Image © Adobe Stock

The Australian Dollar is under significant pressure, but fears tend to recede quickly.

Financial markets know this is a serious escalation in the Middle East and are responding to Israel's attack on Iran by putting in some big moves.

Israel’s air force struck Iran overnight, with Binyamin Netanyahu saying Israel had launched a targeted military operation to "roll back the Iranian threat to Israel’s very survival".

Nuclear and scientific facilities were struck, as were senior Iranian commanders.

Iran has vowed to retaliate.

Asian stock markets dropped sharply, and European and U.S. markets will follow suit, according to futures pricing. Gold and oil prices are surging, and safe-haven currencies such as the Dollar, Yen and Franc are in demand.

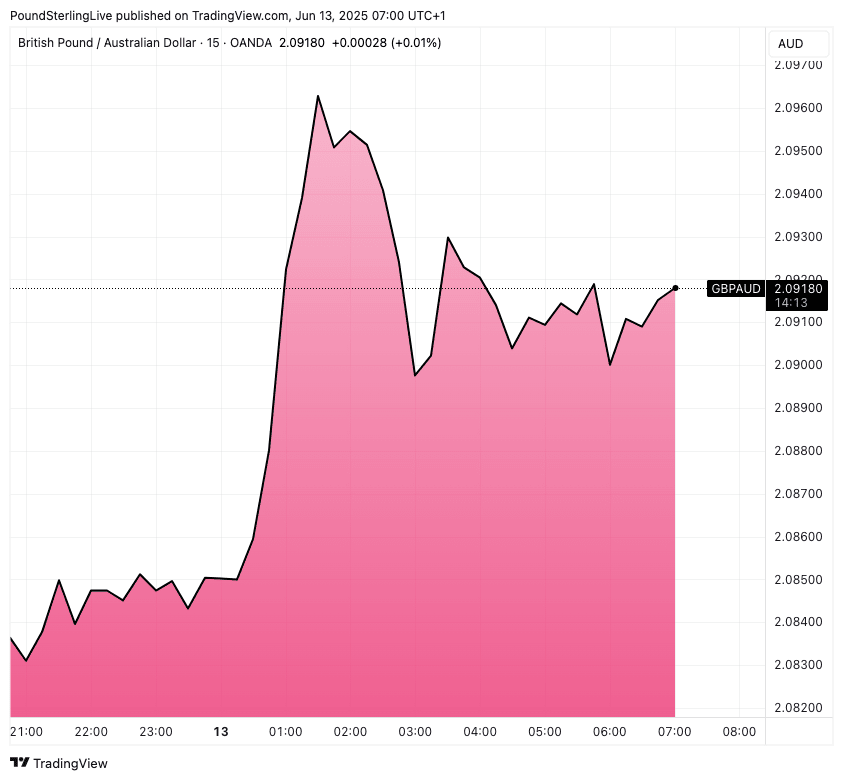

The Australian Dollar's 'high beta' to equity markets means it is tracking stocks lower, leaving it in the red against most of its G10 peers, including the Pound: The Pound to Australian Dollar exchange rate is higher on the day by 0.40% at 2.0911.

Against the U.S. Dollar, the Aussie is down by nearly a per cent at 0.6473, against the Euro it is down 0.40% at 1.7807.

"AUD/USD dropped by more than 1% on the news that Israel had attacked Iran, and is currently trading near 0.6470. AUD also fell sharply against all the other major currencies that we track," says Kristina Clifton, FX Strategist at Commonwealth Bank of Australia. "AUD/USD will be sensitive to news of retaliation by Iran over the coming weeks."

Israeli Prime Minister Benjamin Netanyahu said in a video statement that senior Iranian commanders, nuclear facilities and senior scientists advancing nuclear weapons were hit. In anticipation of Iranian retaliation, Netanyahu warned the public to be prepared to spend an extended period in shelters.

The U.S. emphasised it knew of the strikes, but did not participate. It warned Iran not to target U.S. assets in retaliation.

Above: GBP/AUD at 15-minute intervals.

Markets will stay on tenterhooks through the day as further signs of escalation are awaited. What happens over the weekend will determine where markets start the new week.

An important point for those watching Australian Dollar exchange rates: previous flare-ups between Iran and Israel were short-lived, and geopolitical tensions tend to be reversed by markets in short order.

"Geopolitical fear often fades fast," says Michael Brown, Senior Research Strategist at Pepperstone. "Once markets have got bored of the aforementioned headline-watching, which if history serves won’t take too long, it is clear that the path of least resistance continues to lead to the upside, as stocks remain supported by a resilient US economy, solid earnings growth, and the direction of travel on trade continuing to be one that points towards calmer rhetoric, and deals being made."

A recovery in global equity markets means the Australian Dollar would tag along too, meaning the brave might view the pullback in AUD values as a dip-buying opportunity.