Image © Adobe Images

The Australian Dollar was higher against all its G10 counterparts after a monthly measure of inflation beat expectations.

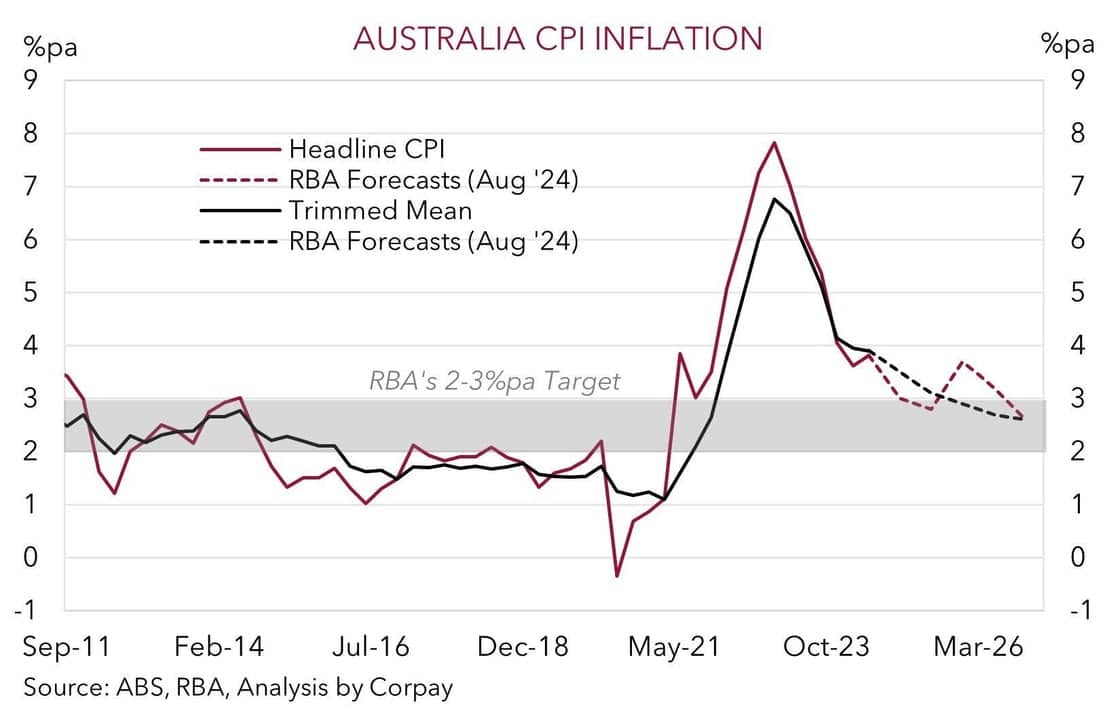

The Pound to Australian Dollar exchange rate (GBP/AUD) is 0.20% lower on the day it was reported CPI inflation fell to 3.5% year-on-year in July from 3.8% in June, but this was higher than the market expectation for 3.4%. AUD/USD rose to its highest level since January 02 at 0.6812, and EUR/AUD fell to 1.6399.

The data beat provides a succint explainer as to why the Aussie Dollar is outperforming: higher inflation means less of a chance of a rate cut at the Reserve Bank of Australia (RBA) before year-end. In fact, the RBA looks to be one of the last developed market banks to cut rates, which can offer AUD yield support over the coming weeks and extend a period of outperformance for the currency.

It must be remembered that Australia's monthly reading is incomplete and provides input into the definitive quarterly reading. Nevertheless, it still has market-moving power.

We also wonder if any AUD upside following the inflation release is sustainable: looking into the inflation report's details shows a more nuanced picture as core inflation readings are falling, which could prompt the RBA into action before year-end.

The monthly trimmed mean measurement of core inflation fell to 3.8% from 4.1%, and another measurement that excludes volatile items and holidays fell to 3.7% from 4.0%.

Image courtesy of Corpay.

"Core measures of inflation came in lower and may offer more hope that inflation is finally beginning to respond to higher rates," says Robert Carnell, Regional Head of Research, Asia-Pacific, at ING.

The rolling three-month measure of inflation is also falling comfortably, which suggests that inflationary pressures are heading in the right direction for the RBA.

"The market response to this data is slightly odd, and while an end-of-year rate cut is still more than fully priced in, the implied yield for December has risen slightly. It looks like markets are more agitated by the slight upside miss to the headline index than accepting that the underlying story seems to be improving," says Robert Carnell, Regional Head of Research, Asia-Pacific, at ING.

The Aussie's outperformance can also be thanks to recovering iron ore prices, which can boost Australia's terms of trade going forward.

Global factors are also supportive, with an ongoing rally in stock markets underpinning this 'high beta' currency.