Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is forecast to maintain its short-term upside momentum in the coming five days.

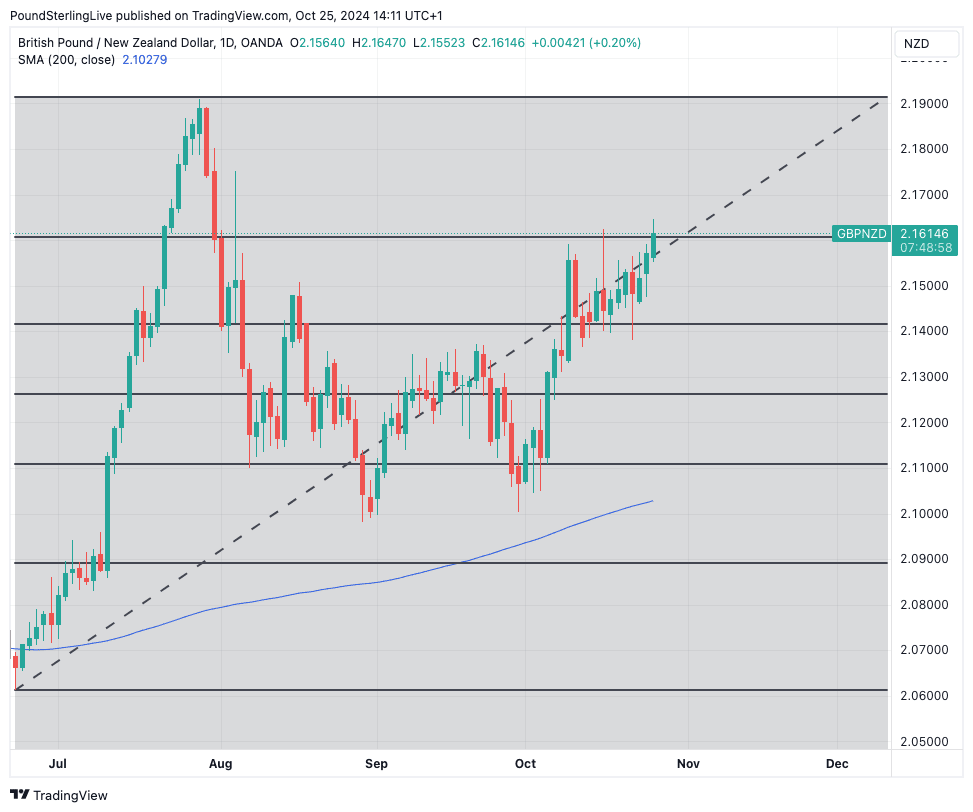

In our previous edition of the GBP/NZD Week Ahead Forecast series, we said 2.16 was an achievable target, and this call was spot-on as the pair hit target on Friday, October 25.

For the coming week, we are again watching 2.16 as a break above here would provide confirmation that a new, higher range is forming.

From a technical perspective, then, GBP/NZD is currently attempting a breakout from October's consolidation range.

Our forecast is to expect further upside in the coming days, but we don't have any concise numbers to target until the breakout is confirmed.

Note that 2.16 is the 23.6% Fibonacci retracement level of the June-July surge. The area between the 23.6% fib level and the 38.2% fib level has formed the bounds of the October consolidation:

Bigger picture, the weakness that we saw from July through to October was just a retracement of that surge as the market unwound overbought conditions.

Given this assessment, the uptrend is intact, with the pair residing over key longer-term moving averages.

If a break above 2.1606 is confirmed (by a couple of daily closes above here), then the pair is set to target the 2024 high at 2.1914.

There are no major economic releases due from New Zealand in the coming week, but the currency is struggling, being the biggest loser in the G10 currency complex over the course of the past week and month.

Both the Australian and New Zealand Dollar appear weighed down by subdued investor sentiment coming out of Asia amidst disappointment regarding Chinese efforts to stimulate the economy.

October has been a difficult month for NZD as the currency has also proven particularly vulnerable to the rise in U.S. bond yields that have followed improving economic activity in the world's biggest economy.

This speaks to the Kiwi's sensitivity to global investor sentiment.

Expect the Dollar to remain supported and markets nervous ahead of Friday's U.S. job report and the U.S. election the following Tuesday.

Strong data will bolster the Dollar, and it looks as though New Zealand's Dollar is most vulnerable to this strength.

Chancellor Rachel Reeves. Picture by Kirsty O'Connor / HM Treasury.

GBP/NZD could see some excitement from the GBP side of the equation as the UK government will announce its budget.

We know this is likely to be a difficult budget for businesses and is, therefore, a potential headwind for growth This could provide a headwind to the Pound, particularly if the market thinks the extent of tax rises will lower the UK's growth potential.

However, analysis suggests the budget will be expansionary as the Chancellor has changed the UK's fiscal rules to allow her to borrow more money in order to invest in projects that would boost the UK's growth potential.

Some estimates suggest the boost to growth could amount to 0.50% in 2025, which would require the Bank of England to be more cautious in cutting interest rates.

This would amount to a GBP-positive outcome.

Risks to the Pound would be the market not taking kindly to expectations for increased borrowing, similar to the reaction to Liz Truss' aborted mini-budget of 2022 that caused a meltdown in the Pound.

All analysts we follow say they have seen and heard enough to believe this is unlikely, so we think the budget is no major impediment to GBP upside.