates twice before the year is over.

The Pound to New Zealand Dollar exchange rate took advantage of NZD weakness to rally to 2.10, its highest level since early May and meeting our prediction set out in our Week Ahead Forecast.

This is after the RBNZ said it expects "headline inflation to return to within the 1 to 3 per cent target range in the second half of this year."

It added that restrictive monetary policy (i.e. elevated interest rates) "will be tempered over time consistent with the expected decline in inflation pressures."

It looks like a 'job done' assessment by the RBNZ and Kiwi bond yields and the NZD fell as investors looked to a lower interest rate future.

"Financial markets reacted swiftly, with the bellwether 2yr swap rate around 18bp lower, and the NZD around half a cent lower, within an hour of the MPR. We think that reaction was understandable given the number of dovish judgements in the press release and summary record of meeting, which read like a mini-pivot," says Sharon Zollner, a chief economist at ANZ.

[See what over 30 investment banks are forecasting for GBP/NZD in Corpay's free download.]

"The Reserve Bank of New Zealand surprised markets with a dovish tilt in communication as it kept rates on hold at 5.50% overnight. We had thought that the lack of hard data for the second quarter would argue for a reiteration of a hawkish stance, but the Bank displayed greater confidence on disinflation," says Francesco Pesole, analyst at ING Bank.

The central bank is also worried that higher interest rates are weighing heavily on economic activity, as highlighted most recently by last week's "recessionary" business confidence data.

"The RBNZ subtly softened its language. The downside risks to growth and inflation were acknowledged and emphasised. We continue to expect the cutting cycle to commence in November this year," says Jarrod Kerr, Chief Economist at Kiwibank. "The economy is clearly responding to restrictive monetary policy. Economic activity looks likely to contract over Q2 and unemployment is set to rise further. We expect inflation to fall in line, eventually."

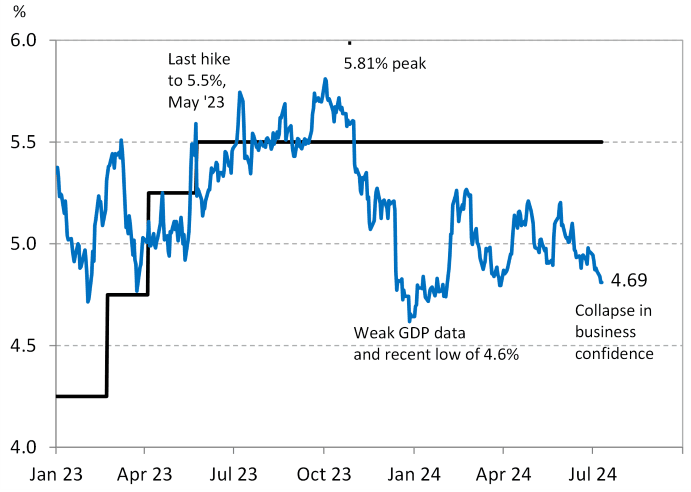

Above: The RBNZ's base interest rate (black line) vs. the market's expectations for future rate levels in the form of the two-year swap rate. Image courtesy of Kiwibank.

Economists at ANZ say risks are tilting towards the first cut coming in November rather than February as they were previously forecasting.

ING says there is now the prospect of two RBNZ rate cuts in 2024. That said, economists warn they continue to see some "substantial upside risks" to New Zealand's non-tradable inflation.

All eyes will turn to next week's second-quarter inflation print. A strong reading could help the NZD overturn recent weakness if it pushes back against the recent build-up in bets for interest rate cuts.

The RBNZ forecasts a fall in the annual inflation rate to 3.6% from 4%.

"The data will decide: next week’s CPI data was always going to be more important for the OCR outlook than whatever the RBNZ had to say today," says Zollner.

Interestingly, the market sees 60 basis points of rate cuts priced for November (which implies a September and November cut).

This means there is scope for a pullback in expectations, which can support NZD if next week's inflation data tops estimates.