Image © Adobe Images

A strong Australian employment report and the tailwinds of a generous 50 basis point cut from the Federal Reserve have boosted the Aussie Dollar and will press GBP/AUD towards range lows.

The Australian Dollar rose against the Pound, Euro and U.S. Dollar after the Federal Reserve cut interest rates by 50bp and gains extended into Thursday after the ABS reported Australia added 47.5K jobs in August, easily beating expectations for 25K.

The country's unemployment rate remains unchanged, signalling there is no pressing need for the Reserve Bank of Australia (RBA) to cut interest rates. With the RBA likely the last of the major central banks to cut rates (save the Bank of Japan), the Australian Dollar can continue to benefit from firm domestic interest rate dynamics.

"The August labour force data continues to point towards relatively strong employment in the Australian economy, that is being matched with available supply of labour," says Belinda Allen, Senior Economist at Commonwealth Bank of Australia.

"The strong labour market report helped the AUD strengthen as it solidified market expectations of the RBA keeping rates unchanged for some time to tame sticky price pressures," says Daragh Maher, Head of FX Research at the Americas for HSBC.

David Forrester, Senior FX Strategist at Crédit Agricole, says barring a collapse in the Australian economy (or a large external shock), the RBA should hold off starting to cut rates until February 2025 and about five months after the Fed.

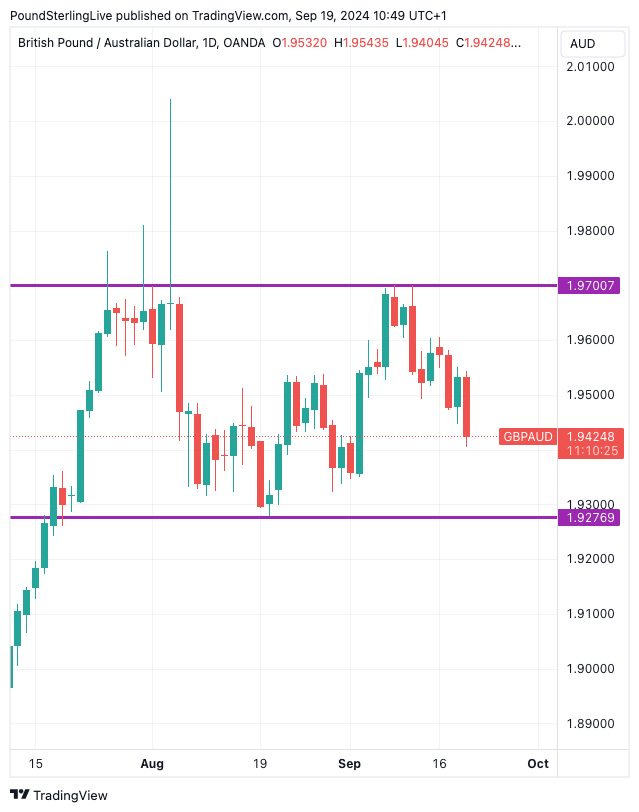

Aussie Dollar strength is bearing down on the Pound to Australian Dollar exchange rate (GBP/AUD), which is now at 1.9420 and is trending towards the lower end of a range that has been in place since July. We think a move to 1.9276 is now in prospect but don't look for a more concerted break below here as yet.

The two other key drivers of Aussie value are China and global economic sentiment centred on the U.S. economy. The former remains a headwind, and analysts think China's stuttering economy will ultimately limit AUD upside.

"Investors are growing increasingly concerned about global growth due to China’s weak economy," says Forrester.

However, the U.S. economy received a boost overnight when the U.S. Federal Reserve cut interest rates by a sizeable 50 basis points. This can underpin growth and bolster global investor sentiment, which is ultimately supportive of the Australian Dollar.

With markets sensing further cuts from the Fed in the coming months, further AUD upside in sympathy with rising stock markets are possible.

"We continue to look for the funds rate to be reduced to 4.125% by the end of this year—implying one 25bp easing and one 50bp—followed by a further 150bp easing, to 2.625%, over the first half of 2025," says Samule Tombs, Chief U.S. Economist at Pantheon Macroeconomics.