Above: File image of President Xi. Image: Government of Rwanda. Source location. Licensing: CC.

The Pound could fall back against the Dollar from here.

The Pound to Dollar exchange rate could retreat from current levels in the coming days if a call between the leaders of the U.S. and China goes to plan.

The call is not officially scheduled, but all signs point to it being soon. Investors hope that it would unlock progress between the two countries in implementing a May trade accord that would lead to lower tariffs and put lingering fears of an all-out trade war to rest.

For the Dollar, which has been stung by trade tensions and waning international investor enthusiasm for a more erratic United States, this would offer a boost.

"In a social media post this morning, Trump said Xi Jinping is difficult to make a deal with, as markets await details on the scheduled call between the two leaders this week. There is some positive USD potential here," says Francesco Pesole, FX Strategist at ING Bank N.V.

"Recently, such direct talks have eased trade pressures, and in our view, there is potential for a temporary uptick in the dollar after the event," he explains.

The Dollar fell after Trump on the weekend said China "totally violated" the U.S.-China trade reset announced in May, suggesting the improvement in sentiment on trade had ended.

U.S. Trade Representative Jamieson Greer, who helped establish the agreement made between the U.S. and China in Geneva, said China has been "slow" in rolling out its compliance to the recent trade agreement, "which is completely unacceptable and has to be addressed."

He said China has not followed through on withdrawing additional retaliation to earlier U.S. tariffs, such as curbing exports of rare earths that are critical to the tech, auto, aerospace, and defence sectors.

"If bilateral relations between the US and China sour further, the U.S. and Chinese governments may reinstate tariffs and non‑tariff measures on each other," says Kristina Clifton, Senior Currency Strategist at Commonwealth Bank.

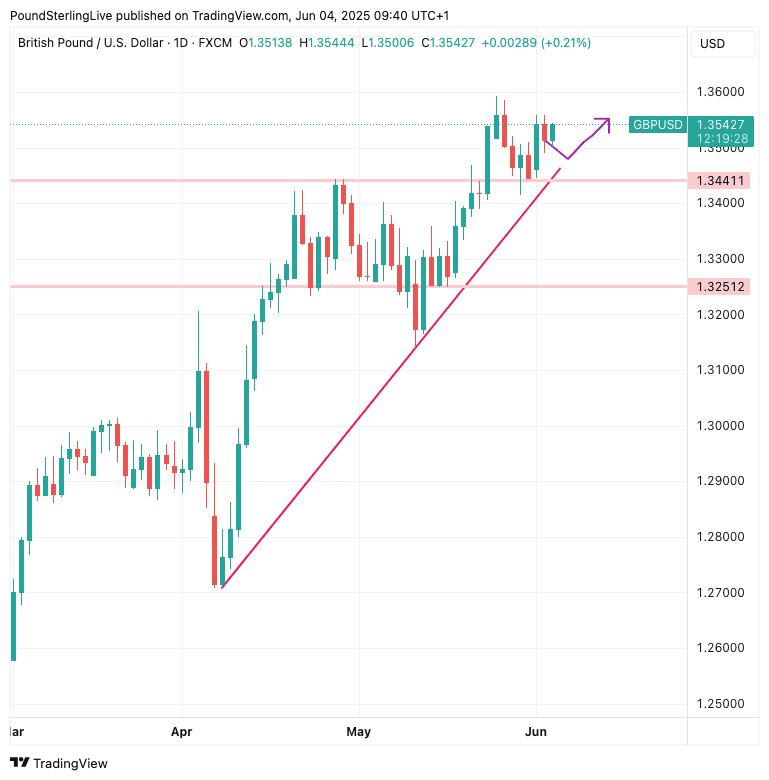

GBP/USD trades at 1.3536 at the time of writing, with the 2025 high at 1.36, reached on May 26.

In the wake of a positive Trump-Jinping call, the exchange rate could extend a retreat back down to 1.3479, and then to graphical horizontal support at 1.3441.

Above: GBP/USD at daily intervals with the predictions we drew onto the chart on Monday.

This pullback would still be in keeping with our most recent GBP/USD Week Ahead Forecast, which called for a near-term pullback ahead of an extension higher to fresh multi-year highs.

However, even if GBP/USD declines on trade positivity, analysts point out that periods of USD strength are ultimately likely to prove short-lived as the bigger trend is towards a weakening Dollar.

"We believe that the longer-term USD slide is just beginning, but this will be a marathon, not a sprint," says Mark McCormick, an analyst at TD Securities.

An additional concern for the Dollar is America's ballooning debt pile, which will become embedded by the imminent passing of Trump's Big Beautiful Bill, which will add $3.8 trillion to the $36 trillion national debt, according to the non-partisan Congressional Budget Office,

"With or without the bill, the U.S.' debt trajectory is unsustainable in the long run," says Rogier Quaedvlieg, an economist at ABN AMRO Bank N.V.

"The impact is also less sudden and dramatic, leaving more scope for this to play out over a longer period of time. The fiscal largesse points to upside risks to US long-term interest rates, which could eventually prove to be a headwind for both the economy and financial markets," he warns.

A huge portion of this debt will need to be financed by foreigners. However, the same bill makes provisions for the U.S. to arbitrarily tax the same foreigners in order to allow the administration to pursue its geopolitical agendas.

Analysts warn this 'revenge tax' will deter foreign investment when it is most needed, which will further undermine the Dollar.