Image © Adobe Images

Australian dollar trading has surged following the unwinding of popular carry trades over recent sessions, making the antipodean currency the fifth most traded on the interbank market, according to Goldman Sachs data.

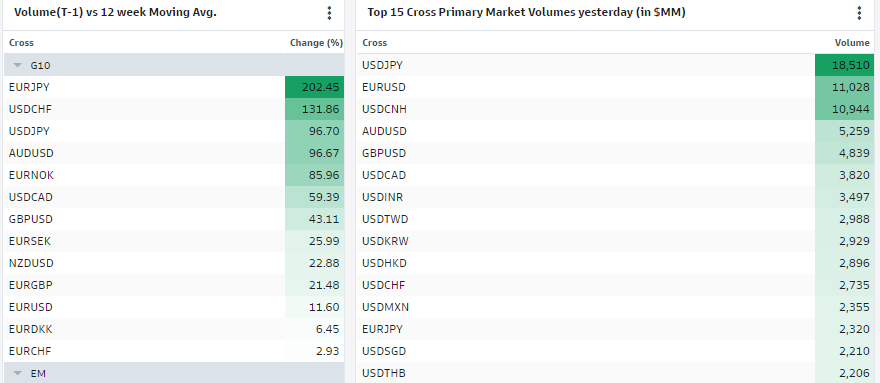

Trading turnover in AUD/USD surged to $5.29 billion on Monday, some 96.67% above its 12-week daily moving average, according to Goldman Sachs data sourced from two of the market’s most popular trading venues.

This saw the Australian dollar edging out Sterling to become the fifth most traded pair at the interbank level as global markets stabilised on Tuesday, drawing fund flows back into high beta and high carry currencies.

“The trifecta of a hawkish Bank of Japan, rate cut hints from the Fed, and escalating geopolitical risks have led to a sharp strengthening of the yen recently. This has spurred concerns of an unwinding in carry trades, which negatively impacts the preferred carry target like AUD,” Saxo Bank said in Wednesday market commentary.

Above: Change in primary market trading volumes on April 26 trading day. Data covers RUT and EBS platforms. Source: Goldman Sachs Marquee.

AUD/USD had fallen to year-to-date lows around 0.6350 on Monday when global global markets collapsed further, prompting the safe-haven Japanese yen to extend a spectacular rally that had already seen it rise by a double-digit percentage against most major currencies over the recent month

Appetite for the yen cooled notably on Wednesday, however, after an influential rate setter said the recent turbulence in global markets and rally by the yen make it less likely the Bank of Japan will raise its interest rate further up ahead. The BoJ’s July rate hike was one of the factors lifting the yen in more recent days.

“AUD should find some relief given the RBA's pushback on market pricing for cuts this year. On the crosses, we expect a more defensive market posture and continue to favour JPY, especially against high beta currencies like CAD, AUD, NZD, EUR and GBP,” TD Securities strategists said previously in a Tuesday note to clients.

“For AUDNZD, we expect an imminent break above 1.10 and pushing towards the 1.14 high in 2022 as the RBNZ may soon opt for aggressive easing given the cracks in the New Zealand labour market,” they added.

Above: AUD/USD shown at daily intervals alongside AUD/JPY and NIKKEI 225 index. Click image for closer inspection.