U.S. President Donald Trump said a deal has been signed with China. Official White House image.

The Dollar is under pressure, but its tariff headache could be close to ending.

This comes after news that the U.S. and China have finalised the trade accord reached last month in Geneva. "We just signed with China yesterday," U.S. President Donald Trump said at the White House on Thursday night.

U.S. Commerce Secretary Howard Lutnick said in a news interview the agreement means China will "deliver rare earths to us," and in response, "we'll take down our countermeasures."

At one point in April, the total tariff wall on Chinese imports towered at an effective 143%, according to the World Trade Organisation's tracker.

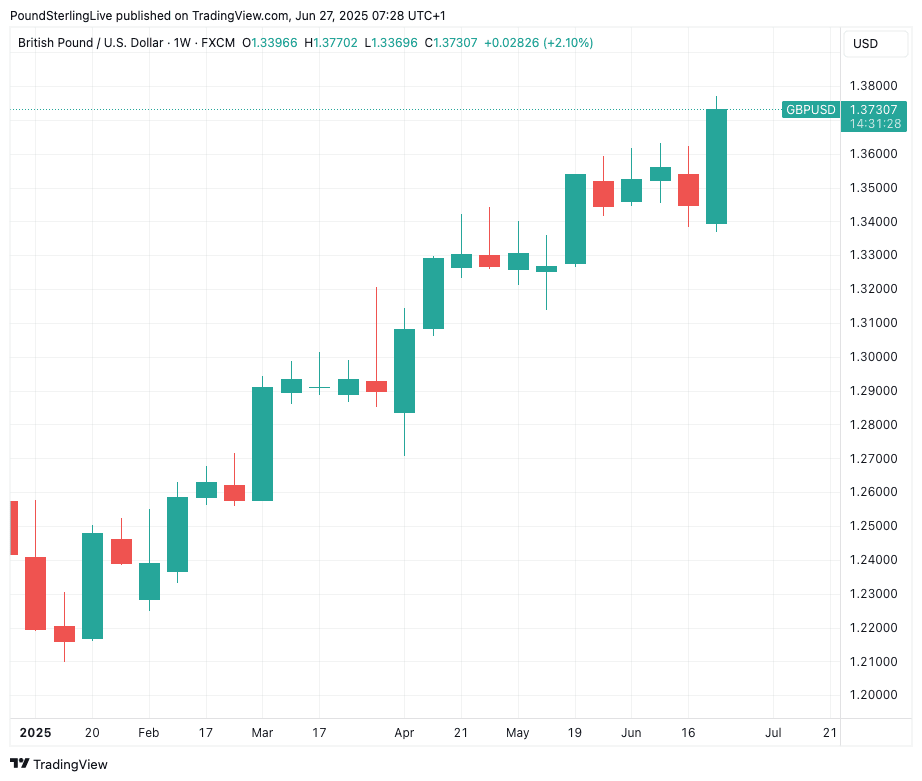

The tariffs risked significantly slowing the U.S. economy, which has prompted significant selling of dollars. The Dollar has fallen by 11% against the British Pound in 2025, and is down 13% against the Euro.

The Dollar jumped on May 12 when markets welcomed news that China and the U.S. had reached an accord to lower tariffs in Geneva, Switzerland. That accord was not a complete trade agreement, and negotiating teams have met since, most recently in London.

Signs that a major tariff shock will be avoided further lower the odds of a U.S. recession, reducing one headwind against the under-fire Dollar.

Above: The Dollar has steadily lost value against the Pound in 2025.

Importantly, Lutnick said agreements with 10 major trading partners were at hand.

The deals lower the odds of a trade 'cliff edge' on July 09 being reached, when a temporary moratorium on tariffs announced on April 02 ends.

"We're going to do top 10 deals, put them in the right category, and then these other countries will fit behind," said Lutnick.

"We would expect the USD to depreciate further if tariffs are imposed, and to strengthen modestly if they are postponed again," says Constantin Bolz, Strategist at UBS Switzerland AG.

The comments are a significant signal that trade uncertainty is close to resolving, removing a major uncertainty that has been bedevilling investors since Trump started his second term as President.

"If people want to come back and negotiate further, they’re entitled to, but that tariff rate will be set and off we’ll go," said Lutnick.

There was more good news for the Dollar on reports that U.S. Commerce Secretary Scott Bessent has asked Congress to remove the so-called revenge tax provision (Section 899) from the Big Beautiful Bill that is currently making its way through the U.S. legislature.

The tax is designed to be levied on investors from countries deemed to have 'unfair' taxes on U.S. companies. However, investors see it as punitive and open to significant interpretation, effectively exposing themselves to the whims of the U.S. President.

It's just another significant reason to be wary of U.S. assets, and its removal would also benefit the Dollar.