Image © Adobe Images

Investment portfolio managers will need to buy protection against further U.S. Dollar weakness.

Analysis from SEB, the Nordic bank, suggests such demand could run up to $500-600BN worth of hedges.

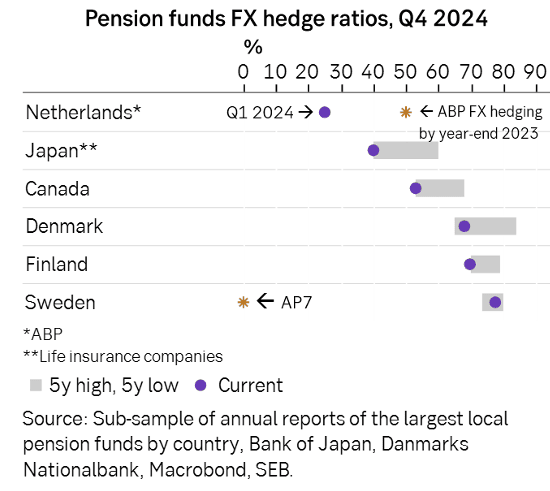

"Large asset managers and pension funds ended 2024 quite exposed to foreign currencies, as reflected in their historically low FX hedge ratios relative to their foreign asset holdings," says Filip Carlsson, Quantitative Strategist at SEB, the Scandinavian bank.

The data shows that a large proportion of investment portfolio managers investing in the U.S. entered 2025 unhedged:

Image courtesy of SEB.

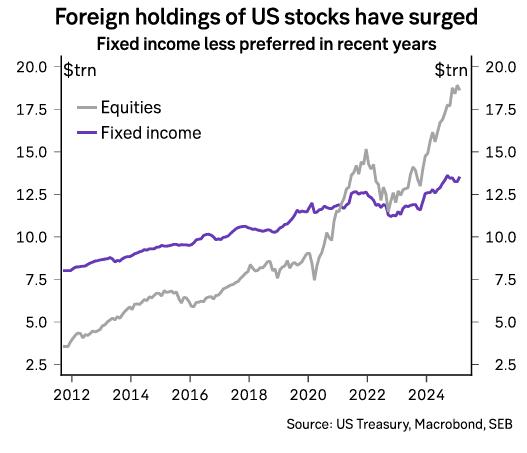

"Outright unhedged FX exposure to the stock of U.S. assets is very high," says George Saravelos, Global Head of FX Research at Deutsche Bank. "Foreigners own $7 trillion of American fixed income and $18 trillion of American equities. Since 2010, ownership has risen by $3 trillion in bonds (almost doubling) and a staggering $15 trillion in equities (sixfold increase)."

Why were investors unhedged?

The traditional FX playbook says that when stock markets rise, the Dollar falls, which would typically require a hedge.. However, under the 'U.S. exceptionalism' trade that was particularly prevalent in 2024, stocks and the Dollar rose in tandem, leading investors to forgo protection.

The consensus expectation at the start of the year was for U.S. Dollar outperformance to continue as the U.S. exceptionalism trade extended under Donald Trump, who promised to deregulate and cut taxes, hence the low hedging ratios seen heading into this year.

Unfortunately, 2025 has seen Trump's policies kill the U.S. exceptionalism trade, which has now mutated into "sell America"; Dollar weakness accompanies falling stocks.

Image courtesy of SEB.

Having been burnt, SEB analysts reckon portfolio managers will now be rebuilding hedge exposure and sell the Dollar, thereby offsetting further USD weakness.

"Rising FX hedge ratios is one part of the argument against the dollar," says Carlsson.

"Assuming that hedge ratios return to their 5-year highs and combining that with the AUMs, this would imply $500-600bn in FX selling – a large share of it USD-denominated," he adds.