Image © Adobe Images

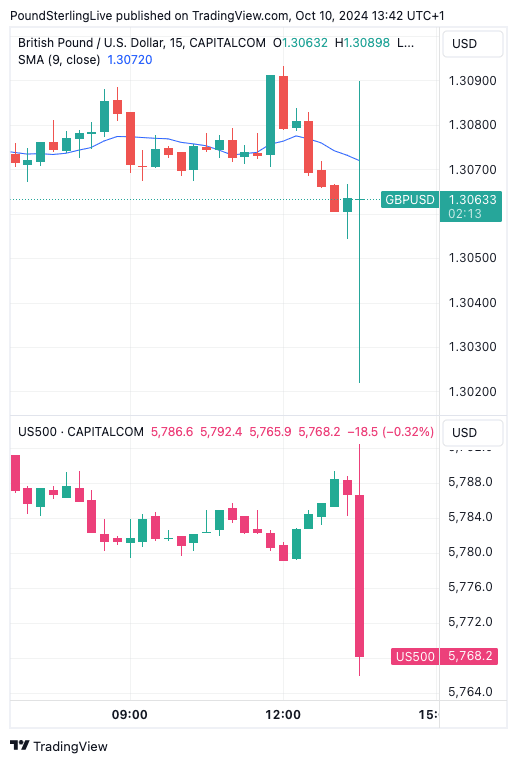

The Dollar rose, and stocks retreated after U.S. inflation data beat expectations right across the board.

The Pound to Dollar exchange rate fell to 1.3056 in the minutes following news that CPI inflation was unchanged on a month-to-month basis in September at 0.2%, disappointing expectations for a fall to 0.1%.

These data are the latest signal that the U.S. economy is in fine fettle and is not exactly crying out for lower interest rates.

The year-on-year rate of CPI inflation fell to 2.4% from 2.5%, but this was a shave higher than expectations for a decline to 2.3%.

Core inflation was unchanged at 0.3%, which is higher than the 0.2% expected by the markets. The year-on-year rate of core inflation lifted to 3.3% from 3.2%, which was also ahead of expectations for a repeat 3.2% reading.

U.S. stocks fell and U.S. bond yields and the USD rose amidst a further recalibration lower in expectations for the amount of Fed rate cuts coming down the line.

Markets are no longer priced for two interest rate cuts in 2024, with a December cut now pricing at less than 100% odds.

Although U.S. inflation has gone the Dollar's way, there is a risk that Fed rate cut expectations have become too 'hawkish'.

Simply put, markets might have moved from expecting too much by way of rate cuts to now expecting too little.

"Repricing was justified after the stronger than expected September jobs figures," says Michael Brown, an analyst at Pepperstone, "as has happened so often this year – participants have gone too far to the other extreme."

Brown thinks the Fed is almost certain to deliver 25bp cuts at each meeting this year and into the start of next until the Fed funds rate reaches a neutral level late next summer.

If the repricing were to ease and potentially reverse, the Dollar's recent run of strength could be reaching its limit in the near term.

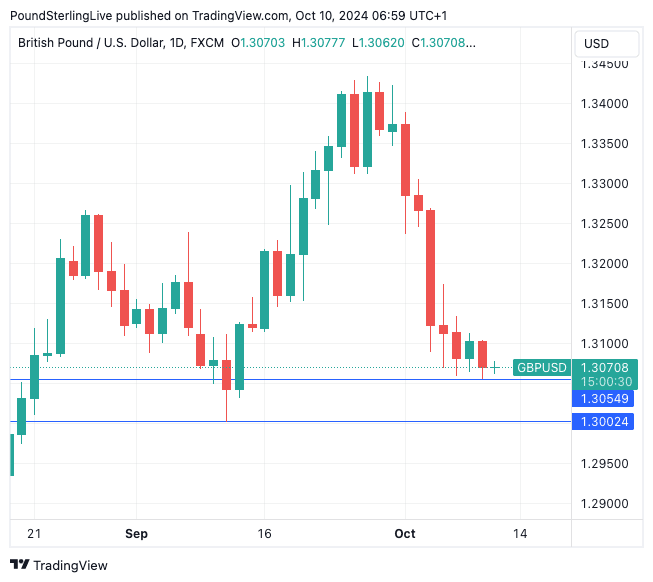

To be sure, the Pound to Dollar exchange rate (GBP/USD) is looking increasingly supported just south of the 1.31 level, and we would anticipate further buying interest into 1.30.

Above: GBP/USD is looking better supported in the run-up to 1.30.

The odds of a sizeable rebound in the Pound to Dollar exchange rate remain limited, however, given the potential for growing nervousness ahead of next month's U.S. election.

The vote is too tight to call, and measures of expected foreign exchange volatility are elevated for the period leading into and after the vote.

The prospect of increased volatility could naturally favour the Dollar, with potential further follow-through buying in response to a Donald Trump win.

"Markets are now within touching distance of US elections, and the outcomes remain too close to call with any confidence. Given that a “Red Sweep” remains a realistic possibility, and an outcome that we see as clearly USD-bullish," says Shahab Jalinoos, Strategist at UBS.