Image © Adobe Images

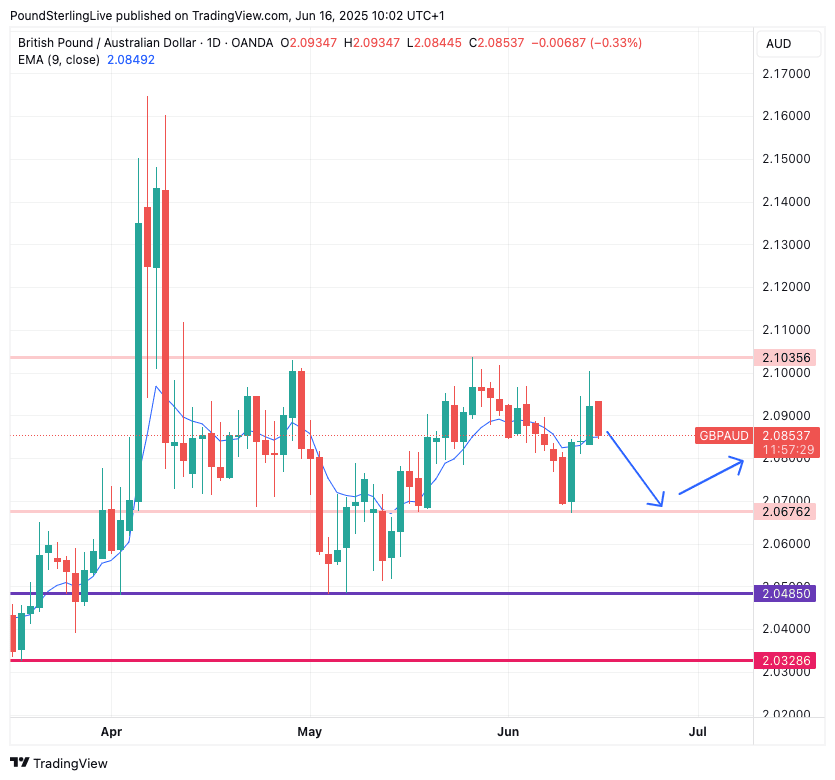

The Pound to Australian Dollar exchange rate (GBP/AUD) risks a move to 2.0676 as geopolitical tensions are discounted.

The Australian Dollar fell sharply on Friday as markets reacted to Israel's surprise attacks on Iran, which is the natural response of a currency that is very sensitive to broader sentiment.

The developments allowed GBP/AUD to rally to 2.1000, before the advance was pared and we see more of this geopolitical discount evaporate on Monday, deflating GBP/AUD further. Currencies with a 'high beta' - or correlation - with stock markets are recovering lost ground as investor sentiment improves.

"Risk aversion subsided overnight with dips in high beta FX and equities bought, reflecting confidence among investors that the crisis in the Middle East will be contained and higher oil prices are not permanent and will therefore not destabilise the global economy," says Kenneth Broux, a strategist at Société Générale.

Should stock markets recover in the coming days, the AUD can find itself better placed, allowing GBP/AUD to retreat to 2.0676.

As the chart shows, this is the vicinity of support for the pair, although the charts are messy and moves below here, or even higher to 2.1035 can't be discounted as an oscillation within a broader sideways range is playing out on the multi-week timeframe.

Above: GBP/AUD at daily intervals.

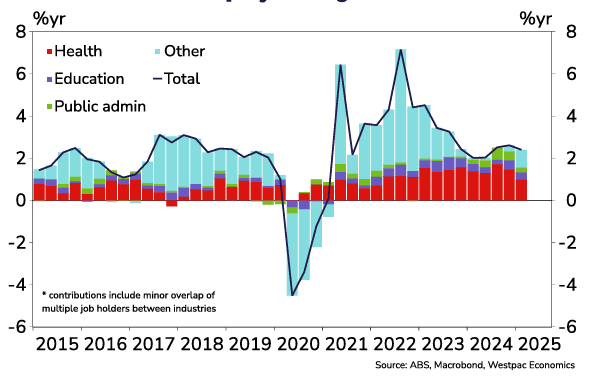

In Australia this week, the May Labour Force report will attract attention.

The April employment surprised materially to the upside as the +89k surge more than doubled the top-of-the-range estimate.

"While quite volatile on a monthly basis, this latest read toned down some of the apparent softness that looked to have emerged over the first few months of the year," says a note from Westpac.

The market consensus looks for a reading of 20K, with anything above only adding to the sense that the economy remains robust and that the Reserve Bank of Australia can take its time when considering further cuts.

This would provide some supportive local flavour for AUD trade in the coming days.

A below-consensus reading would have the opposite effect, although post-employment report readings are likely to have a durable impact on GBP/AUD, given that the broader trends in risk sentiment are largely in control of this pair.

Also, keep an eye on the Bank of England's Thursday meeting.

The Bank will maintain rates at current levels, but readers should expect policymakers to address the recent set of soft employment figures and GDP numbers, potentially signposting an August rate cut in the process.

The market raised the odds of an August rate cut following last week's labour market and GDP numbers, which mechanically weighed on domestic bond yields and the Pound.

However, an adjustment in expectations is now arguably fully 'in the price' of the Pound, and for this reason, we don't think the moves in GBP/AUD following Thursday's update will be massive.