Image © Adobe Images

The Pound to Dollar exchange rate has hit 1.30 and a break here opens the door to further gains, according to analysts.

"The only major currency to rise against the US dollar this year is... the pound!" says Neil Wilson, Chief Market Analyst at Finalto. "Sterling hit a fresh year-high above $1.30 on slightly warmer-than-expected inflation data."

Pound Sterling rose following the release of UK inflation data for June, which showed continued strength in services sector inflation despite the headline rate remaining at the Bank of England's 2.0% target.

A second consecutive 2.0% y/y reading in CPI inflation would typically be enough to encourage the Bank of England to cut interest rates, diminishing the yield advantage that has benefited the Pound for much of 2024.

However, the details show strong inflationary pressures in the UK economy's dominant services sector, which leads economists to warn that inflation will start to rise again.

The odds of an August rate cut have now faded to about 25% from 50% ahead of the inflation release.

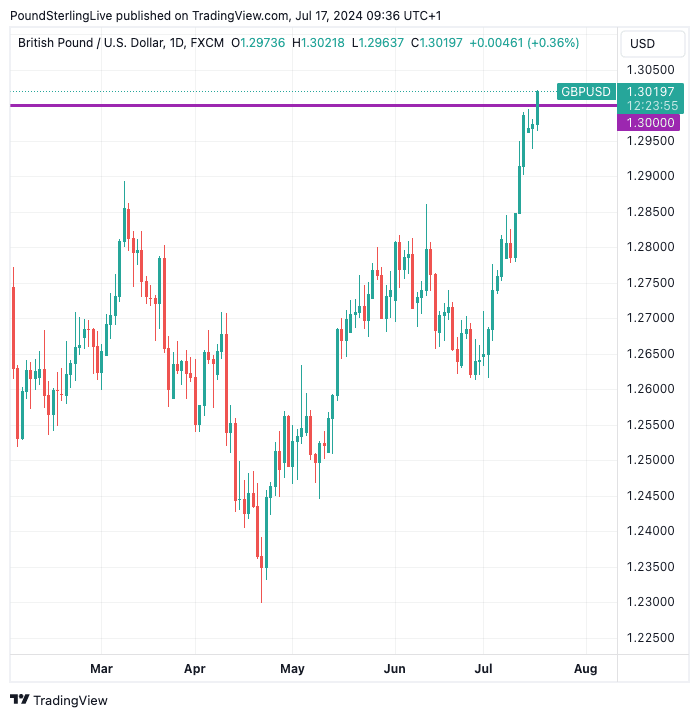

Above: GBP/USD at daily intervals. Track GBP/USD with your custom alerts; find out more here.

A slower path of rate cuts in later months is also expected. These developments are supportive of the Pound, which stands to benefit as global capital is diverted to high-yielding assets in the UK.

The UK data comes days after the U.S. reported below-consensus inflation numbers, leading analysts to raise bets that the Federal Reserve will cut interest rates in September, and maybe once more in 2024. The building of expectations for a September rate cut at the Fed have weighed on the Dollar broadly, and opened the door to gains by GBP/USD.

Analysts at Natixis, the French investment bank, say that if GBP/USD breaks through 1.30, then a run higher into the 1.31s could prove relatively easy owing to a lack of resistance.

"Watch out for any break of 1.30 this week, as technically there is no resistance till 1.3140," says a note from the Natixis spot trading desk.

Although we are seeing GBP/USD quote above 1.30 at the time of writing, we would need to see the exchange rate close the day above here as a first confirmation that a break is developing.

Also, keep in mind that Thursday brings with it UK wage figures and an undershoot here could weigh on the Pound and push the Pound-Dollar back below 1.30.