Image © Adobe Images

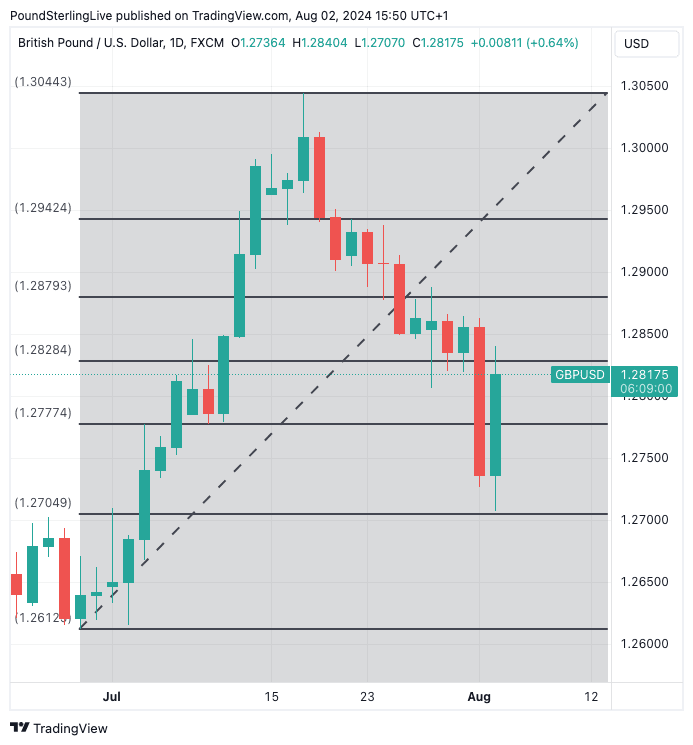

Pound Sterling has declined for three weeks in succession but ultimately clings onto a broadly constructive setup.

Our Week Ahead Forecasts from the past three weeks have opined that the Pound to Dollar exchange rate had become overbought and that a corrective move lower was in order.

We have seen that play out recently, as the pair dipped from levels north of 1.30 to last Friday's low of 1.2707.

Despite the low, Friday was an important day from a technical perspective, and it will inform price action in the coming days: the recovery that followed the non-farm payroll report hints that the bottom of the corrective pullback might be in.

Pound-Dollar never bothered the major support level at the 100-day moving average (DMA) located at 1.2683 and didn't convincingly hold the break below the 50 DMA (1.2786). This confirms the broader constructive setup is still intact.

Our bias is to anticipate a messy recovery in the coming days back to 1.2850, potentially taking in 1.29 again.

Track GBP/EUR with your custom alerts; find out more here

Should the post-Bank of England GBP selling theme stay in place, another test of the 1.2707 low could be in order (we note that it represents the 78.6% Fibonacci retracement of the June-July rally, as per the above).

But be warned: the bigger picture probably now matters more than domestic events for the Pound, and it is fluid.

Markets have ramped up bets that the Federal Reserve will need to cut more than previously thought owing to a slowing economy. Money markets moved to price in 100 basis points of interest rate cuts at the Federal Reserve in 2024 after the U.S. unemployment rate rose to 4.3% in July, and nonfarm payroll employment edged up by 114K, down from 179K in June and well below analyst expectations for 176K.

Economists think the Fed could deliver an outsized 50 bp cut in September or even opt for an inter-meeting cut. Both smack of panic and a sense that the Fed has made a mistake by holding interest rates at high levels for too long.

Steven Blitz, an economist at TS Lombard, says the Fed has a lot of room to cut; "the topline is that next up is whether a more than 25BP cut is in the offing for September, or even an inter-meeting cut in the funds rate."

The net result of this is that the Dollar won't be able to count on the support of elevated interest rates, which underpins a thesis that it can decline in value over the coming months.

"We reiterate our core view that the US Dollar, as well as both short-term interest rates and long-term bond yields should start to soften more meaningfully across 3Q, once the Fed embarks on its rate cutting cycle in September," says Peter Chia, Senior FX Strategist at UOB.

"Our updated forecasts see stronger upside for EUR/USD and GBP/USD to 1.15 and 1.36 respectively by 2Q25," he adds.