Jerome Powell speaks at the ECB conference. Image copyright: ECB.

Dollar exchange rates firm through the midweek session, although strength is still expected to be limited.

The Pound to Dollar exchange rate (GBP/USD) retreated from fresh four-year highs owing to a splash of above-consensus U.S data prints released in recent hours that question the veracity of a July interest rate cut at the Federal Reserve.

With the odds of a rate reduction later this month on the rise, these data suggest the economy will give reason for caution:

- ISM Manufacturing survey read at 49% in June, up from 48.5% in May and above consensus expectations for 48.8

- ISM prices paid were decidedly inflationary at 69.7%, beating expectations for 69 and May's print of 69.4

- JOLTS job openings rose to 7.769M in May, exceeding estimates for 7.3M and a rise on April's 7.395M

"These are not decisive signals, but they point toward higher prices and a resilient labour market – hardly a case for imminent Fed action... giving the dollar some brief support," says Francesco Pesole, FX Strategist at ING Bank.

The Pound-Dollar is down from Tuesday's high at 1.3788 at 1.3712 (-0.25% d/d) at the time of writing, Euro-Dollar is down a similar margin at 1.1776, having been as high as 1.1829.

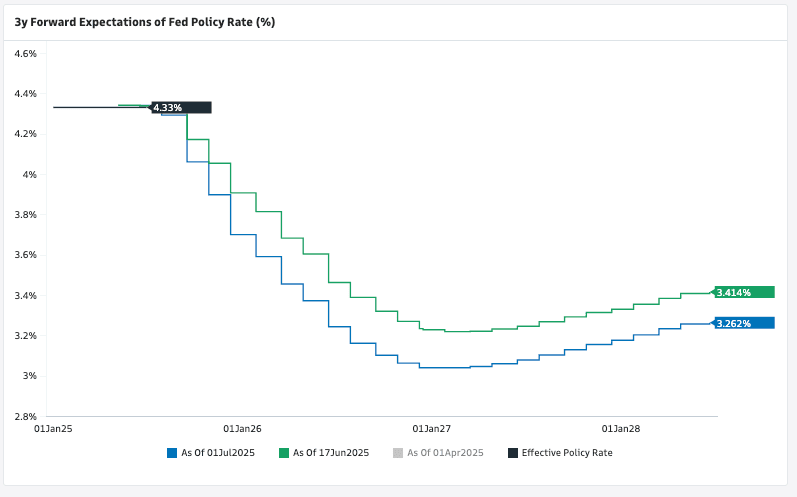

The odds of a July interest rate cut have risen of late, driven by softening U.S. data and growing confidence that tariffs aren't having a massive upward impact on domestic inflation.

This 'dovish' shift in expectations has contributed to the general downtrend in the Dollar, which is currently the dominant feature of global FX markets.

Above: The market has lowered its expected path for future interest rates at the Fed over recent weeks. Image courtesy of Goldman Sachs.

For his part, the Federal Reserve's Chair Jerome Powell refused to rule out the prospect of a July rate cut in an appearance with fellow central bankers at the ECB's conference in Portugal.

It all depends on the data, he said, adding that the Fed is going "meeting by meeting".

Given this, the odds of a July rate cut will recede again if imminent data print above consensus expectations, potentially offering the Dollar further support.

The next key test will be Thursday's all-important U.S. non-farm payrolls job report.

Yet, even if the payrolls beat expectatons and boost the dollar, gains are still expected to be termporary owing to the broader and more structural headwinds that are blowing.

"We keep our Unattractive view on the USD as we expect a combination of macro and geopolitical drivers to keep the dollar under pressure. We also believe global investors will continue to rethink their U.S. exposure over the coming quarters," says Constantin Bolz, CFA, Strategist, UBS Switzerland AG.

Impending tariff deadlines - particularly the July 08 date - will keep traders weary of the Dollar in the coming days, as will fears for the future of the U.S. debt pile.

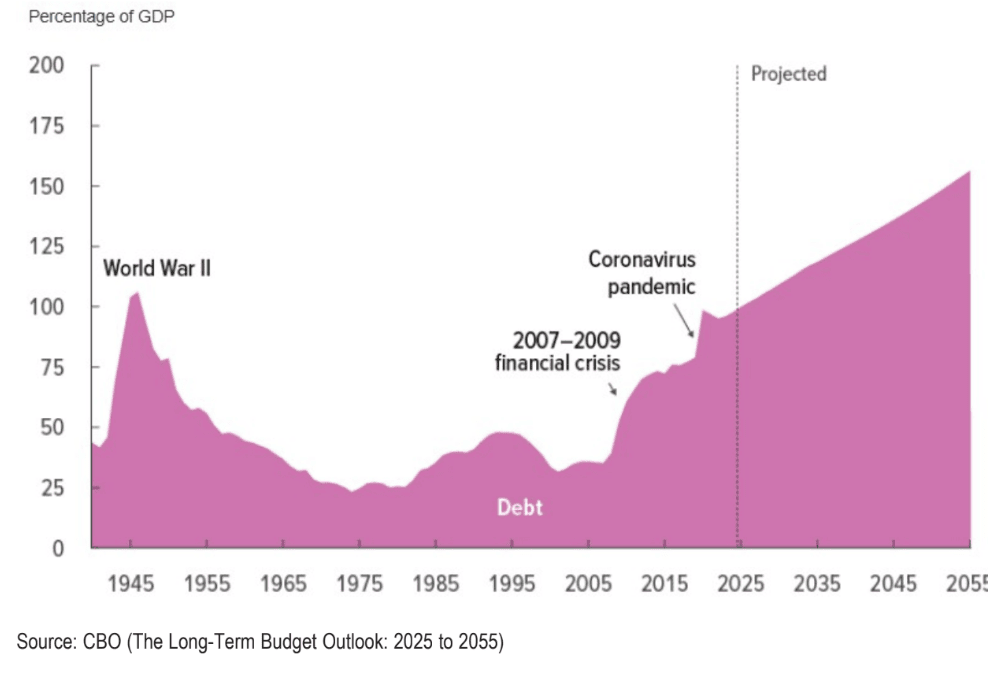

Powell told the ECB conference that America's debt trajectory is on an unsustainable footing, with trillions in additional borrowing needed over the coming years to fund the Federal government.

President Donald Trump's marquee One Big Beautiful Bill narrowly passed through the Senate on Tuesday, bringing it a step close to a July 04 ratification.

Under a "current policy" baseline, the CBO (via the Committee for a Responsible Federal Budget) estimates $3.94 trillion in total added debt through 2034, comprising approximately $3.25TRN in primary deficits and $0.69TRN in interest.

"The Trump administration’s erratic trade policy, rising US fiscal risks, the de-dollarisation narrative as well as the expected upcoming Fed cuts in 2H25 are key drivers weighing down on the USD," says Peter Chia, Senior FX Strategist at United Overseas Bank.