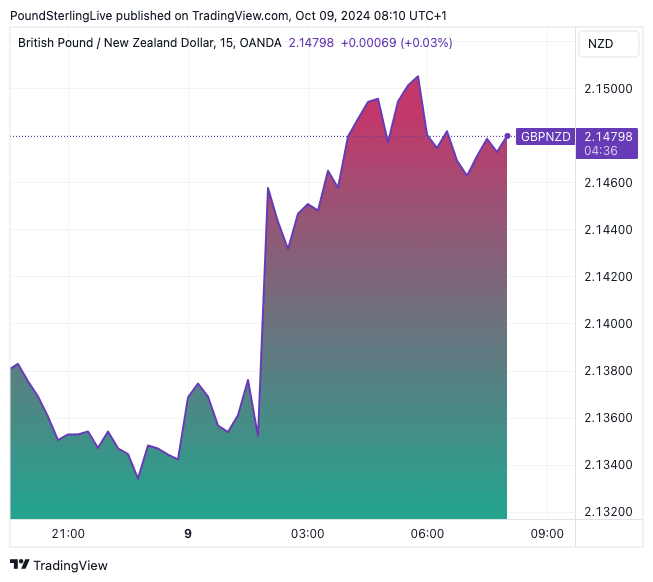

Above: GBP/NZD pushes higher post-RBNZ.

The New Zealand Dollar dropped by more than half a per cent after the Reserve Bank of New Zealand (RBNZ) cut interest rates by 50 basis points and left the door open to another such move.

This step change in the pace of rate cuts - up from 25bp in August - was largely expected by our regular readers, and market pricing shows the investment community saw an 80% chance of such a move.

What was less certain and 'in play' for the NZ Dollar and financial markets was the guidance on further moves. The financial market reaction suggests investors think the RBNZ could go with another 50bp move as soon as next month in order to "avoid the unnecessary instability in output," referred to by the RBNZ in its statement.

This would amount to a 'dovish' reading of today's RBNZ decision and guidance and explains why the Pound to New Zealand Dollar exchange rate (GBP/NZD) has risen by more than half a per cent to quote at 2.1475.

The New Zealand Dollar to U.S. Dollar exchange rate (NZD/USD) is down three-quarters of a per cent at 0.6093

The policy statement said a 50bp cut was the "most consistent with the Committee's mandate of maintaining low and stable inflation, while seeking to avoid unnecessary instability".

The RBNZ's committee assessed that annual CPI inflation had fallen to within its 1 to 3% target range and was converging on the 2% midpoint.

Economists at Auckland-based lender ASB expect another 50bp cut at the next meeting in November because economic data will likely remain soft but will then move back to 25bp moves thereafter.

"Economic activity in New Zealand is subdued, in part due to restrictive monetary policy. Business investment and consumer spending have been weak, and employment conditions continue to soften. Low productivity growth is also constraining activity," said the RBNZ.

"We expect another 50bps cut in November. The Kiwi economy needs it. And there’s a long gap until they meet again in 2025," says Jarrod Kerr, Chief Economist at Kiwibank.

Kiwibank's latest FX research shows to expect the New Zealand Dollar to remain in a broad downtrend in the next 3-6 months.

"The speed and magnitude of expected easing (rate cuts) underpins our exchange rate forecasts," says Kerr.

However, analyst Kristina Clifton at Commonwealth Bank notes markets are currently pricing 125bps of cuts over the next three meetings, "which is too much in our view."

Instead, 100bps of cuts over the next three meetings are seen as more likely, "if we are correct, NZD/USD can receive some support when pricing adjusts," she says.