Image © Adobe Images

The Pound to New Zealand Dollar exchange rate (GBP/NZD) is in a multi-month trend of appreciation, but this week, we could see some losses as a short-term pullback plays out.

GBP/NZD is in the process of retracing the strong rally we witnessed in October, and all the excitement that surrounded last week's U.S. election doesn't actually change the picture much.

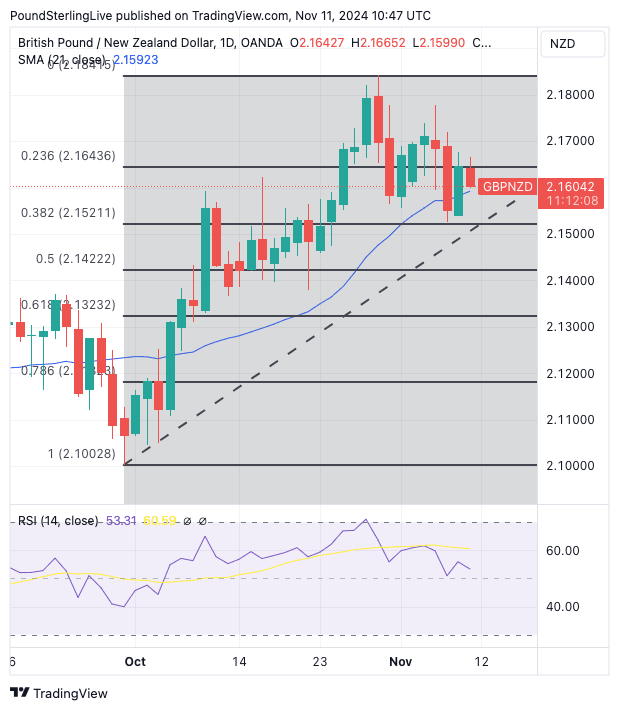

Big picture, the exchange rate is retracing the October run higher from 2.10 to 2.18.

That rally happened unusually rapidly, leaving GBP/NZD overbought.

November has thus far seen a retracement of those gains as the oversold conditions unwind.

Where does that leave us this week? We don't think the retracement is over, implying further soft trading conditions.

The post-election selloff brought GBP/NZD back to the 38.2% Fibonacci retracement of the October rally, where buying interest emerged.

Now, the market is seen trying to break the 23.6% Fib retracement line (2.1643).

What looks to be happening is that the recent attempt to break higher failed, and the pair is trending lower to the 38.2% Fib level again (2.1521).

Such a decline would be consistent with the signal the RSI is sending; it is at 53 and pointing lower, which suggests momentum in GBP/NZD is to the downside:

Note, too, that the pair is capped by the 9-day moving average, which is pointing lower. Our Week Ahead Forecast model suggests when this is the case, the subsequent few days will see weakness.

But, the 21-day moving average is also in play: it is at 2.1592 and rising, which can offer support and a way higher for GBP/NZD.

So there are some mixed signals but, on balance, we think further near-term weakness is more likely than not and we see 60% odds of a retest of 2.1521.

Whether the call is correct could depend on the midweek release of U.S. inflation figures, which will have a notable impact on broader investor sentiment.

This serves as a reminder that investor sentiment is particularly important for NZD: last week's rally was a response to the big uptick in global stock markets that followed Trump's win.

Can that rally extend this week? To be sure, headlines concerning the incoming administration will be important in this regard. But, the inflation print will also be of significance.

The expectation is for a reading of 0.2% month-on-month and 2.6% year-on-year. Anything more and we could see the USD catch a bid and NZD sold.

However, there has been a significant repricing away from Federal Reserve rate cuts during October as investors prepare for U.S. economic outperformance, with the market now seeing a limited number of cuts forthcoming in 2025.

We think delivering a material reduction in rates would take a significant upside surprise for the USD. This is because a large part of the reduction in rate cut bets has already taken place, and it is difficult to see too much by way of USD upside in response.

Instead, the bigger reaction could follow a softer-than-forecast outcome, given there is now more space for markets to rebuild rate cut bets.

This can keep GBP/NZD under pressure.