Image © Adobe Stock

The Pound and Australia are two of the FX market's outperformers, which has left the GBP/AUD exchange rate tracking a sideways trend.

However, we think a soft Australian inflation reading, paired with any temporary setbacks to global risk sentiment can prompt the exchange rate to test higher levels in the short-term.

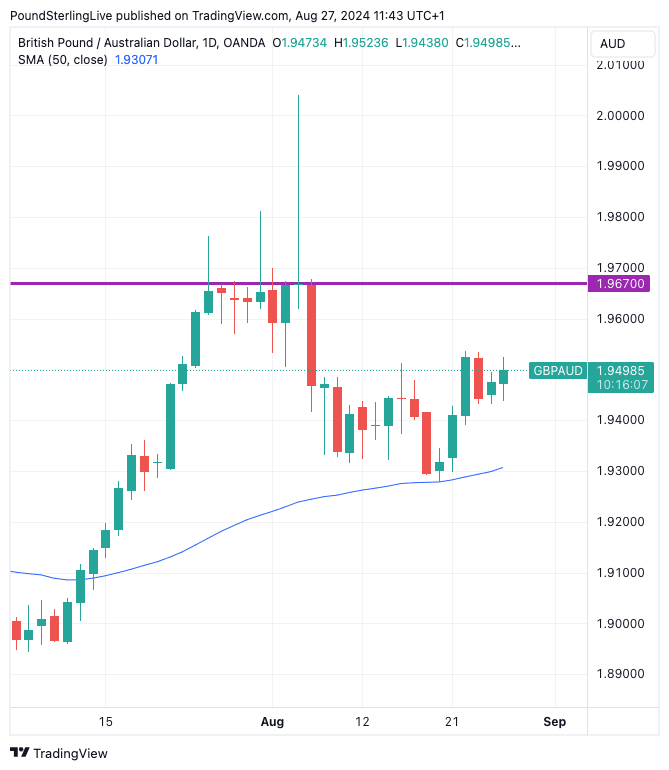

From a technical perspective GBP/AUD downside will remain limited to the 1.93 area, which has been established as a horizontal support level that will prompt some hesitation for sellers of the pair. It is also the location of the 50-day moving average, which underpinned the pair when tested on August 20.

On the upside, rallies have stumbled at 1.6970 on repeated occasions in July and August, which leaves us thinking strength might be limited by this barrier. We think the rebound in GBP/AUD, in place since August 20, can potentially extend to this level in the coming days.

That said, much will depend on the midweek release of Aussie inflation figures. The monthly release is not to be confused with the more important and holistic quarterly release, but it can give a good steer as to where inflation is heading.

Consensus looks for inflation to read at 3.4% in July, meaning any undershoot of this headline figure could result in Aussie Dollar weakness and GBP/AUD upside. However, upside surprises will prompt the market to lower the odds of an imminent rate cut at the Reserve Bank of Australia, potentially sending GBP/AUD down to 1.93 again.

Above: GBP/AUD at daily intervals with the 50-day MA and horizontal resistance annotated. These provide the confines of our technical expectations for coming days.

"Higher petrol prices & sticky rents may also keep inflation elevated this month. Ordinarily markets ignore the first month of the quarter but a large upside surprise will likely reinforce the RBA's message that rate cuts are not on the Bank's agenda this year," says a note from TD Securities ahead of the release.

Domestic data could provide some idiosynchratic AUD volatility, but the global sentiment backdrop could yet prove the more decisive factor in determining trend direction. Global equity markets - to which the Aussie correlates - are in a firm and undeniable uptrend owing to rising expectations that the Federal Reserve could cut interest rates by as much as 50 basis points next month.

This would take the pressure off U.S. businesses while lowering USD-denominated lending rates the world over, potentially improving the economic outlook. Rising equity markets and an improving growth impulse would typically be associated with an Aussie Dollar upside, frustrating GBP/AUD buyers.

With sentiment in charge of AUD, bear in mind we get a trading update from AI darling Nvidia on Wednesday.

"Nvidia is slated to release its fiscal second-quarter results tomorrow afternoon, and high-beta currencies - like the Australian and Canadian dollars - are very likely to move in response as risk appetite shifts," says Karl Schamotta, Chief Market Strategist at Corpay. "Nvidia has become a bellwether for the global capital investment cycle."

Sentiment received a boost late last week and AUD rose sharply against the USD and the majority of G10 peers last Friday after Federal Reserve Chair Jerome Powell effectively greenlighted a September interest rate cut, saying: "The time has come for policy to adjust," said Powell in a speech to the Jackson Hole symposium.

The speech was surprising in that it made repeated references to fears that the labour market is at risk of deteriorating, which signals the Fed that it needs to cut rates to protect jobs. Markets hiked expectations that the Fed could kick off its rate cutting cycle with an outsized 50bp cut.

Dollar trade in the coming week will be determined by how expectations for a 50bp cut evolve: if they increase, AUD/USD can rise, potentially helping the majority of AUD exchange rate pairings higher. If they fade, the exchange rates can pull back again.

The global data highlight will be Friday's release of the PCE deflator, which is a measure of inflation impacting consumers. The Fed tends to watch it closely, but we think there is a limited chance of it throwing up the kind of surprise that would shift the broader narrative.

Powell said in his Jackson Hole speech he was confident inflation would not make a surprising return and that he was now much more focused on the labour market. This suggests that the early-September release of the U.S. non-farm payroll report will be the next major event for the Dollar.

The next major U.S. data release will be next Friday's U.S. job report. But, also be aware that we are approaching month end. This can throw up some unusual newsless currency market action, and we would not see any unusual moves as a signal that current trends are changing.