Image © Adobe Images

The prospect of a meaningful rebound in the Pound to Dollar exchange rate (GBP/USD) looks a remote prospect for the coming days.

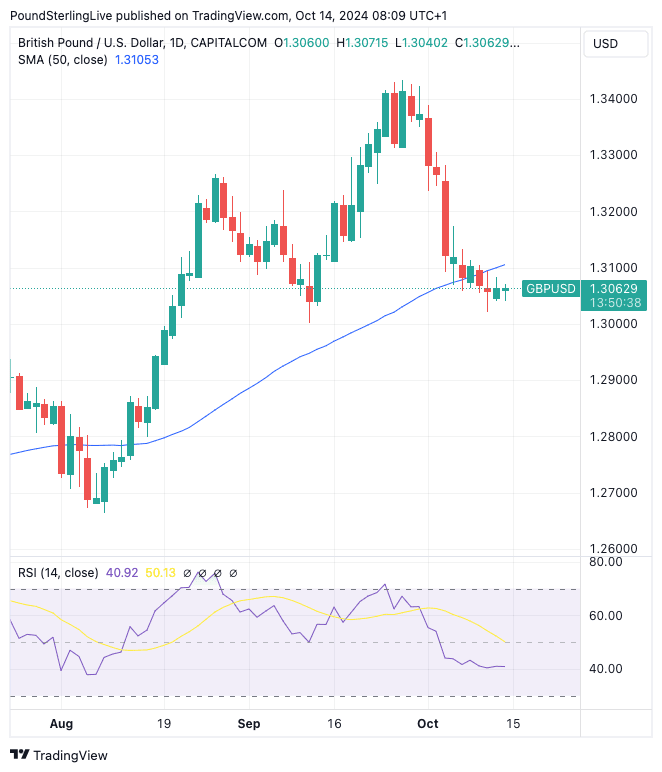

Recent days have seen GBP/USD stabilise above the 1.30 area, confirming this psychologically significant visual support has something to offer the falling Pound.

However, last week's confirmed break below the 50-day moving average (DMA) - currently at 1.3105 - represents a potentially notable technical breakdown that means the recent selloff risks turning into something more than a mere pullback.

At the same time, the Dollar's October rebound looks to be running out of steam, and last week, we reported the market might be reaching the end of its readjustment to the realisation that fewer Federal Reserve rate cuts lie ahead in 2024.

"It seems to me that the spike in U.S. yields has just about run its course, and what we will continue to see, is a bumpy rather than trending FX market," says Kit Juckes, head of FX analysis at Société Générale. "Next month’s labour report is going to be messed up by hurricanes, which would argue for cutting 25bp rather than pausing, in my opinion."

Fading Dollar strength is reflected in the bottoming out in the Relative Strength Index on the GBP/USD daily chart at 40 as it looks to turn higher again.

However, any rebound potential in GBP/USD looks limited in the week ahead and we think strength will be resisted by the 50 DMA, suggesting gains would fade at 1.3105.

UK Calendar Poses Downside Risks

We have a busy UK data calendar this week and we think the Pound to Dollar exchange rate will come under pressure if inflation and/or wage numbers undershoot.

Pound Sterling is highly sensitive to the market's expectations for the outlook for UK interest rates, and an undershoot in these data will prompt investors to bet on two further successive rate cuts over the duration of 2024.

Currently, the Bank of England is expected to cut rates in November and leave them unchanged in December. But soft data this week would mean December comes back into play.

Tuesday's average earnings release should show growth of 5%, down from 5.1%, and when bonuses are included, the figure is expected to be 3.8%.

Anything below this would put the Pound under pressure and make a restest of 1.1894 a real possibility.

Survey data has consistently pointed to a slowing in the UK economy since mid-summer, which has been creating slack in the labour market and easing pressure on wages. It is expected this will, in turn, press down on inflation.

Wednesday's inflation figures will be closely watched, with the headline CPI rate predicted to come in at 1.9%, which puts it back below the Bank of England's 2.0% target.

Wednesday's UK inflation figures will be closely watched. The headline CPI rate is predicted to be 1.9%, which is back below the Bank of England's 2.0% target.

"We estimate that CPI inflation temporarily dipped to 1.7% in September, which would be the lowest reading since April 2021. Two factors are likely to have weighed on inflation last month," says a note from Oxford Economics. The primary factor cited by analysts at Oxford Economics is the fall in global oil prices, which is not necessarily a sign home-grown inflation has plummeted.

Nevertheless, the Pound is sensitive to interest rate expectations; two weeks ago it dropped sharply after Bank of England Governor Andrew Bailey said the Bank would be more "activist" on cutting interest rates if the data allowed.

Could this week's fall in headline inflation below 2.0% give the "activist" Bailey the ammunition he is looking for?

We think it could, as the Bank will likely want to gloss over the fact that falling oil prices will be behind the fall in inflation.

"All of the undershoot relative to the MPC's call is accounted for by falling motor fuel prices," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Keep an eye on services inflation, which is expected to come in at 5.4%. This is arguably the most important figure in this week's inflation docket as it pertains to domestically generated inflation, the kind the Bank can target.

If services inflation fall below 5.4%, the Pound will come under pressure as the market will ramp up bets that a December rate cut will be added to the roster.

"Underlying price pressures should remain on a downward path for the foreseeable future. This will further alleviate concerns about inflation persistence and therefore lower the bar for the MPC to adopt a progressively more “activist” stance on rate cuts," says Konstantinos Venetis, an economist at TS Lombard.

Also keep an eye on retail sales, due Friday, as we have seen over the course of the past year instances where the Pound reacted more to retail sales than it did to inflation and employment numbers from the same week.

This is because retail sales are a measure of consumer sentiment and demand, which in turn impact inflation and any sizeable deviation from consensus could impact the Pound.

US Retail Sales, Elections in Focus

The U.S. calendar is dominated by the midweek release of U.S. retail sales figures, which will give an insight into the state of the consumer.

A reading above 0.3% month-on-month would bolster the Dollar as it would underpin the recent tendency of the market to discount further aggressive easing at the Federal Reserve.

This message will likely be reiterated by a bevvy of U.S. Federal Reserve governors, with Waller, Kashkari and Bostic all due to speak this week. Kugler, a relative newcomer to the FOMC, will speak on Tuesday.

The U.S. election is getting closer and could well start to dominate FX market action. Currently, forex market measures of volatility show investors are prepared for volatility to steadily rise into the vote.

The outcome of the presidential election is virtually a 50/50 call, which should create enough uncertainty to keep the Dollar bid.

The election is another reason why the prospect of GBP/USD retesting its 2024 highs at 1.34 is unlikely until December at the earliest. Before then, don't be surprised if sub-1.30 is tested.