Image © Adobe Images

The Pound to Australian dollar exchange rate fell heavily on Thursday as hawkish remarks from the Reserve Bank of Australia Governor Michelle Bullock helped the antipodean currency to outperform, but the pair has likely reached a near-term bottom and may even have scope to recover as far as 1.97 in the days ahead.

GBP/AUD fell back below the 1.94 as the Australian dollar rallied, outperforming all G10 counterparts, after Governor Michelle Bullock said inflation is now likely to take longer than previously expected to return to 2% to 3% target band and that the RBA will not hesitate to raise interest rates again if it becomes necessary.

“I know this is not what people want to hear. But the alternative of persistently high inflation is worse. It hurts everyone,” the Governor said in remarks made at the Rotary Club of Armidale Annual Lecture.

AUD/USD rallied more than half a percent and GBP/AUD fell by a similar amount in response as Australian cash rate futures sold off with the rate implied by the December contract rising 20 basis points to 4.12%.

Above: Pound to Australian dollar rate shown at daily intervals alongside AUD/USD.

Markets scaled back their expectations for interest rate cuts from the RBA this year on Thursday, offering a boost to a beleaguered Australian dollar, which had fallen heavily over the prior week owing to a meltdown in global markets and a widespread sell-off among high beta and high carry currencies.

“I expect the market will buy AUDNZD into the RBNZ meeting next week. This has been a popular view over the past few months because the RBNZ flipped dovish, and the RBA should not be as extremely dovish as the other central banks around the world,” said Brent Donnelly, president at Spectra Markets.

“Real rates in Australia are uber-low while real rates in other countries (including NZ) are tight. I think the big offside positions in AUDNZD are rinsed and now it’s safe to get back in the water,” he said in Thursday’s am/FX daily macro newsletter.

The RBA’s rhetoric has turned hawkish in recent months after inflation rose and surprised on the upside of expectations over four consecutive months heading into June. However, the second quarter CPI number released last week was in line with RBA forecasts, enabling it to avoid another rate rise this Tuesday.

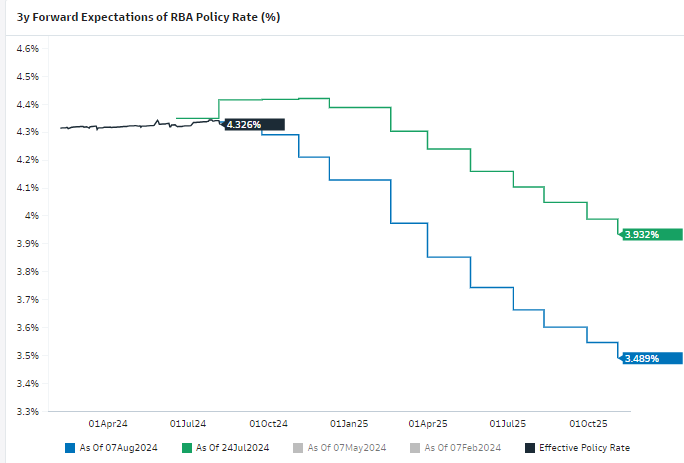

Above: Changes over time in market-implied path for RBA cash rate. Source: Goldman Sachs Marquee.

Despite the latest adjustments, financial markets have continued to bet confidently that the RBA will cut its 4.35% cash rate to 4.1% by year-end, even though Governor Bullock said on Thursday that inflation is unlikely to return to the target band until the end of next year.

The slow and tardy decline of inflation means there is a risk of the anticipated interest rate cut being pushed further out into the future in the coming months, which would likely deliver a further boost to the Australian dollar and weigh on GBP/AUD as the adjustment plays out.

However, the author’s model suggests GBP/AUD reached at least a near-term bottom when trading down to 1.9350 on Thursday, and that it could have scope to recover as far as 1.97 in the days and weeks ahead.

Such a recovery would become more likely if global markets falter afresh, placing renewed pressure on high beta and high carry currencies as the Australian dollar tends to underperform Sterling in those environments.